Review on Adelfibanking

Summary

About Adelfibanking

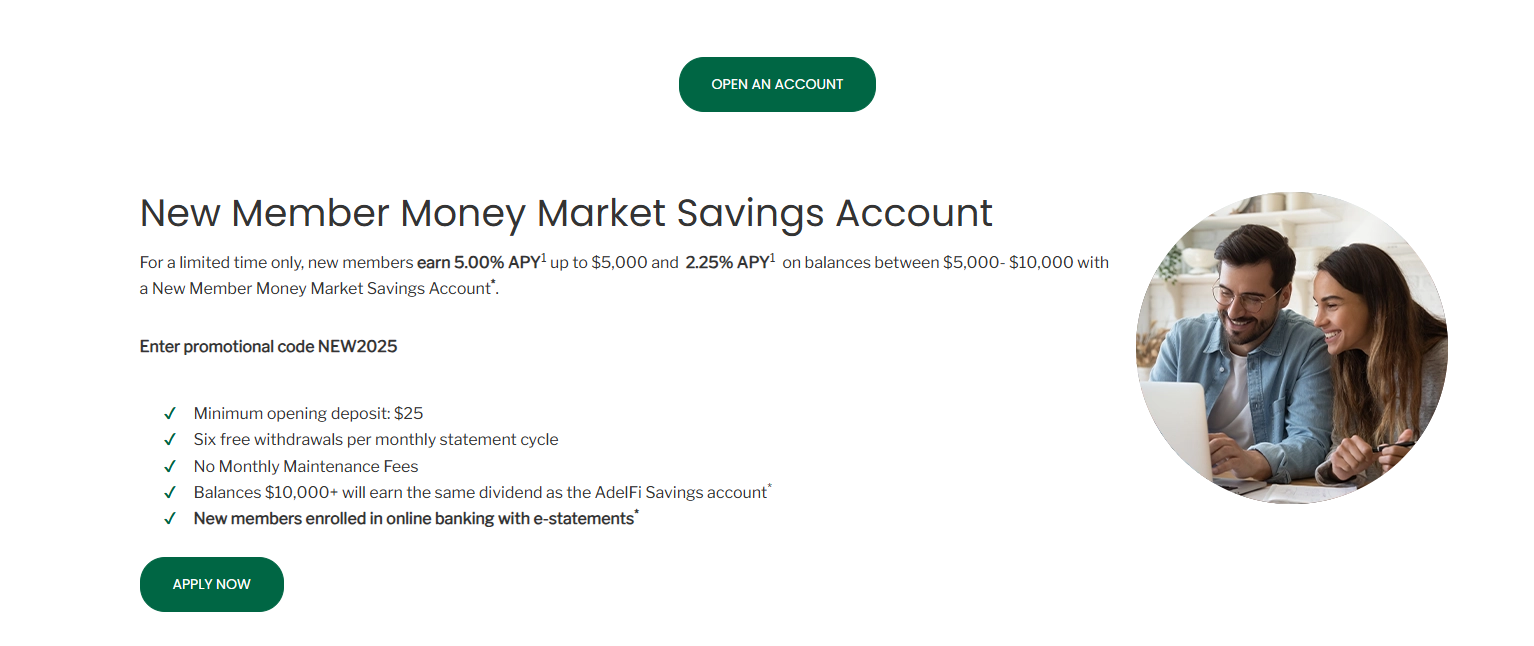

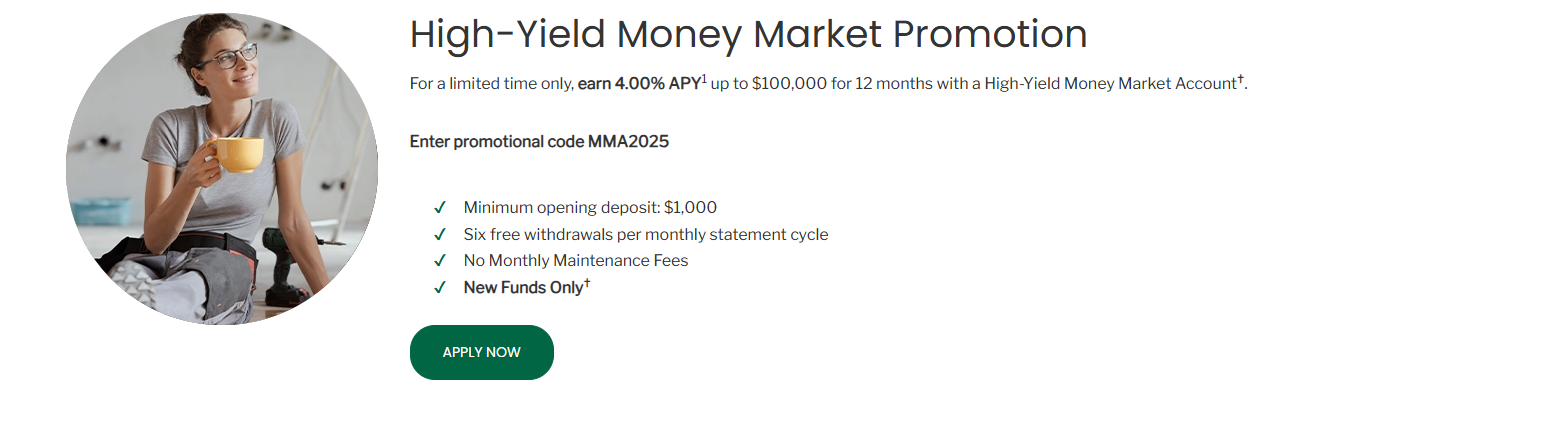

AdelFi (accessible at adelfibanking.com) presents itself as a values-driven, Christian financial institution offering a full suite of banking services: savings accounts, high-yield certificates, checking, loans, and more. Its mission is explicitly faith-based — to help “protect, grow, and share” financial resources in alignment with Christian values. On its site, AdelFi promotes competitive Annual Percentage Yields (APYs), digital banking features, security measures like fraud prevention, and a commitment to giving (it claims to give at least 10% of profits to Christian causes). Recent publicly available information shows that AdelFi was recognized by S&P Global Market Intelligence as one of the top-performing credit unions in 2023. Overall, the website communicates a mature institution, with a well-defined ethical and organizational mission, not just a fly-by-night operation.

More Details

Legitimacy Analysis (Why AdelFi Is Real / Trustworthy):

-

Regulatory Backing: The credit union is federally insured (NCUA), which is a major trust signal.

-

Long History & Rebranding: The institution dates back decades (originally ECCU), not a recent “get rich quick” website.

-

Financial Performance Recognition: Its inclusion in S&P Global’s top-performing credit union list shows it is financially sound.

-

Transparency: Publicly available documents (fee schedule, account terms) are published; leadership team is publicly listed.

-

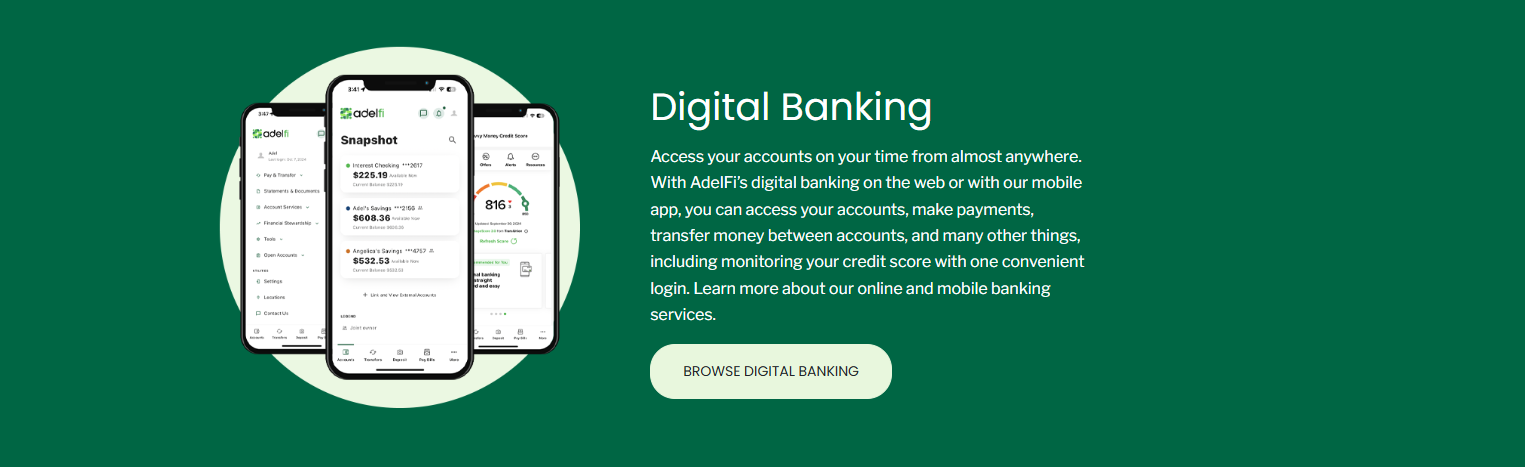

Digital Infrastructure: Offers robust digital banking and fraud prevention, suggesting serious investment in technology.

-

Community & Mission: Clear mission tied to Christian stewardship, giving, and community, which aligns with their customer base.

Risks / Caveats to Be Aware Of:

-

Because its niche is faith-based, some may feel limited in membership or alignment.

-

Some third-party web reputation checkers indicate moderate security risk (depending on tool).

-

User-reported linkage issues with some financial tools (Reddit) may matter if you use account aggregation services.

-

As with any banking relationship, users should ensure their own device security (passwords, 2FA) to avoid fraud risk.

Conclusion: Legitimate, not a scam. A credible credit union with a specific value proposition. If you fit their membership profile and want faith-aligned banking, they appear to be a safe and mission-driven choice.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Adelfibanking

Pros

- Community / Impact: Giving back, partnering with Christian ministries and universities.

- Strong leadership: Experienced team, credible background.

- Strong leadership: Experienced team, credible background.

- Fraud protection: Business accounts benefit from Positive Pay and ACH monitoring.

Cons

- Potential usability quirks: Some users report trouble linking accounts in financial aggregation tools.

- Limited consumer reviews: Not many publicly accessible user reviews or deep independent feedback.

- Relatively small scale / low visibility: According to third-party ranking, the site does not get very high traffic.

Website Overview

Country:

USA

Operating Since:

2021

Platforms:

Mobile/Desktop

Type:

Online bank

Spread:

N/A

Funding:

Online bank

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

History & Credibility AdelFi was formerly known as the Evangelical Christian Credit Union (ECCU). In 2022, the rebranding to "AdelFi" took place to better reflect its Christian membership (“adelphos / adelphoi” = brothers and sisters in Christ) and financial stewardship. It has a well-established leadership team; for example, Carey Price joined as SVP & Chief Banking Officer in 2023.

Performance & Reputation According to a press release, S&P Global Market Intelligence ranked AdelFi #23 among top-performing credit unions in 2023. On ScamAdviser, the site is given a relatively high trust score: SSL is valid, and domain age is a positive sign. On another security check site, it scores 99/100 trust, indicating low risk.

Regulation & Protection The Personal Account Information & Fee Schedule PDF discloses that “Your savings [are] federally insured to at least $250,000 …” via the NCUA (National Credit Union Administration). This is a very strong legitimacy signal: NCUA insurance means it’s regulated like a standard U.S. credit union.

Services & Features Digital Banking: The site describes a modern digital-banking platform: view balances, statements, transfer funds, block cards, alert notifications, budgeting tools, etc. Fraud Prevention: For business accounts, there is “Positive Pay” for check fraud, and ACH transaction monitoring. Social Impact / Stewardship: AdelFi markets itself strongly on Christian stewardship: It claims to give 10% of profits to Christian nonprofits, ministries, etc. Partnerships: It has partnered with Christian organizations; for example, Judson University selected them as a preferred financial institution.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

After a detailed review, AdelFi (adelfibanking.com) appears to be a legitimate and well-established Christian credit union, not a scam or fly-by-night operation. The evidence for legitimacy is strong: a valid SSL certificate, NCUA insurance on deposits, a published fee schedule, a clear leadership team, and external recognition (such as its ranking by S&P Global). Its rebranding from ECCU, backed by credit union industry press, further adds to its credibility. While its niche focus (Christian values) may limit appeal to everyone, for those who align with its mission, it offers a compelling, values-based banking option with modern digital services.

That said, like any financial institution, some caution is warranted: limited online traffic and low third-party review volume mean prospective customers should do their own homework (read its fee schedule, understand account terms, make sure user devices are secure). But overall, there are more strengths than red flags, and nothing currently suggests it is a scam.

Comments