Review on Airmaxproduction

Summary

About Airmaxproduction

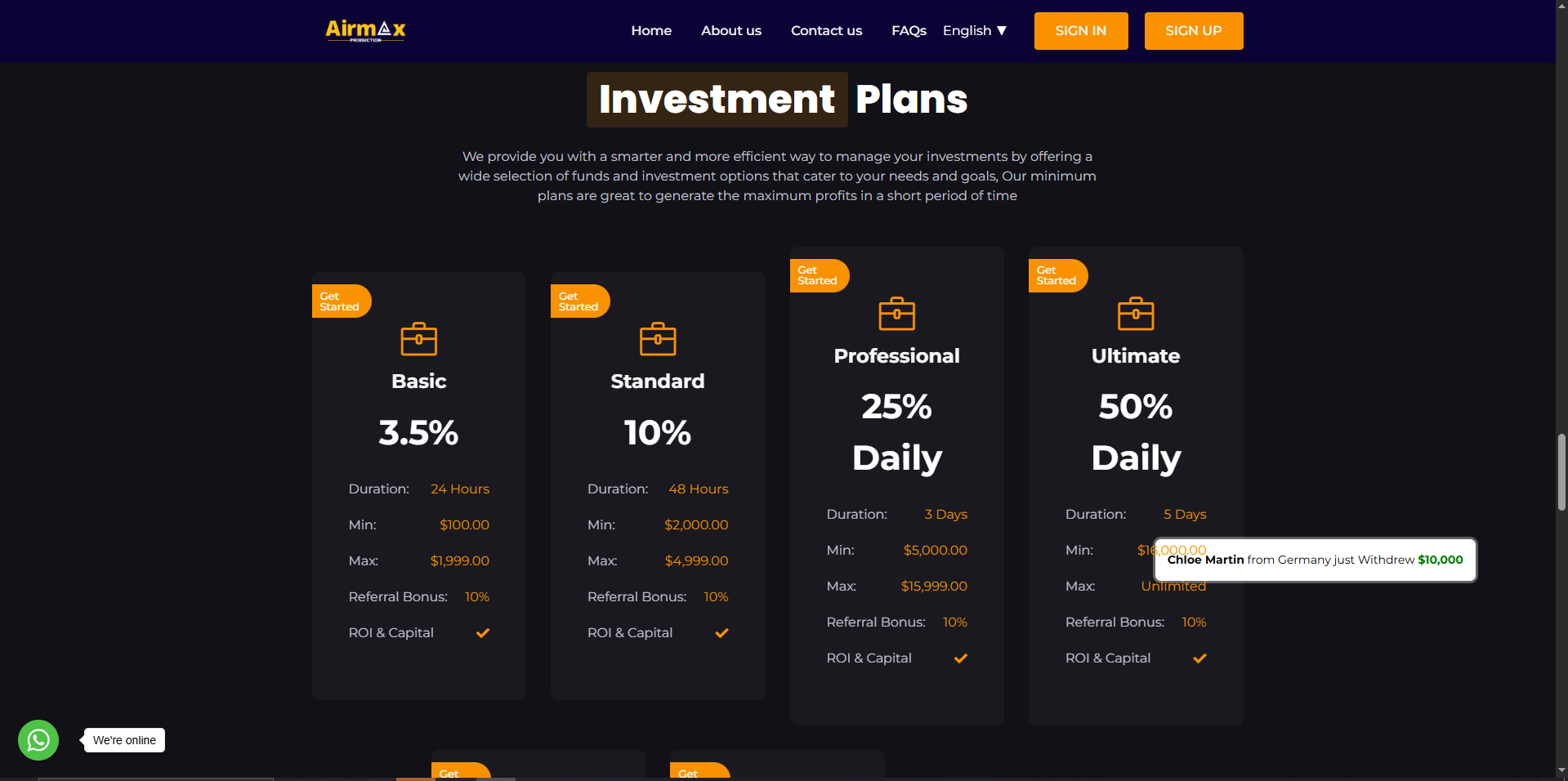

At first glance, airmaxproduction.com looks like a legitimate aviation consultancy firm offering strategic, data-driven insights to clients such as airlines, investors, and aerospace companies. It touts itself as an SEC-registered, Qatar-based entity providing aviation, real estate, agriculture, crypto, and insurance investment opportunities—all under one polished online roof. It also lists attractive high-yield plans (e.g., 50% daily returns, 250% in 30 days), including referral bonuses and instant withdrawals.

But beneath the professional veneer lies a web of red flags. ScamAdviser rates the domain as very low trust, pointing to hidden ownership (WHOIS privacy), possible ties to cryptocurrency investment, a low-tier SSL certificate, and hosting with Namecheap—indicative of risk. All signs point to a classic HYIP-style scam disguised with high-end aviation language.

More Details

. Explosive ROI Offers

Genuine investment firms cannot sustainably deliver 50% daily returns or 250% in a month. Such mathematics fail under real-world financial constraints—these numbers scream “scam.”

2. Domain and Ownership Opacity

When a domain hides its ownership, claiming legitimacy while refusing to stand behind it publicly, trust evaporates. Legitimate firms publish leadership, registration documents, and audit histories.

3. HYIP Hallmarks

Referral bonuses, fixed returns, instant withdrawal promises—this portfolio matches the textbook layout of high-yield investment programs, which frequently collapse.

4. Reputation Engine Signals

ScamAdviser’s verdict isn’t absolute proof—but it reflects data-driven patterns that ought not be ignored. It reports a very low trust rating for airmaxproduction.com.

5. Jumbled Industry Focus

Consulting aviation? Great. Off to offering real estate startups, crypto investment plans, and insurance-backed funds? Now it sounds like a scattershot sales pitch, not a coherent business.

Conclusion of this section: All signs denote a high likelihood of fraudulent operations. Until transparent proof and verifiable regulatory backing are provided, this site should be viewed as dangerous territory.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Airmaxproduction

Pros

- Clean, modern design—appears polished and professional at surface level.

- Lists multiple industry sectors, giving an illusion of diversification and expertise.

Cons

Website Overview

Country:

USA

Operating Since:

2023

Platforms:

Mobile/Desktop

Type:

Investment/FOREX

Spread:

N/A

Funding:

Investment/FOREX

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

Too-good-to-be-true returns: Promised 50% daily and 250% in 30 days are alarmingly unrealistic for any investment.

Obscured domain ownership: Privacy-protected WHOIS makes accountability impossible. Low trust score from ScamAdviser: This is a big red flag. The site lacks credibility based on technical reputation.

Mixed business narrative: From aviation consulting to real estate, insurance, and high-yield crypto plans—this breadth reeks of a scatter-shot scam strategy.

Suspicious SSL configuration: Domain-validated certificate is easily acquired and doesn’t signal legitimacy

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

Airmax Production disguises itself as an elite, multi-industry consultancy, but the reality is starkly different. The combination of extravagant ROI promises, anonymity, fragmented offerings, and poor trust metrics marks it as a probable scam. No legitimate entity operates with such opacity or unsustainable financial claims.

In real, cautious investor terms: don’t touch this platform. There’s no audit trail, no public oversight, and no valid regulatory footprint. Your best protection is walking away.

Comments