Review on Avatrade

Summary

About Avatrade

A Detailed Overview of AvaTrade and Its Operations

AvaTrade is a well-known online trading platform established in 2006, headquartered in Dublin, Ireland. The company offers trading in a wide array of financial markets, including forex, cryptocurrencies, commodities, stocks, indices, and contracts for difference (CFDs). With over 1,250 instruments available and access to several trading platforms including MetaTrader 4, MetaTrader 5, AvaOptions, WebTrader, and a mobile app (AvaTradeGO) the platform aims to cater to both beginner and experienced traders.

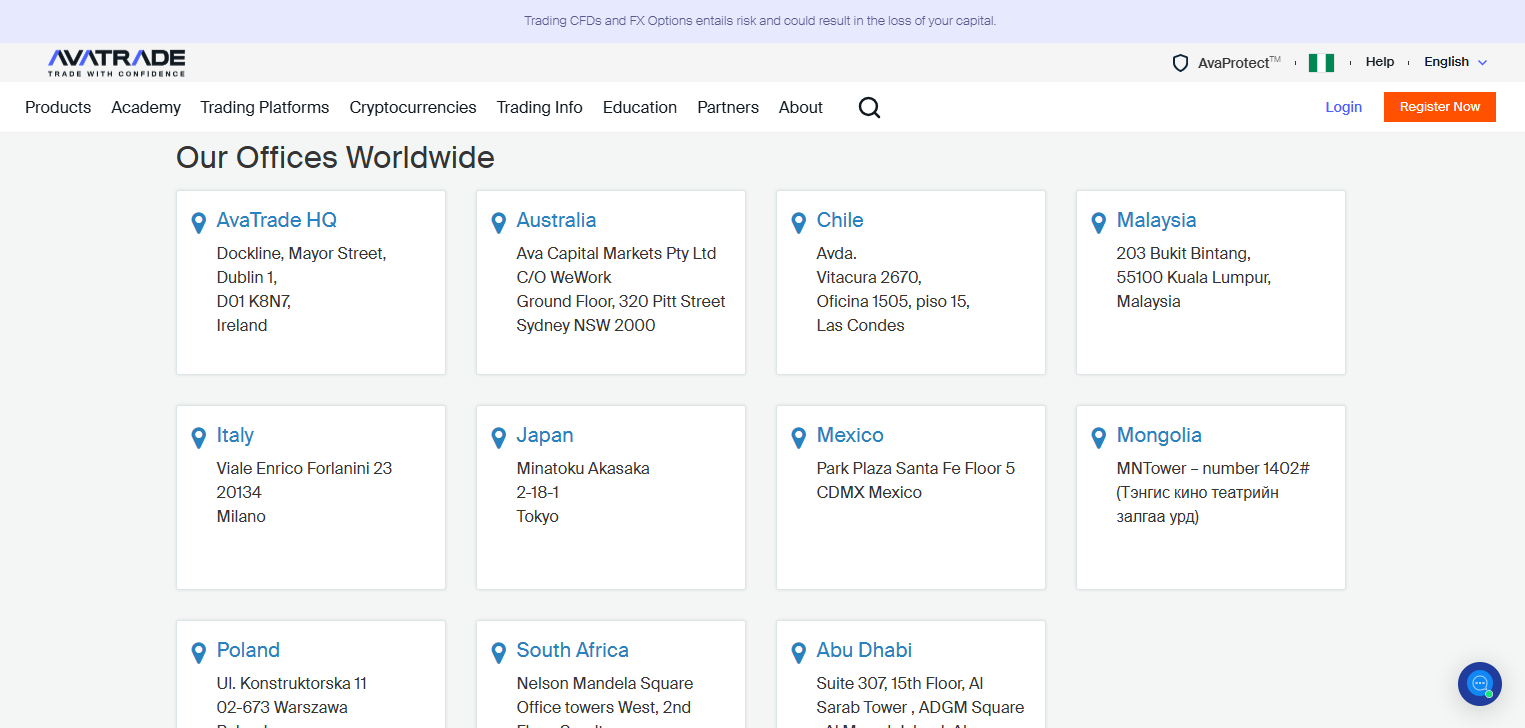

AvaTrade promotes itself as a secure and regulated broker. It is licensed by multiple financial authorities across the globe, including the Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA) in South Africa, and Japan’s Financial Services Agency (FSA).

In addition to its trading services, AvaTrade offers educational resources through a dedicated academy. These include video tutorials, courses, webinars, and market analysis, all aimed at enhancing clients’ trading knowledge.

While these features suggest a well-rounded platform, concerns have emerged from various user reviews about account handling, withdrawal processes, and customer service responsiveness. These mixed opinions warrant a balanced evaluation of the platform’s strengths and shortcomings

More Details

A Comprehensive Breakdown of Why AvaTrade Is Considered a Scam by Some Users

AvaTrade presents itself as a sophisticated and secure trading platform, offering a wide range of financial instruments such as forex, cryptocurrencies, commodities, indices, stocks, and CFDs. It promotes a user-friendly interface, flexible trading tools, and a collection of educational materials designed to assist users of all experience levels. On the surface, these features appear to position the platform as a competitive and reliable option for traders across various global markets.

However, when one delves deeper into the platform's operational structure and user feedback, a more complex narrative begins to unfold. A significant number of individuals have raised concerns about the overall trustworthiness of the platform, especially in relation to how it handles user funds, account access, and withdrawal processes. Reports suggest that users sometimes encounter unexplained delays when attempting to withdraw their profits. In some cases, accounts are suddenly suspended or frozen without prior warning or adequate explanation. Such experiences, particularly when they affect real capital, often trigger suspicion and frustration among users, prompting accusations of unethical behavior or even outright fraud.

Another common issue arises from the platform’s internal policies, specifically the enforcement of inactivity and maintenance fees. These charges, while outlined in the fine print, are not always made clear to new users during the onboarding process. For casual or long-term traders who do not engage with the platform frequently, these charges can accumulate over time and result in a noticeable depletion of account balances. The perception that funds are being drained under vague policies contributes to the narrative that the platform may not be fully transparent in its dealings.

In addition, customer service and user support functions have been widely criticized for being unresponsive or unhelpful, especially in situations where users face urgent challenges such as locked accounts or failed transactions. Traders who experience issues often find it difficult to receive timely and satisfactory responses from the support team. In a field where financial decisions can lead to significant gains or losses within minutes, delays in communication or assistance can have severe consequences. This lack of prompt and effective customer engagement fuels distrust and raises questions about the platform’s accountability.

Furthermore, many users express concern over the platform’s aggressive marketing and account management tactics. For example, users may be repeatedly contacted by representatives pressuring them to deposit more funds or accept guidance from so-called trading experts. While guidance in trading is not inherently problematic, the high-pressure nature of these interactions often makes users feel coerced or manipulated, especially when initial deposits are followed by requests for additional capital before any returns are realized.

The platform also promotes various risk protection features and advanced tools which are meant to help traders minimize losses. However, some users claim that these tools do not work as advertised or fail to activate when needed. The result is often the loss of trades that users believed were secured, leading to further suspicion regarding the platform’s integrity and whether it is acting in the user’s best interest.

Despite its long-standing presence in the online trading industry, these cumulative experiences have led many to view AvaTrade with caution. While some traders may have had satisfactory experiences, the volume and consistency of complaints cannot be overlooked. It is not uncommon for questionable platforms to operate under a veneer of legitimacy by providing a polished user interface, claiming to follow industry standards, and displaying credentials that seem to assure credibility. This blend of professional presentation and behind-the-scenes issues makes it difficult for users to discern whether they are dealing with a genuine financial service or something more deceptive.

Overall, while the platform may offer a broad range of tools and market access, its operational inconsistencies, lack of transparent communication, user complaints about restricted access to funds, and questionable handling of client accounts contribute significantly to the growing perception that it may not be a trustworthy trading environment. These recurring issues raise serious doubts about its ethical standards, prompting many to conclude that the platform is not a safe place to trade and may, in practice, exhibit characteristics associated with scams

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Avatrade

Pros

- AvaTrade is licensed in several regions under different regulatory bodies, which increases the platform’s credibility. Regulatory oversight helps ensure transparency and adherence to international financial standards.

- The platform supports trading across a large number of assets, including forex pairs, cryptocurrencies, commodities, indices, and shares, offering ample opportunities for diversification.

- AvaTrade’s platform options include MetaTrader 4, MetaTrader 5, and proprietary applications like AvaTradeGO. These platforms offer accessible interfaces and tools suitable for traders with varying levels of experience.

- Through its learning center, AvaTrade provides structured education including video guides, eBooks, and tutorials designed to assist beginners and refine the strategies of advanced users.

- Features such as AvaProtect allow users to safeguard trades from losses over a specific timeframe, which adds a layer of security.

Cons

- Some users have reported difficulty in processing withdrawals, with delays or unresponsive customer service. While not universal, these issues may affect user trust.

- AvaTrade imposes a $50 fee after three months of account inactivity, and a $100 administrative fee after 12 months, which may be discouraging for infrequent traders.

- Support is not available around the clock, potentially inconveniencing users in different time zones or those facing urgent technical issues.

Website Overview

Country:

Ireland

Operating Since:

2008

Platforms:

Mobile/Desktop

Type:

Investment/Forex

Spread:

N/A

Funding:

Investment/Forex

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

AvaTrade is licensed in multiple regions, which adds legitimacy.

The platform offers a wide range of financial instruments.

Risk-management tools like AvaProtect are integrated.

Inactivity and administrative fees may reduce account value over time.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

A Balanced Verdict on AvaTrade’s Credibility

AvaTrade appears to be a professionally managed trading platform with extensive regulation, comprehensive educational content, and a diverse range of tradable assets. These elements typically indicate a legitimate business rather than a fraudulent operation.

However, concerns raised by users particularly regarding withdrawals and customer service should not be dismissed. While these issues do not categorically prove malicious intent, they suggest possible inefficiencies or policies that may inconvenience certain traders.

Ultimately, AvaTrade is a legitimate trading platform that operates under recognized regulatory authorities. Nonetheless, potential users should proceed with caution, test the platform with minimal funds initially, and maintain clear records of all communications and transactions.

Comments