Review on Best-funding

Summary

About Best-funding

Best-Fundings.com presents itself as a full-featured online broker / trading platform offering CFD (Contracts for Difference) services across Forex, cryptocurrencies, indices, commodities, and shares. They claim to offer:

-

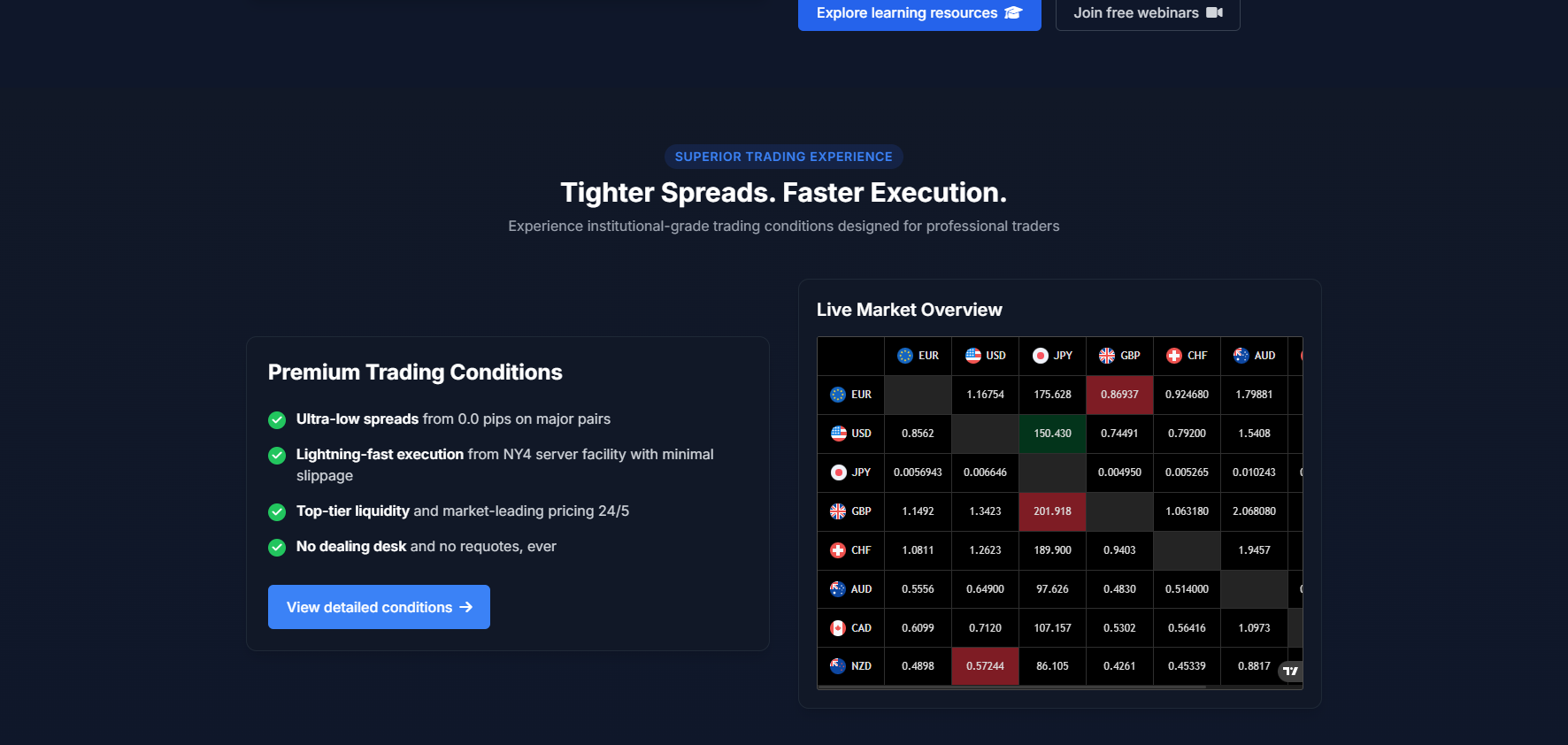

Competitive spreads, lightning-fast execution, various trading tools.

-

Multiple funding methods, segregated client funds, insurance up to USD $1,000,000.

-

Regulatory compliance: they state they are registered in Seychelles under an FSA, and also licensed as a Cyprus Investment Firm (CIF) under CySEC (European regulator) under MiFID II.

-

Various account / investment plans with promised returns (“trading plans” / “investment opportunities”) that are quite high.

At a glance, their marketing strongly emphasizes ease of use, high returns, broad asset classes, global reach, advanced trading tools, and heavy regulation.

More Details

Regulatory mismatch / false claims

-

Best-Fundings claims CySEC & Seychelles regulation. But the regulator FCA (UK) has issued a warning that this firm is unauthorised. If the company was legitimately registered under CySEC or similar, it would appear in their public registers. No independent evidence was found confirming its regulation.

-

Regulatory oversight is critical in financial services; false claims of regulation are a frequent tactic of scam brokers to give the veneer of legitimacy.

-

-

Promises of guaranteed high returns / investment plans

-

They advertise plans with very high percentage returns (“150% / Trade”, instant withdrawal, etc.). Legitimate brokers do not offer guaranteed returns. Returns in trading are uncertain; risks are disclosed. This is often a tell-tale sign of a Ponzi or otherwise fraudulent scheme. Even legitimate brokers offer profit share, but never promises.

-

-

Warnings from real regulatory authority

-

The UK FCA has publicly warned about “BEST FUNDINGS” for offering or promoting financial services without permission. That is official. This strongly supports the conclusion that the site is acting outside legal/regulatory bounds at least in the UK.

-

-

Marketing / testimonials suspicious

-

The “success stories” are vague, lack independent verification. Very large gains in short times are almost always suspect, especially in forex / CFD trading.

-

-

Risk to clients

-

Given the likely lack of legitimate regulation, there may be no recourse if funds are lost or withheld. Users might deposit money, but find that withdrawals are blocked, that additional fees appear, or that the promised features are not delivered.

-

-

Behavior in line with known scam patterns

-

Use of a glossy site, promises of investor protection, insurance, segregated accounts, frequent claims of safety and security are common in both legitimate brokers and in scam ones. But in this case, stricter checks (regulatory registers, independent reviews) do not support their claims.

-

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Best-funding

Pros

- Professional design, polished website, detailed “features” & “tools” described.

- • Range of products & asset classes is wide (Forex, indices, crypto, commodities, shares) which many traders might like.

- • Multiple payment / funding methods, claimed ease of deposit/withdrawal.

Cons

- • Regulation claims seem unsubstantiated / false. Presence of regulatory warnings from reputable regulator (FCA).

- • Very high return promises, “guaranteed returns” type plans – unrealistic and generally a red flag.

- • Likely difficulty withdrawing profits, hidden terms; testimonials likely misleading.

- • Discrepancies and high risk of fraud; unauthorized status in jurisdictions; chances of losing funds high.

Website Overview

Country:

Turkey

Operating Since:

2025

Platforms:

Mobile/Desktop

Type:

Investment/forex

Spread:

N/A

Funding:

Investment/forex

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

Regulation claims They claim to be regulated by Seychelles FSA and by CySEC as a CIF, under MiFID II. There’s a warning by the UK FCA (Financial Conduct Authority) that "BEST FUNDINGS" (same name, same domain) is not authorised by them, and may be promoting or providing financial services without permission. If they were truly regulated by CySEC, they should appear in public registries — there’s no reliable evidence (from independent sources) that they are properly registered/licensed. So “claimed regulation” may be false or misleading.

Warning from FCA The FCA has warned consumers about BEST FUNDINGS as an unauthorised firm. This is a major red flag. It means at least in the UK, the regulator is saying this firm is not licensed. That undermines claims of being regulated.

High returns / “investment plans” The site advertises investment / “plans” with large returns (“150% / Trade”, instant withdrawal, “principal return on maturity”, etc.) Offers of guaranteed or extremely high returns are classic hallmark of scams or high-risk platforms. In regulated brokers / legitimate investment firms, no guarantee of profits is ethical or legal.

Segregated accounts, client protection, insurance The site claims segregated client funds, insurance, etc. While these are plausible features for legitimate brokers, unverified claims without proof / evidence (e.g. license numbers, regulators listing, third-party audits) are weak. Some scam sites include these terms to build trust without backing them.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

While Best-Fundings.com looks sophisticated on the surface, the balance of evidence strongly indicates that it is not trustworthy. The combination of regulatory warnings, unverifiable regulation claims, high return guarantees, and marketing tactics points to a high risk of fraud. For someone considering depositing money or trading on this platform, the risks are very high:

You may not be able to withdraw your profits (or even your deposited capital).

You may be misled by hidden fees or unfulfillable contract terms.

Legal protections are likely absent, especially if the claimed licenses are false.

In conclusion, Best-Fundings.com appears to be a scam or at best a very risky platform. The safest approach is to avoid investing or depositing any funds there, unless you find verified proof of regulation from legitimate authorities and very clear transparent terms.

Comments