Review on Bitinvestflow

Summary

About Bitinvestflow

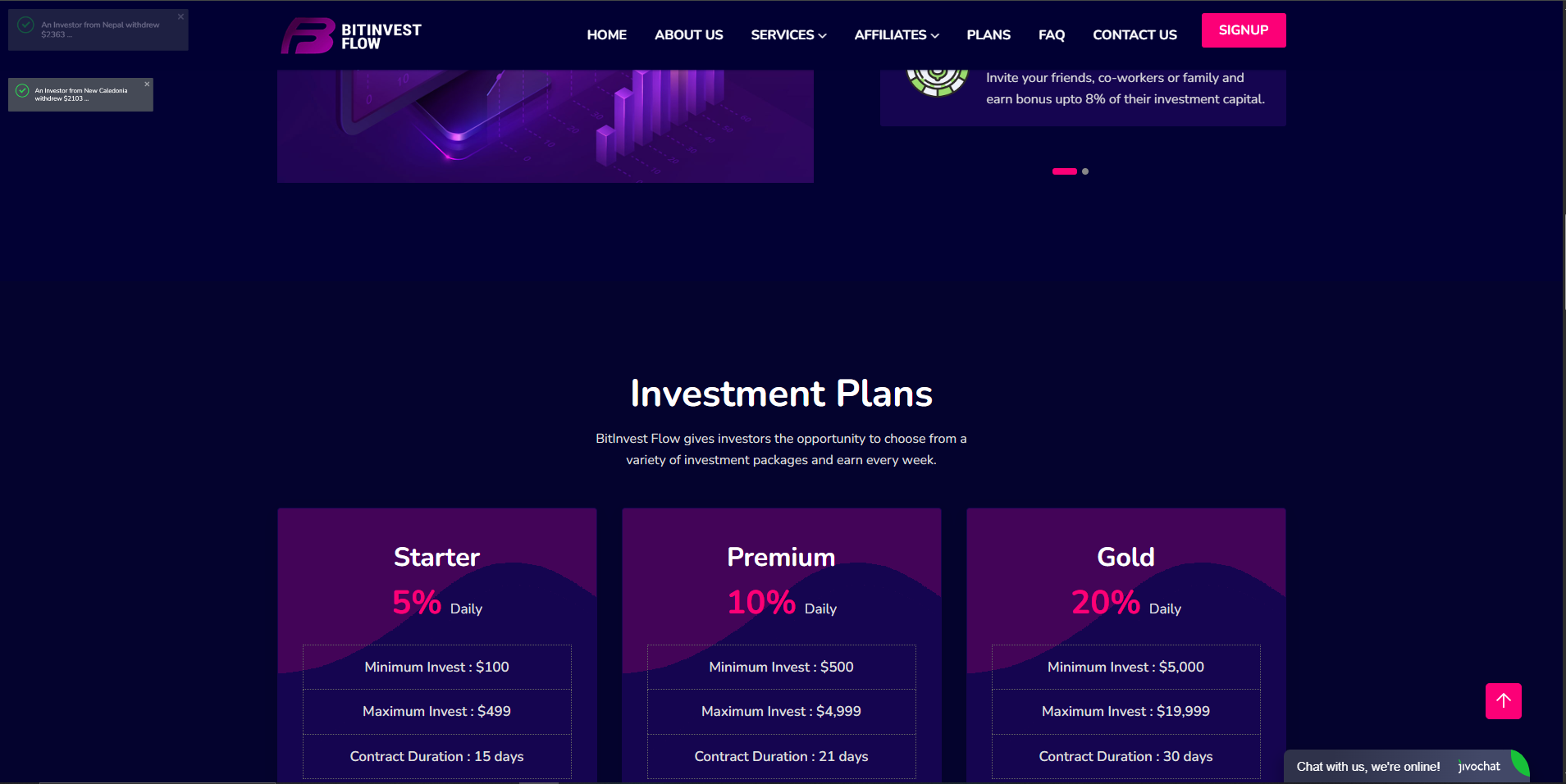

BitInvestFlow positions itself as an online investment/trading platform offering investors “investment packages” with frequent (weekly) returns. The site claims to operate internationally, with “offices” in the UK, USA, Ukraine, and Russia. On its front page, it advertises that users can choose various plans and “earn every week.”

However, public analysis and user reports strongly suggest it exhibits the common hallmarks of high-risk, potentially fraudulent or Ponzi-style investment schemes. There is no credible evidence that it is regulated by recognized financial authorities. Reports from user forums and broker watchdog aggregators say withdrawal requests are blocked or delayed, and extra “fees” are demanded before disbursing funds.

In short: the promise is fast, high returns with minimal effort. The reality—based on available data—leans heavily toward risk, opacity, and possible nonpayment.

More Details

1. Business Model Unsustainable & Unsound

Any platform promising fixed, steady weekly returns in a volatile market like trading or investing must either charge extremely high risk strategies or raise funds from new users to pay old ones (i.e. Ponzi mechanics). Without transparent disclosure and audited proof of trading operations, the business model is suspicious.

2. Lack of Regulatory Oversight / License

Credible investment/trading operations must maintain oversight by government or independent bodies. BitInvestFlow’s “Regulatory Index = 0.00” on review sites means it has no validated regulatory approval. This means if losses happen, there is no legal protection for users.

3. Complaints & Withdrawal Issues

Reported experience from users show that when trying to withdraw profits, platform demands extra “fees” or refuses to release funds. These are classic tactics in scam investment sites: lure people in with small demo withdrawals, then block or delay larger ones.

4. Obfuscated Domain / Hosting Behavior

Mirror login paths like bitinvestflow.com.grinhold.com suggest domain masking or use of third-party hostings — techniques used to confuse tracing or regulatory scrutiny.

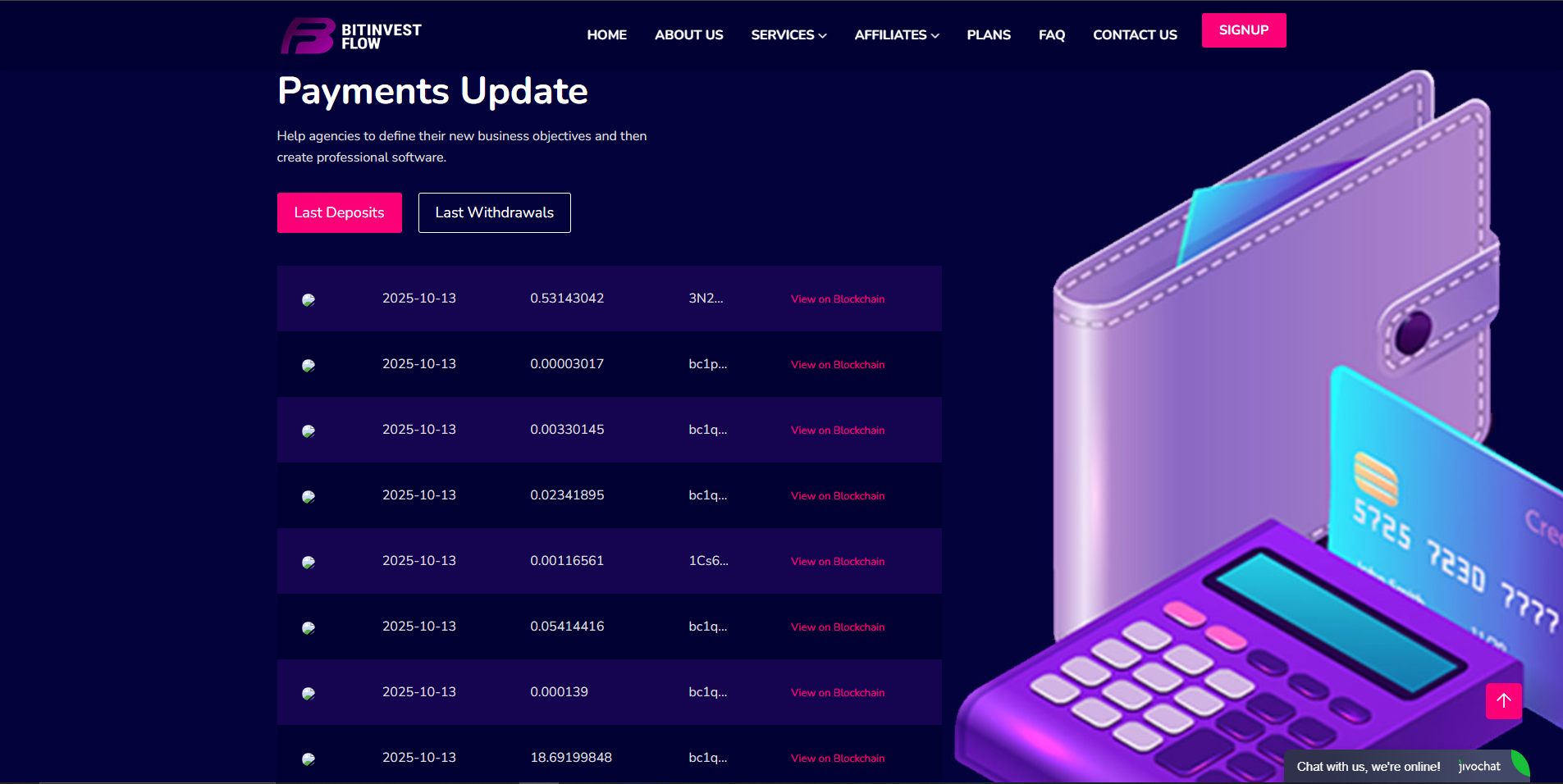

5. Absence of Real Proof / Audit / Performance

No published audits, no proof of actual trading, no performance verification. This is a huge red flag. A legitimate platform will often share audited financials or third-party verification of trades.

6. Appearance on Unverified / Scam Aggregators

Sites that have already flagged it as “unverified” or suspicious further lower credibility.

7. Typical HYIP structure

The “investment packages,” “weekly returns,” “choose your plan” structure aligns with classic High Yield Investment Programs (HYIPs), many of which turn out to be scams or pyramid-style models.

Conclusion of Post Section: While it is impossible (without insider access) to prove 100% that this is a scam, the weight of evidence (lack of regulation, user complaints, unrealistic promises, obfuscation) strongly suggests BitInvestFlow is not a legitimate, sustainable investment or trading platform. It behaves like a high-risk, possibly fraudulent scheme.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Bitinvestflow

Pros

- Slick presentation / marketing appeal: The website looks professional, which can build trust for novice investors.

- Ambitious reach / claims: It markets with big promises, which appeals to people seeking fast returns.

- Multiple “packages” options: This gives illusion of choice and flexibility to investors.

Cons

- No verifiable regulation or license — users have no legal recourse.

- No public proof of performance / audits — no transparency.

- Typical red flags of HYIP/ Ponzi schemes — frequent weekly payouts, “investment packages,” referral schemes, etc.

- Unrealistic profit promises — likely unsustainable business model.

Website Overview

Country:

Turkey

Operating Since:

2025

Platforms:

Mobile/Desktop

Type:

Trading/investment

Spread:

N/A

Funding:

Trading/investment

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

Lack of verifiable regulation or license No record of BitInvestFlow being registered or regulated by top-tier financial regulators (e.g. FCA UK, SEC, ASIC, etc.). Platforms offering financial products without regulation are inherently risky.

No proof of actual trading / financial statements / independent audit Credible investment firms often publish audited statements or proofs of reserves; BitInvestFlow does not.

Usage of aggressive marketing & multi-level “packages” Investment “packages” (tiers) often encourage recruiting others or locking funds for fixed periods — a structure favorable to scams.

Domain age / online footprint The domain and associated websites have limited credible history; mirror or login subdomains suggest attempts at obfuscation.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

Given the analysis above, BitInvestFlow should be treated with extreme caution. The site displays many of the textbook red flags of investment scams: unverifiable regulation, lack of transparency, promises of guaranteed returns, difficulty withdrawing funds, and domain/hosting irregularities.

If I were advising a friend, I would strongly warn against depositing substantial funds into BitInvestFlow. It may operate long enough to collect deposits, but paying out consistently over long term is doubtful — and chances of loss are high.

If you already have funds invested or are considering doing so, proceed only with amounts you can afford to lose, and try to verify every claim they make (licenses, audits, registration, proof of trading). But the safer assumption is that this platform is likely fraudulent or, at best, extremely high risk.

Comments