Review on Capitaltrustsbnk

Summary

About Capitaltrustsbnk

The website Capital Trust SBNK (URL: capitaltrustsbnk.com) presents itself as an online banking institution, claiming to offer corporate banking services, crypto-asset accounts, checking and savings, cards, loans, and international payments. On its “About Us” and services pages it states that it is “the first nationally chartered United States Bank” offering checking + crypto wallets in one online platform. It also claims FDIC insurance for deposit accounts (“Each individual customer’s account is insured by the FDIC up to at least $250,000 per account”).

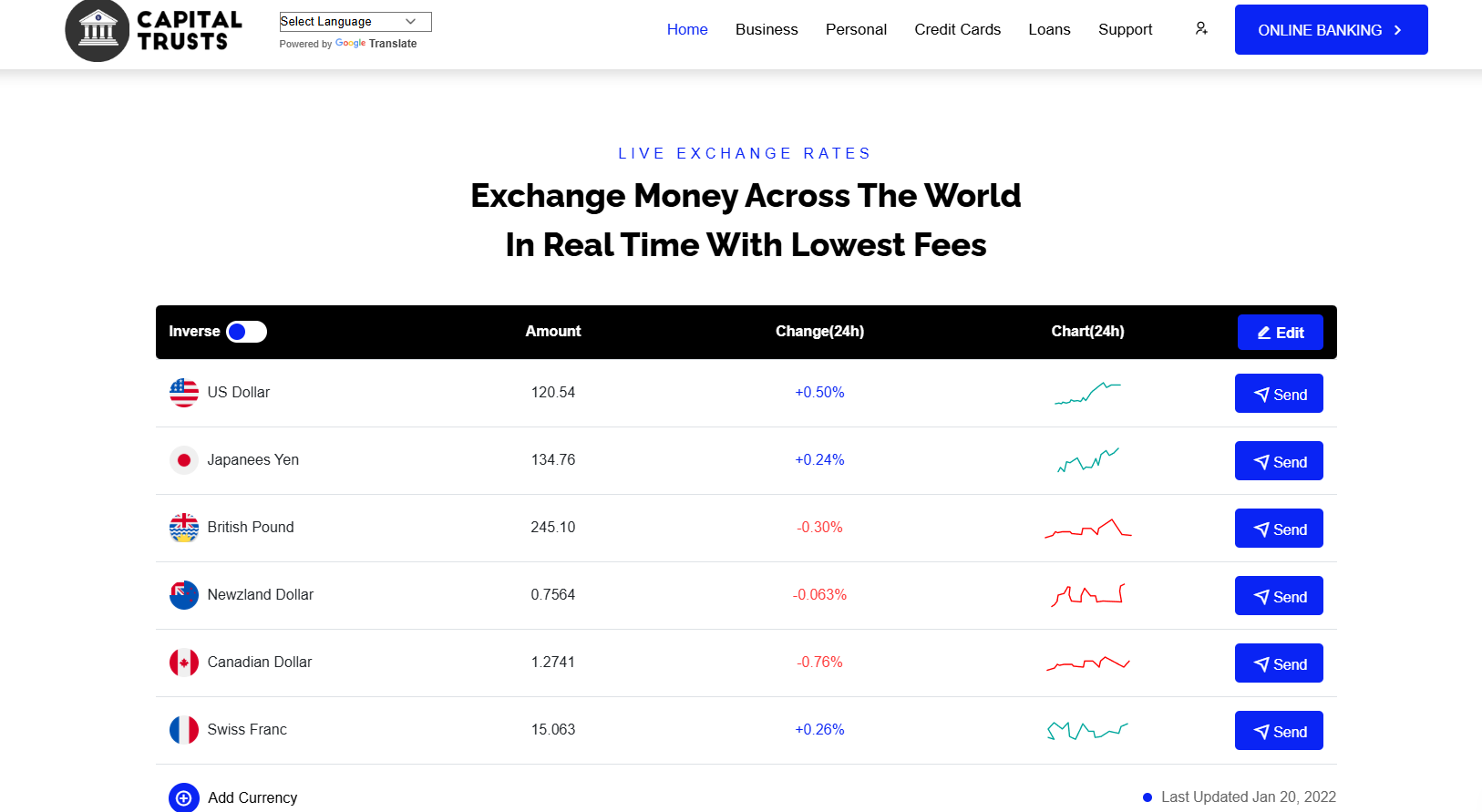

The website shows a structure typical of financial institutions: navigable sections like “About Us”, “Why Choose Us”, “Services”, “Help Centre”, contact details with an address and phone, FAQs, and sign-up flows.

However: upon closer inspection, the website’s claims raise multiple questions regarding legitimacy: the domain looks newly registered (or untrusted), some of the provided contact details are vague (for instance phone listed as “+1 (CAPITAL) TRUST”), some service claims seem overly broad (crypto + checking + global payments + loans) without evidence of regulatory licensing or established banking credentials. The address given (“24486 Yukon Rd, Kasilof, Alaska 99610, USA”) is unusual for a “nationally chartered US bank”.

In short: The website appears professionally laid-out, but there are significant red flags that warrant caution.

More Details

After reviewing all available information, the site must be regarded with extreme caution and currently leans toward high-risk / potentially scam rather than unquestionably legitimate. Here’s a breakdown of why:

-

Regulatory and licensing transparency is lacking. A genuine national bank in the U.S. is required to be chartered by the OCC and be a member of the FDIC. The website claims FDIC insurance, but that claim alone does not substitute for verifiable records. A lookup in the FDIC BankFind database did not show an institution under the exact name “Capital Trust SBNK” or matching charter numbers. Without this, the FDIC-insured claim is unverified.

-

Unusual address and presentation for a bank. The physical address listed is in Kasilof, Alaska — a relatively remote location not typical for a “national bank” serving global crypto+corporate clients. The telephone number is non-standardly formatted. These factors raise questions about the seriousness of the institution.

-

Domain and naming oddities. Using “sbnk” instead of “bank” in the domain raises concerns: either a typo or intentionally misleading. The website may aim to look like “CapitalTrustBank.com” but uses “sbnk”. This could indicate scam-style mimicry.

-

High-promise and risk-y business model. Offering checking + savings + crypto wallet + international payments + loans across corporate and retail clients with minimal age or track record is ambitious. High-yield/novel offerings tend to be associated with fraudulent schemes.

-

Lack of independent external validation. A legitimate bank will have presence in regulatory announcements, ratings, news, user reviews, etc. Here, external data is very thin. The site itself shows placeholders (“00 years”, “00 happy customers”) which indicates the content may not be thoroughly developed.

-

Potential for deposit risk. If users deposit funds believing FDIC insurance applies, and the institution is not actually insured, they could lose money with little recourse. The inclusion of crypto activities further complicates matters, since crypto wallets may not have the same protections as traditional bank deposits.

Given all of the above, the safe conclusion is that this site should be treated with skepticism and the possibility of being a scam (or at least a very high-risk unverified entity) rather than a fully legitimate bank.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Capitaltrustsbnk

Pros

- Clear and simple website UI, aiming at online users globally (which might suit remote or crypto-friendly clientele).

- Depicts standard banking features (checking, savings, cards, loans) which many users expect.

- Provides contact and address details (although atypical) which gives at least a veneer of legitimacy vs. sites that hide all contact information.

Cons

- Major credibility issues: inability to find independent confirmation of national bank charter, regulatory licensing, or FDIC membership under the name.

- Unusual features (crypto wallet + bank) combined with minimal operational history: risky proposition.

- Some details (phone number, “00 years”, “00 happy customers”) suggest template or incomplete site content rather than real matured institution.

Website Overview

Country:

USA

Operating Since:

2024

Platforms:

Mobile/Desktop

Type:

Online bank

Spread:

N/A

Funding:

Online bank

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

The website provides many features typical of banking sites: account creation path, verification steps, FAQs, privacy & policy links.

The service offering (checking + crypto wallet) is somewhat innovative and may appeal to users seeking blended fiat/crypto banking.

The website claims FDIC insurance for deposits — a strong credential if true.

Contact address and phone are displayed, giving the appearance of transparency.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

While the website for CapitalTrustSBNK.com is polished and presents itself as a modern, crypto-enabled online bank, the evidence strongly suggests caution. The lack of verifiable regulatory registration, licensing disclosures, inconsistent details (like “00 years in banking”), and a domain name that raises questions all point to significant risk. If one were considering using this site for real banking or crypto deposits, they should first demand proof of charter, FDIC membership, regulator references, audited financials, and independent verification of its operations.

Until such evidence is made available and confirmed, this remains a potential scam or unverified high-risk financial service. It is unwise to deposit funds, link your assets, or engage in major transactions without further due diligence. If you choose to proceed anyway, do so at your own risk, using only funds you can afford to lose.

Comments