Review on Chainsassets

Summary

About Chainsassets

ChainAssets (also displayed as “chainassets.org” or in some URLs “chainassets”) presents itself as a global systematic investment platform that offers “advanced investment strategies and wealth management solutions” to both institutional and retail investors.

The site claims to use quantitative techniques, algorithmic trading, ESG integration, and disciplined frameworks to deliver “steady income accrued every calendar day.” It also asserts substantial credentials — for example, a claim of $649 billion assets under management (AUM) (though no verification is offered) .

In its “Terms & Conditions / Rules & Agreements” section, the platform clarifies that it is a “private transaction” between the member and the program, that it is not FDIC insured, not a licensed bank or securities firm, and that it reserves the right to change rates or rules unilaterally.

The FAQ page repeats generic assurances: that investments are “safe,” that the site is “registered” with some bodies (e.g. FINRA) — though no verifiable documentation is provided.

In short: ChainAssets markets itself as a sophisticated, professional investment/fund management service offering guaranteed or steady returns through technology-driven strategies. But beneath those claims are numerous inconsistencies, red flags, and ambiguous statements that strongly suggest fraudulent intent.

More Details

No verifiable regulation or licensing

Any legitimate investment firm must be registered or operate under regulation in its jurisdiction(s). ChainAssets provides no credible credentials, no registration numbers, no oversight bodies that can verify its claims. Its own terms disclaim that it is not a bank or securities firm. This lack of accountability is a hallmark of fraudulent operations.-

Promises of guaranteed steady daily returns

Financial markets fluctuate. No investment firm can guarantee returns every day consistently over long periods. When a site promises guaranteed income — especially daily payouts — it is almost always fraudulent or a Ponzi-type scheme. -

Opaque structure & private disclaimers

Labeling transactions as “private” to avoid securities laws, while disclaiming responsibility, inserts a legal shield for malicious behavior. This is a red flag: legitimate investment platforms are transparent in their structure and regulation. -

Unusual and conflicting rules

The rule that new deposits cannot be lower than previous ones is nonsensical for real trading. The freedom to change terms unilaterally is a mechanism to trap funders. Those are mechanisms aligned with schemes rather than real investment businesses. -

Evidence of malicious community experience

Independent users and forums warn against such schemes. While there is no direct specific exposure of ChainAssets, the patterns match many scam operations: forced extra payments, withdrawal difficulties, disappearing platforms. -

Marketing over substance

The site speaks about ESG, algorithmic trading, quant strategies, huge AUM — but offers zero proof, zero audit reports, zero independent validation. It is all sales talk. In contrast, real investment firms publish audited performance, regulatory disclosures, and team transparency. -

Regulator warning patterns matched

Bodies like the CFTC warn of platforms that promise fixed returns, avoid connecting to legitimate banking, and ask users to send crypto tokens to proprietary wallets. ChainAssets’ model mirrors many such warnings.

Thus, from structural, operational, legal, and community perspectives, ChainAssets bears nearly all the traits of an investment scam, not a legitimate investment firm.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

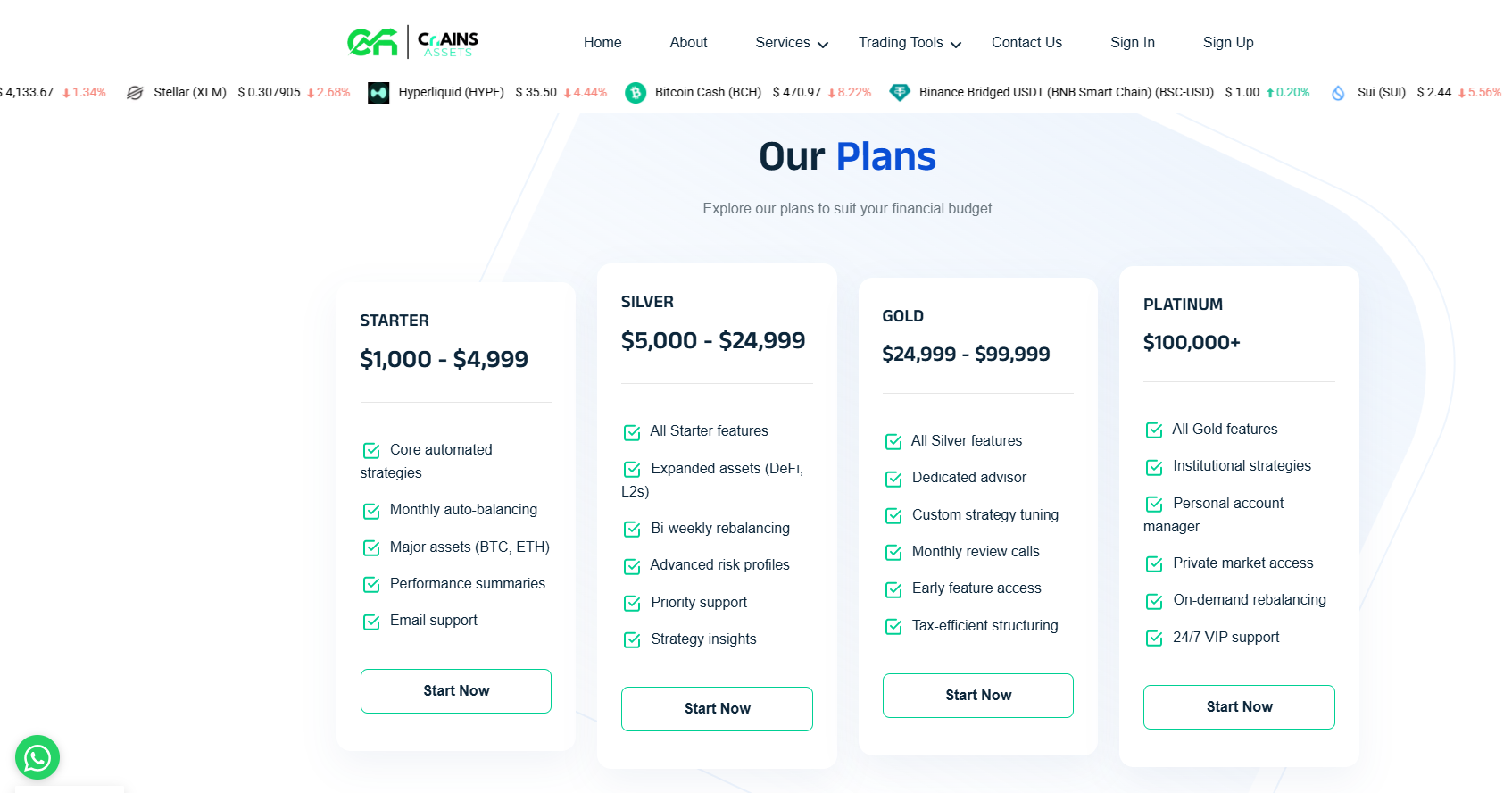

Photos of Chainsassets

Pros

- Wide appeal: It markets to both retail and institutional investors (broad reach).

- Flexibility illusion: The site claims it can change rules, rates, etc., giving impression it's dynamic.

- Seemingly low minimums / easy access: The rules suggest modest minimum withdrawal ($50) and claims of fast processing to lure smaller investors.

Cons

- No real regulation or oversight — thus no protection for investors.

- Vague or unverifiable claims (e.g. AUM, past performance) with zero audit or proof.

- Withdrawal / deposit constraints designed to trap funds or complicate exit.

- Heavy disclaimers that remove liability (classic scam tactic).

Website Overview

Country:

NIGERIA

Operating Since:

2025

Platforms:

Mobile/Desktop

Type:

Trading/investment

Spread:

N/A

Funding:

Trading/investment

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

Lack of verifiable regulatory registration The site claims to be “registered” or “certified” (even referencing FINRA) in its FAQ, but no official records or verifiable license number, regulators, or proof are provided.

“Private transaction” & exemption clauses In its legal terms, it claims that deposits are "private transactions" and thus exempt from securities laws, disclaiming responsibility for disclosures. This is a classic “I’m not regulated” carve-out.

Promise of steady daily returns Legitimate investment platforms cannot guarantee fixed daily returns, especially over long durations — markets are volatile and returns cannot be guaranteed. Yet the site repeatedly assures “steady income every calendar day.”

Ultra-high implicit claims (e.g. $649 billion AUM) The claim of managing $649 billion is extraordinary, yet no supporting evidence, audits, or transparency is given. Such a claim for a relatively obscure site is implausible.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

After deep examination, the evidence strongly indicates that ChainAssets is a scam — or at best, a high-risk fraudulent scheme — rather than a genuine investment platform. While its polished presentation and finance-sounding language may lull people into trust, the underlying structure is rife with classic scam warning signs: no regulation, unverified claims, opaque rules, withdrawal traps, and community suspicions.

If you or anyone you know is considering investing with ChainAssets, the safest and most prudent action is to avoid it entirely. If funds have already been deposited, try to recover them via legal or regulatory channels, but do not engage further with the platform. Warn others not to invest, and report the site to your local financial authorities, cybercrime agencies, or consumer protection bodies.

In conclusion: ChainAssets is not trustworthy. Treat it as a dangerous red zone, not as a legitimate opportunity.

Comments