Review on Dillonmfb

Summary

About Dillonmfb

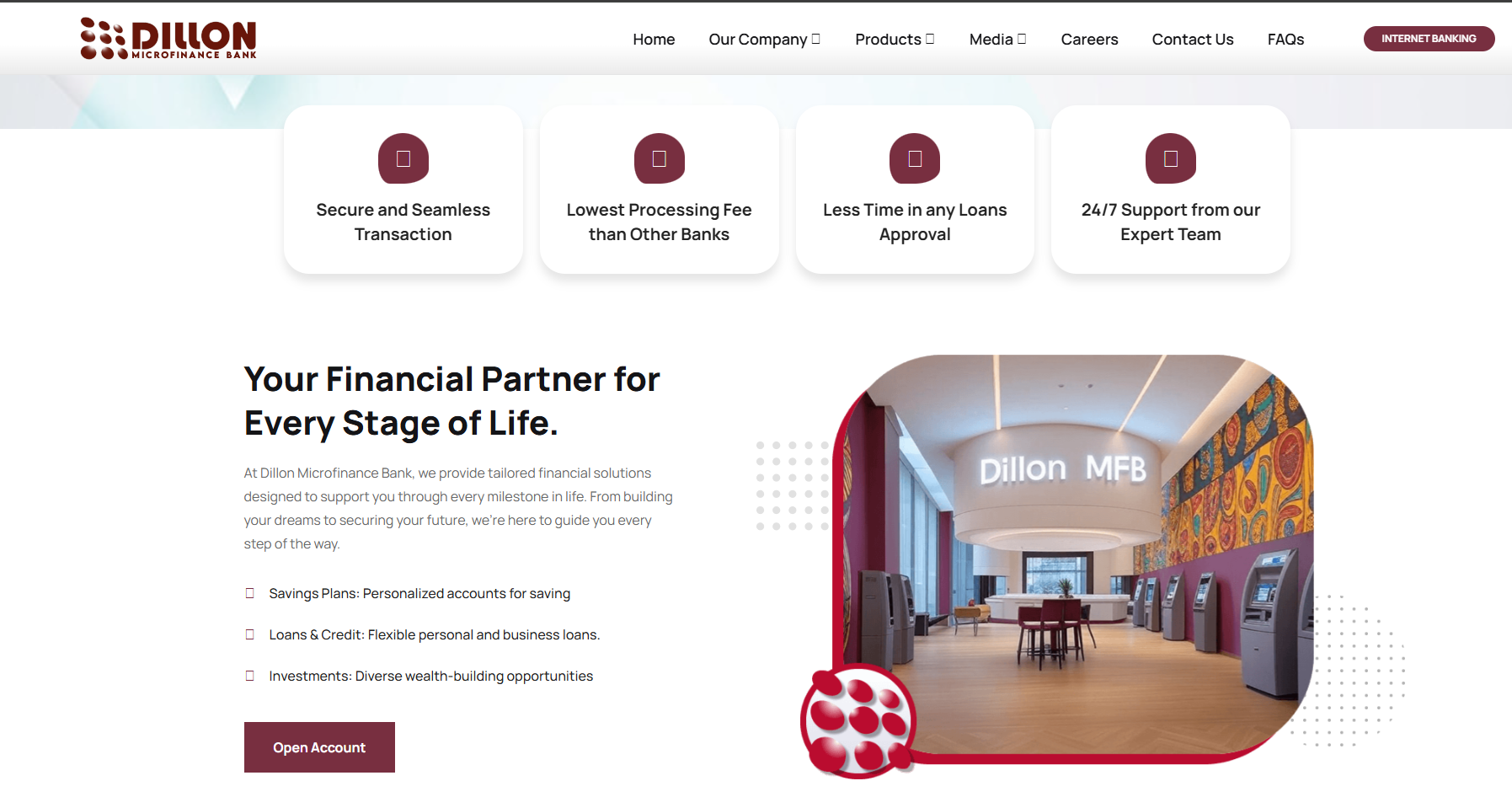

The website at https://www.dillonmfb.com/ presents itself as the online home of Dillon Microfinance Bank (“Dillon MFB”), positioned as a full-service digital microfinance bank in Nigeria. According to its pages, Dillon offers savings accounts (e.g., “Dillon Purse”), medium-term savings (“Dillon Future Account”), a corporate account (“Dillon Plus”), and instant loans with purported approval and disbursement within five minutes.

The site also claims online account opening (no branch visit required), 24/7 support, encrypted global payments, and “lowest processing fees than other banks”. A physical address is given in Lagos (Westbrook Mall, 4th Roundabout, beside ENYO Filling Station, Lekki).

In short: the website aims to operate as a modern, digitally-enabled microfinance bank serving individuals and businesses in Nigeria through online channels.

More Details

Based on the available data, my judgment is that the site is probably real but requires strong caution — it does not appear definitively scam, but it also falls short of fully verifiable legitimacy as a fully-licensed established bank.

Here’s the detailed reasoning:

-

On the positive side, the company appears incorporated; there is a physical address; the website has a legitimate look and presents banking products in a plausible manner. That suggests this is not obviously a fake one-page scheme or phishing site.

-

On the caution side, the lack of clear regulatory licensing information in publicly accessible lists for microfinance banks means whether you are fully protected (e.g., by deposit insurance, strict regulatory oversight) is unclear. Banking takes place in a highly regulated environment in Nigeria, and microfinance banks ordinarily must be licensed and supervised by the CBN. The absence of Dillon MFB in older lists (2021) suggests a very new institution or one not yet fully certified.

-

Because incorporation is so recent (2024), the bank may not yet have an established branch network, track record of customer service, or audited reports. This means risk is higher than with longstanding banks.

-

The marketing claims are ambitious (instant loans in five minutes, lowest fees, global payments) and may oversell; prospective customers should verify terms and conditions carefully.

-

There is some inconsistency in spelling (company registry “Dillion”, website “Dillon”), which could lead to confusion or be a red flag if you are transferring funds.

-

If you choose to do business with them (open an account, deposit funds, apply for loans), you should verify: a) That they hold a valid microfinance bank licence from CBN, b) That your deposits are insured (NDIC), c) The actual terms of benefits (fees, interest rates, loan conditions).

In conclusion: I would treat Dillon Microfinance Bank with cautious optimism. It has many of the trappings of a legitimate bank, but because it is very new and lacks transparent licensing disclosures, you should proceed carefully, keep amounts modest until you see credible testimonials or regulatory confirmation, and always verify direct with the institution.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Dillonmfb

Pros

- Physical address given (which adds a layer of transparency).

- A modern and visually decent website, which suggests a level of professionalism.

- The company incorporation information is publicly available (though recent).

Cons

- Regulatory/licensing clarity is lacking — no obvious publicly verified licence number or listing in official regulator lists.

- Very short operating history (incorporated Feb 2024) means limited track record and possibly higher risk.

- Bold claims (instant loan disbursement, global encrypted payments, lowest fees) may exceed what a standard microfinance bank with limited history can deliver — this could raise expectations unfulfilled.

Website Overview

Country:

NIGERIA

Operating Since:

2024

Platforms:

Mobile/Desktop

Type:

Online bank

Spread:

N/A

Funding:

Online bank

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

A website is present, with clearly stated products (savings accounts, loans, e-channels).

Physical address listed (Lekki, Lagos) and contact number provided (+234 818 582 3404).

The site claims to have management team pages, board of directors, and product details.

Incorporation data appear in business-registry level sources: e.g., Dillion Microfinance Bank Limited (note the spelling with two “l”) is recorded as a Nigerian company, RC-7331597, incorporated 5 Feb 2024, Lagos address (Lekki-Epe Expressway, Ikate Lekki).

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

Working online banking with a microfinance bank presents both opportunities and risks. With the site for Dillon Microfinance Bank (dillonmfb.com) you see a clean interface, modern product set and what appears to be a real company incorporated in Nigeria. That is promising. However, the banking sector is heavily regulated, and the items missing from public view (clear licence, insurance of deposits, years of track record) cannot be ignored.

My recommendation: If you are thinking of placing significant funds, open only a minimal account initially, test their service, and verify with the bank directly via phone or visit the Lagos address listed. Confirm their regulatory status with the Central Bank of Nigeria or NDIC. Until then treat the site as “potentially legitimate but unproven”. Avoid transferring large sums or relying on their “instant loan” promises before you have visible evidence of performance (loan disbursement, good customer reviews, transparent terms). With caution, the service may evolve into a solid opportunity — but it is not yet “fully proven” like a long-standing commercial bank.

Comments