Review on Elitemetatradesignal

Summary

About Elitemetatradesignal

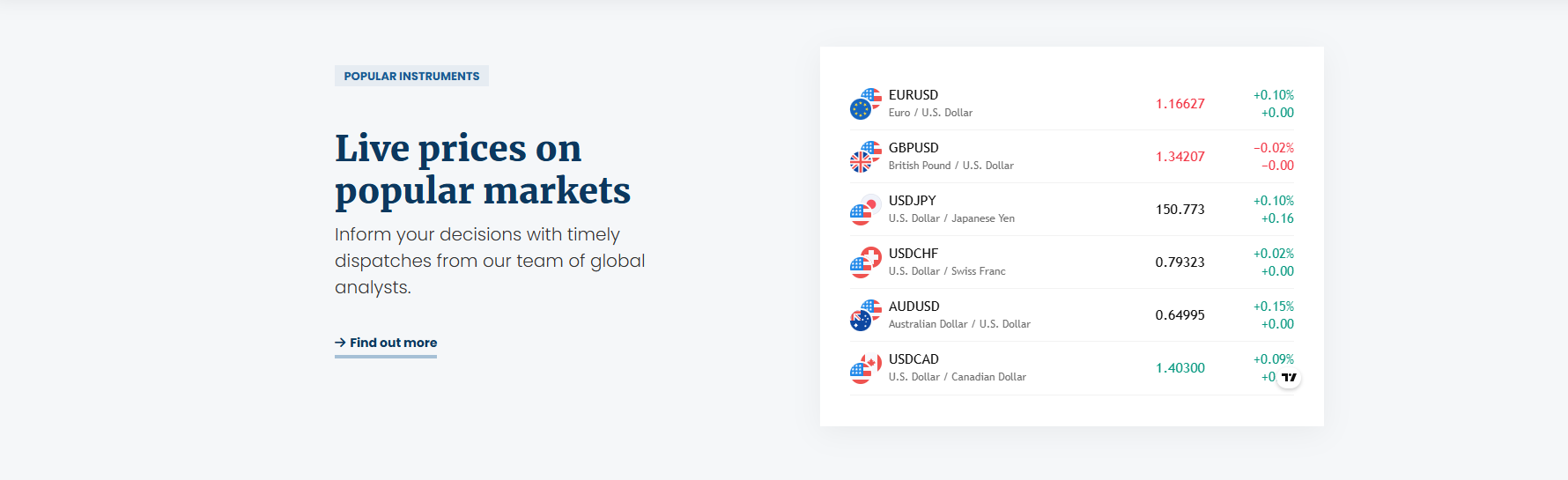

The website Elite Meta Trade Signal (URL: elitemetatradesignal.one) presents itself as a sophisticated trading and signal-provider platform targeting retail traders interested in forex, CFDs, cryptocurrencies and metals. The site claims:

-

To offer access to “more than 3 million products” and “1000+ opportunities to trade” through tight spreads, transparent pricing and “tier-1 liquidity”.

-

To be a “regulated broker” with client funds held in segregated accounts.

-

To provide multiple membership plans (Starter, Basic, Premium, Elite) with promise of “up to 41.7%”, “up to 35%”, or “up to 55%” interest on crypto investments.

-

To guarantee 24 hour withdrawals and “award-winning customer support”.

At first glance, the site is designed to appear like a high-end trading platform / broker with broad product offering, strong performance claims, and professional polish. However, the depth of the promises and the lack of credible independent verification raise serious questions.

More Details

1. Regulation and Transparency

A legitimate broker will prominently disclose its regulatory body (e.g., FCA UK, ASIC Australia, CySEC, NFA US), licence number, physical address and audit statements. This website claims to be a “trust broker” but offers no credible regulator, no licence number, no independent audit. That omission is a classic red-flag seen in many scam operations.

2. Marketing Claims vs. Evidence

The site uses language like “access a wealth of trading opportunities”, “more than 3 million products”, “up to 55% interest”, “award-winning customer service”. Such marketing is designed to excite rather than to inform. In contrast, credible brokers’ claims are tempered with evidence (e.g., “as of 31 Dec 2024 our average spread on EUR/USD was 0.9 pips”; “licence X123456”). The absence of meaningful proof undermines their claims.

3. Interest on Crypto & Membership Structure

Promising “trading interest on crypto” is more typical of schemes where client funds are pooled and returns are promised, rather than execution-only trading. It raises the possibility of client funds being diverted or misused. The membership tiers also appear structured to encourage higher deposit/investment amounts (Premium, Elite) which can lead to greater exposure and losses.

4. Product Risk and Leverage

Leverage of 1 : 200 is very high for retail clients, especially combined with CFDs and cryptocurrencies. Such combinations increase the probability of rapid losses. A responsible broker provides leverage but also matches it to client sophistication and offers robust disclaimers and risk-management tools.

5. Lack of Independent Verification & External Reputation

Searches show little or no credible, independent user feedback specifically about this entity (Elite Meta Trade Signal) or its domain. A real operational broker normally has many user reviews, audit reports and open account verification via Myfxbook, FXBlue or similar. The absence of this suggests the operation may not be genuine or may be very new and lacking track record.

6. Domain and Branding Indicators

Use of a less common top-level domain (.one) combined with a generic brand name (“Elite Meta Trade Signal”) increases risk of deception; such domains are often used in fraudulent operations to mimic legitimate ones. In addition, the duplication of typical claims seen in many Forex signal-scam websites (e.g., “elite”, “meta trade”, “signals”, “1:200 leverage”) suggests this may be part of the wider “signal/FX scam” ecosystem rather than a genuine independent broker.

7. Risk of Client Loss and Withdrawal Issues

Even if the site is not an outright scam, the combination of high leverage, aggressive marketing, unclear regulation, and potential conflict of interest means the risk of heavy client losses is high. Withdrawal promises (“24 hr”) may not be honoured — many scam sites delay or block withdrawals once deposits rise.

8. Conclusion of Scam Likelihood

Putting it all together: absence of regulatory proof + unrealistic returns + high risk instrumentation + signal-/membership-style structure + generic branding = strong indicators of scam behaviour. Until transparent licensed detail, audited performance records and user testimonials with verified withdrawals appear, this site should be treated as very high risk, and most prudent action is to avoid.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Elitemetatradesignal

Pros

- It offers a wide scope of trading instruments (forex, commodities, crypto, metals) which may appeal to traders looking for one-stop access.

- The membership / plan structure is clear on the site (Starter → Elite) which gives users visibility about tiers and benefits.

- The site does mention that trading carries risk which is at least a minimal responsible disclaimer.

Cons

- Lack of verifiable regulation/licensing information is a major con. Without clear regulator name and licence number, trust is severely weakened.

- Lack of publicly accessible verified performance records or reviews from credible third-party auditors.

- Over-promising high returns (“up to 55% interest”, “more than 3 million products”, “1000+ opportunities”) which are unrealistic and not backed by transparent evidence.

- The dual role of broker + signal provider creates conflict of interest — incentives may favour the provider, not the client’s best outcome.

Website Overview

Country:

USA

Operating Since:

2025

Platforms:

Mobile/Desktop

Type:

Trading/foreex

Spread:

N/A

Funding:

Trading/foreex

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

High leverage & risky product mix – The site advertises leverage of 1 : 200 and a product mix that includes forex, crypto-CFDs, commodities and metals. These are high-risk instruments.

Membership plan with “interest” on crypto – The membership structure includes “Trading Interest on crypto” and referral commission zero. Such “interest” offers are typical of investment-scheme style promises rather than pure execution only brokers.

Withdrawal promise vs. track record unknown – They claim “Withdrawal: 24 hrs”, but no publicly verifiable track record or audited withdrawals for clients is presented on the site (from publicly available sources).

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

In conclusion, while Elite Meta Trade Signal presents a slick and professional appearance, the underlying architecture raises major concerns about its legitimacy. The website’s claims are far beyond what many regulated brokers would responsibly promise, yet the transparency and independent verification typically required are missing. The high-risk product suite, high leverage, and “interest/investment” style membership structure tilt the balance toward this being a scam or unreliable operation rather than a trustworthy broker or signal provider.

If you are considering using this site or depositing funds: proceed only with extreme caution — treat any amount you deposit as money you can lose. Better yet, avoid it until proof of regulation, audited performance, and legitimate client feedback surfaces. Given the evidence, my strong recommendation is do not trust this site with any significant funds and steer clear.

Comments