Review on Everguardtrustbank

Summary

About Everguardtrustbank

This review examines the website Everguard Trust Bank (URL: https://everguardtrustbank.com/) and assesses its claims, structure, reliability, and potential risks. The site presents itself as an online bank offering banking, investment, and savings services. It claims licensing, broad financial activity across many countries, KYC for clients, SSL encryption and a full digital banking environment. For example, the FAQs section states: “Yes, our Company is totally a legal platform licensed by the Securities and Exchange Commission to carry out financial activities in over 105 countries.”

However, on closer inspection the website shows multiple red flags: inconsistent naming (the URLs on the site appear to mirror those of other financial institutions rather than matching the name exactly), lack of verifiable regulatory registration, unconfirmed domain history, and borrowed content that appears generic rather than bespoke. There is little to no credible external verification of its claimed status as a fully-licensed banking institution, especially for global operations. Given the nature of online banking fraud and the high risk of unregulated platforms, caution is strongly advised.

In short: while Everguard Trust Bank presents a professional facade, the evidence suggests serious legitimacy concerns. As such this site should be treated as very high risk, and the possibility that it is a scam cannot be excluded.

More Details

Taking all the evidence into account, the website everguardtrustbank.com exhibits the characteristics commonly found in scam or fraudulent online “banks”. Below is a deeper breakdown of why this site is considered very high risk for being a scam rather than a legitimate operation.

-

Regulation and licensing concerns

Legitimate banks—especially those offering deposit accounts, savings, credit cards or investment products—must be regulated by the relevant national authorities (e.g., in the U.S., the FDIC, OCC, state banking regulators). They also disclose insurance schemes, regulatory license numbers, and branch verification. This site does not provide verifiable regulator information. The sweeping claim of being “licensed by the Securities and Exchange Commission” (without specifying which country’s SEC) is too vague to be credible. -

Improbable claims and scope

The claim that the company conducts financial activity across “105 countries” is highly ambitious and atypical for an online start-up bank. Such global reach would require complex compliance, licensing, and local regulation, yet no evidence of that is provided. Scammers often use large-scope claims to impress potential victims. -

Domain age and reputation issues

Without clear long-term domain history and strong user reviews or regulatory listings, the site’s trust is very low. Many legitimate banks have been operating for decades and have extensive public records; this site lacks that track record. -

Template content and inconsistency

When a website uses generic “banking template” content (branch hours, screenshot banks, routing numbers) that seem copied from elsewhere, it suggests the operation may be artificially constructed just for credibility, rather than representing a real, functioning banking institution. -

Contact channels and transparency

Real regulated banks typically provide a full corporate address, branch list, clear customer service phone numbers, disclaimers about FDIC/NCUA insurance, and transparent audit or annual reports. The contact information here is minimal, with generic support email, WhatsApp and only two US addresses which cannot be readily verified. This weakens credibility. -

Potential for financial harm

If you deposit funds, invest or open accounts with this “bank”, you may find that your funds are neither insured nor retrievable. If the entity disappears or shuts down, you have no legal regulatory framework to pursue your money. This is consistent with scam operations that promise high yields, global access, or “simple sign-up and profit” but collapse once they have collected sufficient deposits.

Given all of these factors, this website should be treated with extreme caution, and it is strongly recommended not to deposit or invest any funds with it.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Everguardtrustbank

Pros

- The site presents in a well-designed, professional manner: modern layout, SSL encrypted pages, apparently full banking product descriptions.

- It offers detailed product-style pages: business banking, savings, checking, mobile banking tools — which can make it appear convincing to visitors.

- The presence of a privacy policy and some structuring (FAQs, contact details) may reflect some attempt to appear legitimate, which could be a positive “cosmetic” feature for a real institution.

Cons

- Lack of credible regulatory registration: No verifiable documentation was found to substantiate that Everguard Trust Bank is insured, regulated, or operates under recognised banking laws in the U.S. or internationally.

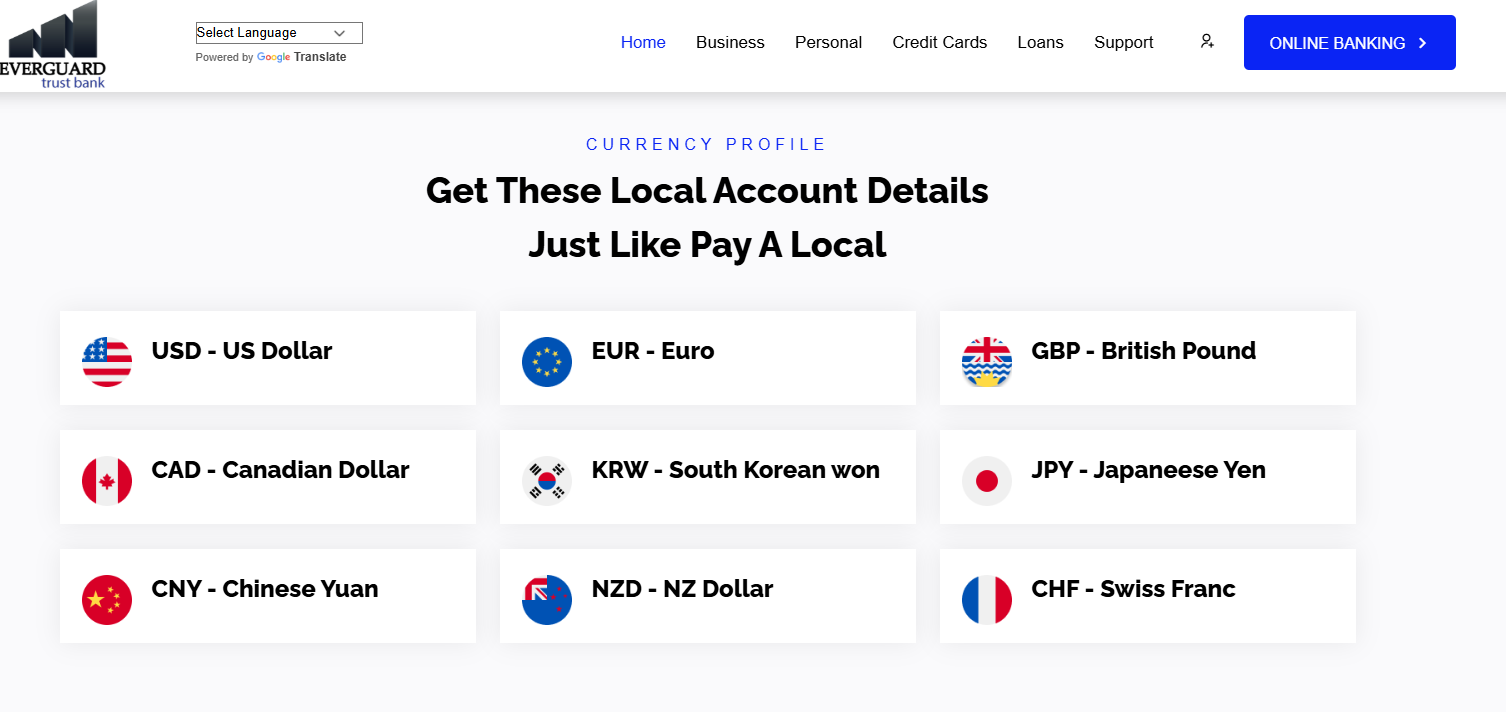

- Inconsistencies and template-reuse: The website appears to have borrowed content from other institutions (mention of “First”, “not-for-profit credit union”, etc.) which suggests it may not be tailored to a genuine banking entity.

- High risk global claims with no oversight: Claiming operations in “over 105 countries” without clear regulatory disclosures is a major red flag.

- Potential for fund loss: If legitimately not a regulated bank, deposits/investments may not be insured or protected and you could lose money.

Website Overview

Country:

USA

Operating Since:

2025

Platforms:

Mobile/Desktop

Type:

Online bank

Spread:

N/A

Funding:

Online bank

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

Claim of being “licensed by the Securities and Exchange Commission to carry out financial activities in over 105 countries.” Such sweeping claims are unusual for a small online bank and would normally be verifiable via regulators.

The website domain (everguardtrustbank.com) has minimal publicly available trustworthy domain age and owner history information, making long-term credibility uncertain.

Contact details: The site provides a generic support email (support@everguardtb.com) and WhatsApp contact numbers for U.S. locations (e.g., +1 424 302-1815). The provided U.S. addresses (e.g., 239 Fayetteville St., Raleigh, NC, and 4031 E 42nd St., Odessa, TX) may not correspond with any clearly verified bank branches.

The website uses language, imagery and page layouts that appear very generic and seem to be copied or adapted from other established institutions — e.g., “Branch Hours”, “Routing # 251480576” etc. This could indicate deceptive mimicry.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

In concluding, my assessment is that the website everguardtrustbank.com is very likely not a legitimate regulated bank but rather a high-risk or scam operation posing as an online bank. While at first glance it appears professional, the absence of verifiable regulatory oversight, the use of generic content, large unrealistic claims, unclear domain history and lack of strong independent evidence all point toward it being untrustworthy.

For anyone seeking to open an account, deposit funds, invest, or share personal data with this site: you should treat it as if you are dealing with a scam. If you have already engaged, you should monitor your funds closely, avoid further transactions, document everything, and consider alerting your bank or financial regulator.

If you are looking for a legitimate online bank, choose one with clear regulatory licensing, customer reviews, insurance protection (FDIC/NCUA or equivalent), long-term track record, transparent contact information and verifiable physical presence. This site fails to meet those criteria.

Comments