Review on Excelsiacommercialbank

Summary

About Excelsiacommercialbank

The website Excelsia Commercial Bank (excelsiacommercialbank.com) presents itself as an online bank offering full-service banking and lending: home loans, car loans, commercial loans, education loans, “gold loans,” land-loans, and more. It claims to have “17+ years of experience,” over 25,800 clients, “100 % success rate,” 1.4 b (billion) in investments, and awards (54 “Award Achievment[s]”).

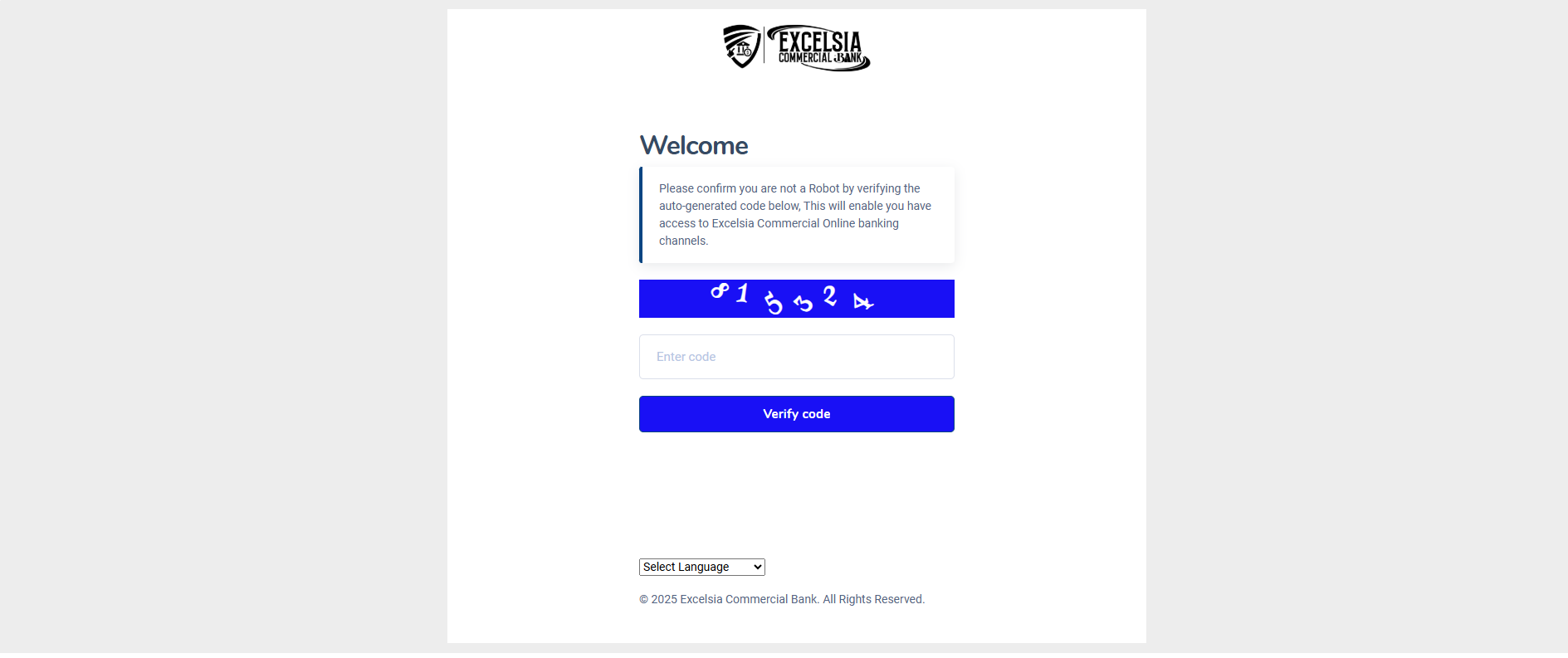

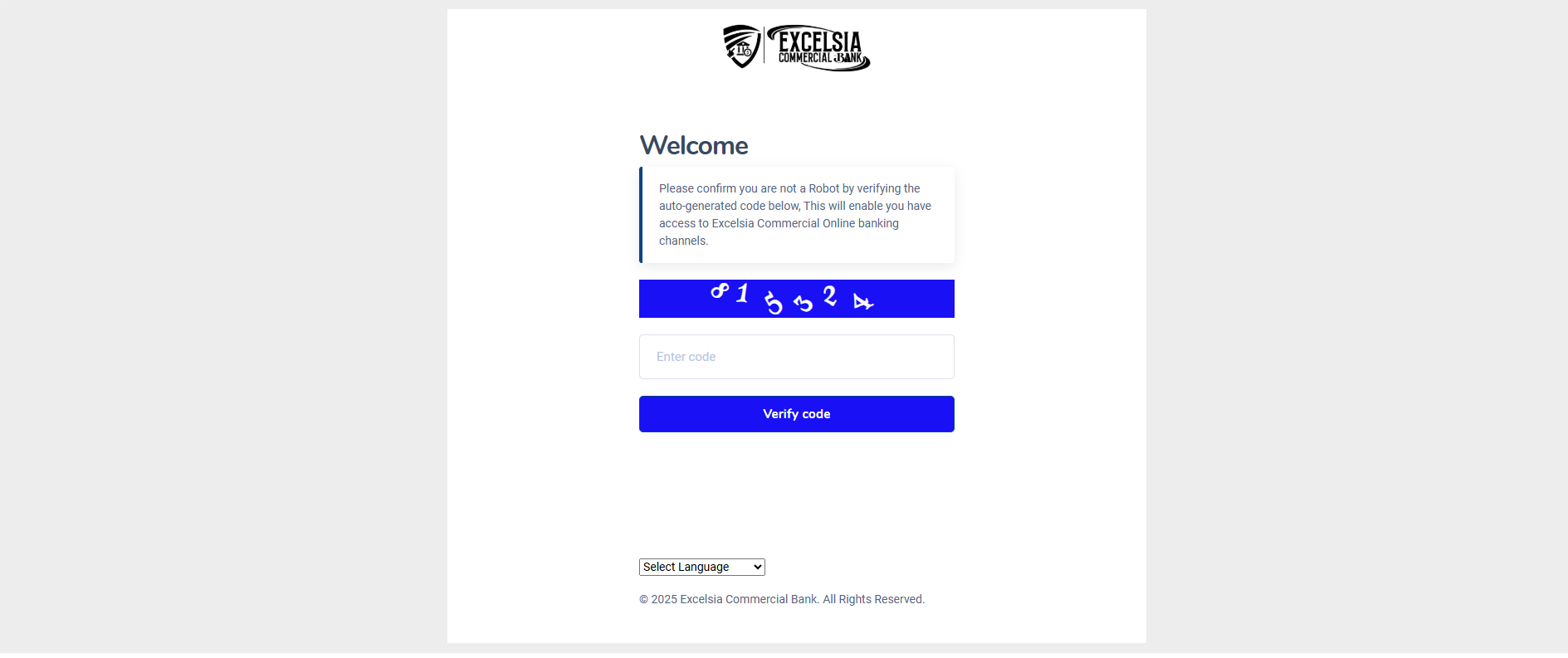

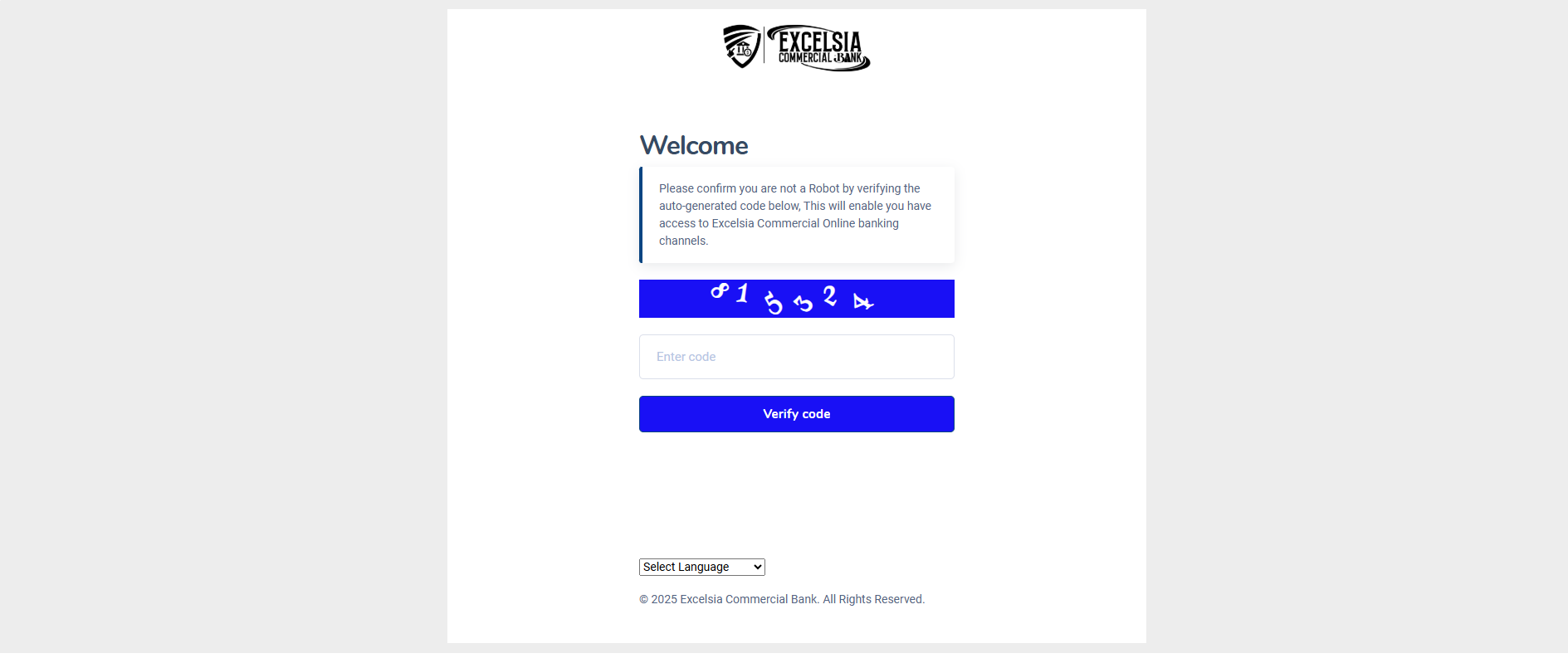

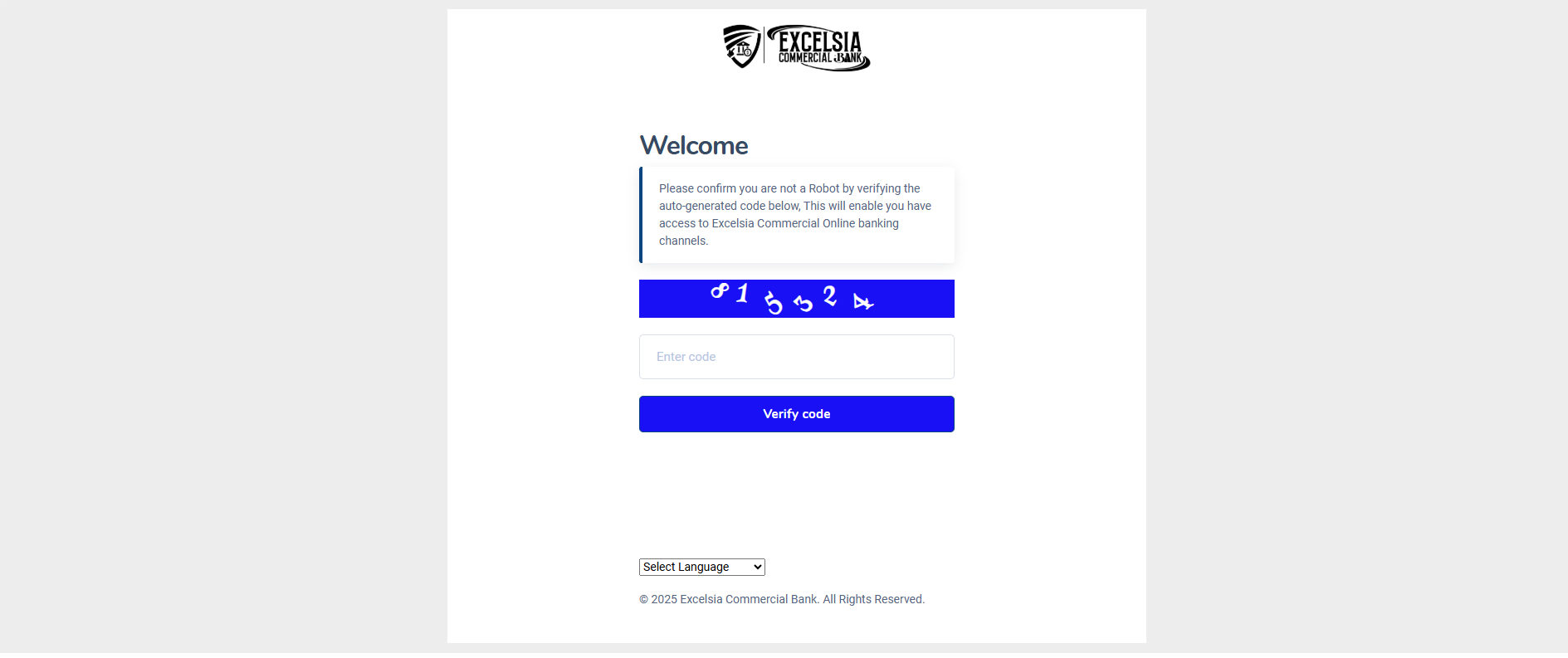

On the surface, the site uses the trappings of a legitimate bank: “Login”, “Create Account”, a professional-looking layout, statements about transparent processes and quick loan approvals.

However, a closer analysis raises very serious doubts about its legitimacy. The domain is extremely new (registered 2025-02-20) and the WHOIS is privacy-hidden. According to a third-party website rating service the site has a low trust score and is flagged as “may be a scam”.

In short: although the website masquerades as a full-fledged bank and lender, the evidence strongly suggests it is not a legitimate regulated banking institution, and quite possibly a scam designed to lure unsuspecting depositors or borrowers.

More Details

Regulation and legitimacy: Banking is a highly regulated industry. A legitimate bank must be licensed in its jurisdiction, provide information about deposit insurance, regulatory oversight, audited financial statements, and be listed in banking regulator registries. This website provides none of that. It simply claims “we are trusted by more than 25,800 clients” without proof, and there is no reference to a regulatory body. Without such licensing, calling oneself a “bank” is misleading and risky.

-

Domain & hosting risk profile: The domain is extremely new (Feb 2025), which means it has had no long track record. Scam operations often create new domains, promise high returns or easy loans, get people’s funds/data and vanish. The fact that the domain owner is hidden raises accountability concerns. The shared hosting with other suspicious domains is another sign of cheap infrastructure typical of scam labs. The independent site scan (ScamAdviser) categorised it as low trust.

-

Unrealistic marketing & promises: The site’s marketing suggests “100% success rate”, “1.4b investments”, “within 24 hours funding after approval”, “we are trusted by more than 25,800 clients”, “54 awards” etc. These superlatives often function as psychological hooks to lure in victims. Real banks don’t guarantee “100 % success” of loans since risk is inherent.

-

Lack of transparency: There is no credible physical address, no clearly dated financial statements, no external verifiable audits, no names of officers/board, no testimonials with full verifiable identities, no standard banking disclosures. Transparency is essential for a legitimate bank.

-

High‐risk for users: If a person uses this site to "open an account" or "apply for a loan", they may face multiple risks:

-

The personal and financial data they enter may be collected and misused.

-

They may be required to pay upfront “fees” or “security deposits” to receive a loan, and then get nothing.

-

They may discover that their “account” is not protected by any deposit insurance scheme.

-

They may find they cannot withdraw funds, or the entity disappears.

-

-

Absence of credible reputation: A real bank tends to have decades of history, press coverage, regulation, customer reviews, physical branches, etc. This site is brand-new and lacks these hallmarks. The only third-party reference found is a scam rating service indicating caution.

In combination, these factors make it highly likely that the website is a baiting vehicle rather than a real bank. For safety’s sake, you should assume it is a scam, avoid interacting with it, do not provide personal data, do not pay money or rely on its “banking” services.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Excelsiacommercialbank

Pros

- It uses HTTPS (valid SSL certificate) which indicates standard encryption of communication.

- It offers a broad range of “banking” and “loan” services, which may appeal to visitors seeking loans or banking online.

- The website appears professionally designed and polished, which may give a first-impression of legitimacy (may attract first-time visitors).

Cons

- Lack of verifiable regulatory licensing or banking authority oversight: huge risk for depositors/borrowers.

- Domain very new, owner hidden: no history of operations, no accountability.

- Host uses shared server with other shady websites: increased risk of compromise.

- Exaggerated/unverifiable claims: success rate, number of clients, awards — likely fabricated or inflated.

Website Overview

Country:

USA

Operating Since:

2025

Platforms:

Mobile/Desktop

Type:

Online bank

Spread:

N/A

Funding:

Online bank

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

Low trust score from independent check: According to ScamAdviser, the site “has a low trust score” and “may be a scam.” Their reasons: owner identity hidden, hosted on shared server with many suspicious sites, website very young.

No evidence of regulatory licensing: On the site, there is no clear mention of a banking licence, regulatory body, country of registration/licensing, or deposit protection scheme. A legitimate bank typically displays such information prominently.

Exaggerated claims: “100 % success rate”, “1.4 b investments”, “29,500 happy clients”, “54 Award Achievment[s]” — these are flashy but unverifiable and raise skepticism.

Generic content & grammar issues: The site contains some unusual phrasing (“loan's terms and agreement”, “grant[s]”, “We have a simple online application Which will give you the adjuct information”) that one might not expect from a major regulated bank.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

In conclusion, while the website for Excelsia Commercial Bank presents itself visually as a modern online bank with a broad suite of services, the deeper signals point overwhelmingly to it being a fraudulent operation rather than a genuine, regulated banking institution. The lack of regulatory identifiers, extremely recent domain registration, hidden ownership, shared hosting, dramatic promises, and low trust rating all combine to form a compelling case for caution.

If you were considering doing business with this entity—depositing funds, taking out a loan, trusting it with your financial information—you should stop immediately. It is far better to work only with banks that are listed by your country’s regulator, have clearly visible licensing, audited accounts, branch presence or verifiable history, and known reputation.

Ultimately: If it looks like a bank but doesn’t say which regulator, where it’s based, how it’s protected, you should treat it as a potential scam. In this case, all the alarm bells are ringing. This website should be avoided.

Comments