Review on Finovatecrestviewfinance

Summary

About Finovatecrestviewfinance

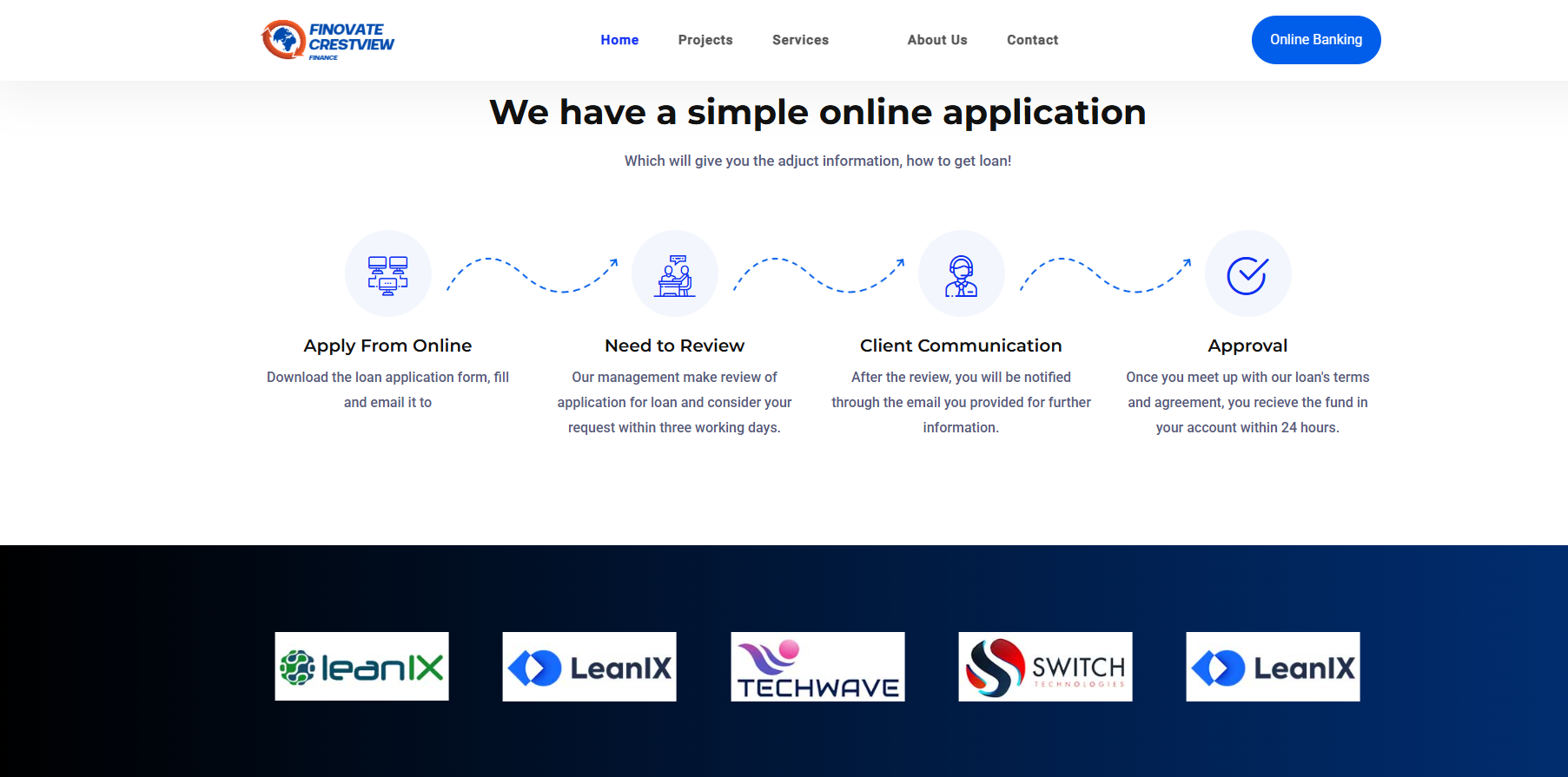

The website of Finovate Crestview Finance (URL: https://finovatecrestviewfinance.com/) presents itself as an online bank offering a wide array of financial services: business loans, home loans, car loans, education loans, land and gold-based loans, loan approval within 24 hours, claims of “25+ years experience,” “280,000 happy clients,” “100 % success rate,” etc. The site mimics the look of a legitimate savings bank (“Savings Bank”, “Account Login / Open Account”) and encourages online applications, promising transparency and speed.

However, closer inspection reveals numerous red flags: the domain is very recently created, WHOIS data is hidden, the server is shared with other low-trust sites, the “trust score” assessed by a website-safety service is very low. The site makes bold, overly favorable claims without providing verifiable evidence of regulatory compliance, licensing, physical address, or independent reviews.

In other words: it looks like a professional front, but the solidity behind the brand and license is almost non-existent. On balance, this strongly suggests the site is not a genuine online bank but rather likely a scam or at least extremely risky to trust.

More Details

Regulatory and licensing void: If a company is calling itself a “bank” or “savings bank,” it must be regulated by a banking authority, have capital disclosures, deposit insurance, etc. There is no credible indication of any such licensing on the site. The absence of these disclosures strongly indicates that the entity is not operating as a legally regulated bank.

-

Temporal mismatch between claim and reality: The site claims “25+ years of experience” and 280 000 clients, yet its domain is only a few months old and lacks any historical footprint or credible third-party references. This mismatch suggests fabrication of credentials.

-

Use of high-pressure, fast-approval language: The promise of loan disbursement within 24 hours and “100 % success rate” are unrealistic. Legitimate lenders perform detailed credit assessments, require documentation, and rarely guarantee success. This type of language is often used to lure victims into quick decisions.

-

Hidden ownership and lack of transparency: The domain’s WHOIS data is hidden, making it impossible to verify the responsible legal entity, its location, regulatory status, or executives. Legitimate banks provide full transparency.

-

Shared server with other dubious sites and trust-score warnings: A reputable bank would be hosted on a secure, dedicated environment and would not share IP space with known low-trust websites. The fact that trust-score services flag the site and list it among risky sites strongly supports scam classification.

-

Data capture risk and potential for abuse: The site asks users to download application forms, provide personal/financial data, and promises quick fund transfer. This creates a risk of identity theft, personal data misuse, or being asked to pay a “verification fee” before loan release, which is a common scam tactic.

-

Absence of credible user reviews or verifiable history: There are no known independent audits, media coverage, or credible testimonials that validate the claims. In contrast, legitimate banks have extensive records and public disclosures.

Based on all of the above, the most prudent conclusion is that the site is not a legitimate online bank and should be treated as a scam or, at best, extremely risky. Users should not submit personal information, financial documents, or send money on the assumption of a loan.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Finovatecrestviewfinance

Pros

- The site is professionally designed with convincing banking-style layout, which may indicate investment into appearance (though appearance alone is no guarantee of legitimacy).

- It offers a broad menu of financial services, which could appeal to someone seeking many kinds of loans.

- The website has a valid SSL certificate, meaning data sent is encrypted.

Cons

- No verifiable licensing or regulation – major concern for any “bank”.

- Very short domain age, hidden ownership – undermines credibility of long experience claim.

- Bold, unverified success statistics – raises suspicion of exaggeration or fabrication.

- Fast-money loan promise – a known hallmark of predatory lending or outright scams.

Website Overview

Country:

USA

Operating Since:

2025

Platforms:

Mobile/Desktop

Type:

Online bank

Spread:

N/A

Funding:

Online bank

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

Very young domain: The domain registration date is February 18, 2025. For a bank claiming “25+ years experience,” that’s inconsistent.

Low trust score and warning flags: A site-safety service (Scamadviser) found “very low” trust score, flagged negative reviews, shared server with other low-trust sites, spam reports.

Grandiose claims without substantiation: “100 % success rate,” “280,000 happy clients,” “10,524 M investments,” “1,000+ projects completed” etc. These large numbers are not backed by verifiable documentation.

Generic “loan application” process: The site asks you to download a form, fill and email it, promising funds within 24 hours. Real regulated banks seldom process large loans this quickly based on simple emailed forms.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

While at first glance the Finovate Crestview Finance website appears polished and professional, this is precisely what makes it more dangerous: it uses the visual cues of legitimacy to mask the absence of real substance. The concept of a new “bank” offering rapid approvals and broad loan types with 100 % success is a classic bounce-back for financial fraud. A valid online bank must demonstrate strong regulatory oversight, transparent legal structure, established track record, secure hosting, and credible public references — none of which are convincingly present here.

In today’s digital environment, scammers can easily create websites that look like real banks, replicate logos, produce faux “about us” pages, and promise rich rewards. Their goal is to extract personal data, charge upfront fees, or simply vanish once they have collected sensitive information or initial payments. Based on the red flags identified, the site falls firmly into that risk category.

If you or someone you know has engaged with this site (especially providing personal info, banking credentials, or paying any “fees”), we strongly advise immediate caution:

Do not send further money.

Do not submit additional documents.

Monitor your bank/credit accounts for unusual activity.

Consider contacting your local consumer protection agency or bank fraud unit.

Change passwords and alert your bank if you feel your data may have been compromised.

In summary: do not trust Finovate Crestview Finance with your money or personal data. The evidence points overwhelmingly toward it being a scam.

Comments