Review on Fxleverageinvestment

Summary

About Fxleverageinvestment

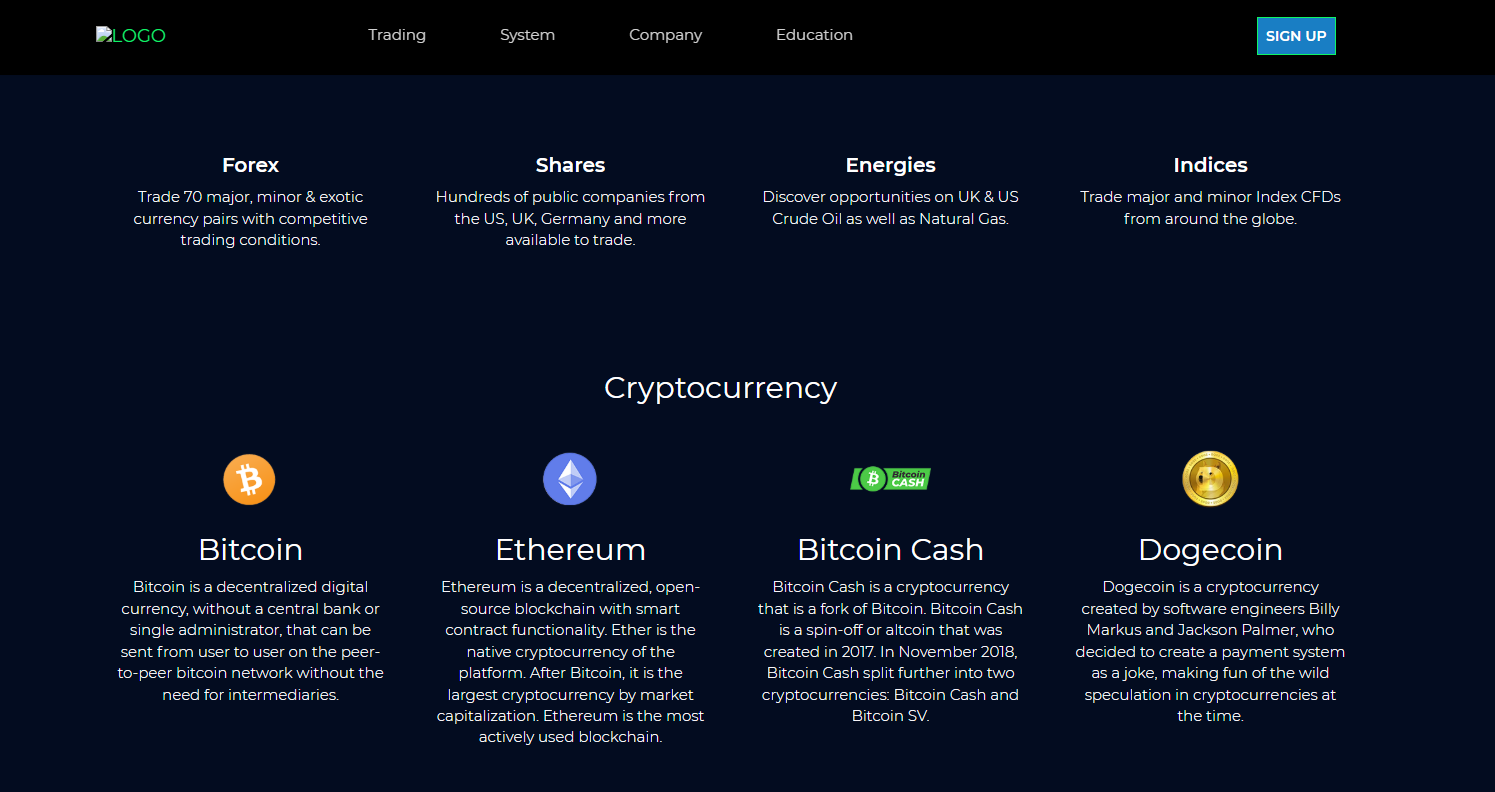

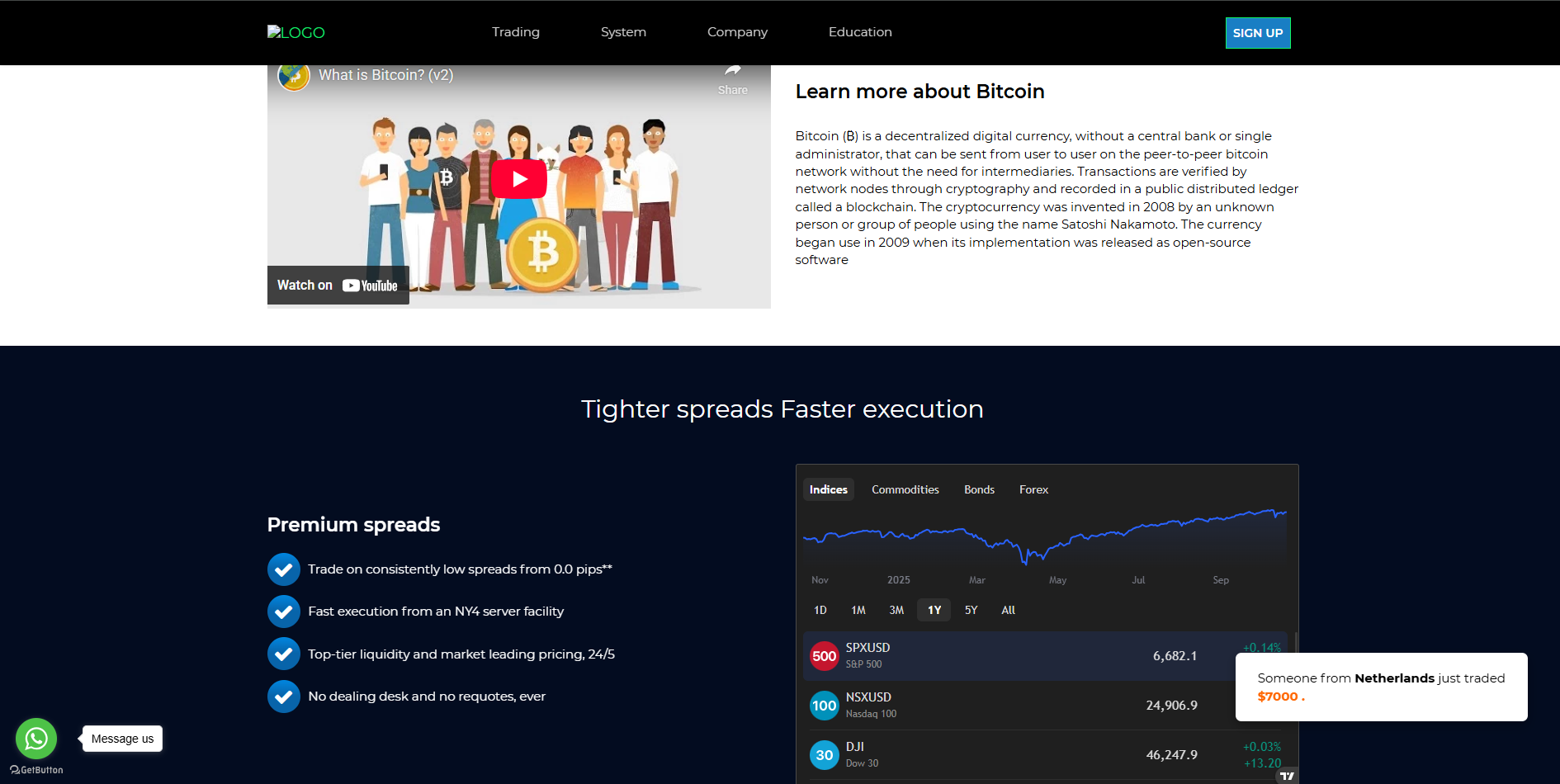

The website FXLeverageInvestment (fxleverageinvestment.com) presents itself as a full-service online trading and forex/CFD platform offering access to global markets including forex currency pairs, commodities (gold, oil), indices, and cryptocurrencies. On its “About Us” and product pages it claims to provide ultra-fast execution, spreads from 0.0 pips, segregated funds, multi-award recognition, “dynamic” account plans with guaranteed principal returns plus large profit multipliers, and multilingual 24/7 support.

However, a review of the site’s public data and risk indicators reveals multiple red flags: the domain is very new (registered Apr 2025) according to a trust-analysis site. The WHOIS information is limited and lists a private owner in Nigeria (Delta State) using a free email address, which undermines transparency.

In short: the site markets itself with very ambitious claims (high returns, low spreads, professional support), but the underlying regulatory, transparency and structural safeguards are weak or missing. That combination suggests this site is extremely high risk — likely unsafe for retail investors, and very possibly an outright scam.

More Details

Licensing & Regulatory Absence: Legitimate brokers (especially offering CFDs and Forex in jurisdictions like the UK, EU, Australia) must be regulated by authorities (FCA, ASIC, CySEC etc). They must publish their licence number, compliance disclosures, risk warnings, segregated fund statements, and annual audits. FXLeverageInvestment does not provide verifiable details of any such regulation, even though its marketing claims “globally regulated”. When you see claims without verifiable backup, it is a red flag.

-

New Domain & Unverified Track Record: The domain was registered very recently (April 2025). For a company claiming to be “one of the most reputable brokers in the industry” with 40+ awards, you’d expect a significantly longer track record with verifiable history. A very young domain in the investment/trading space suggests opportunistic setup — often typical of platforms designed to collect deposits and collapse before regulators intervene.

-

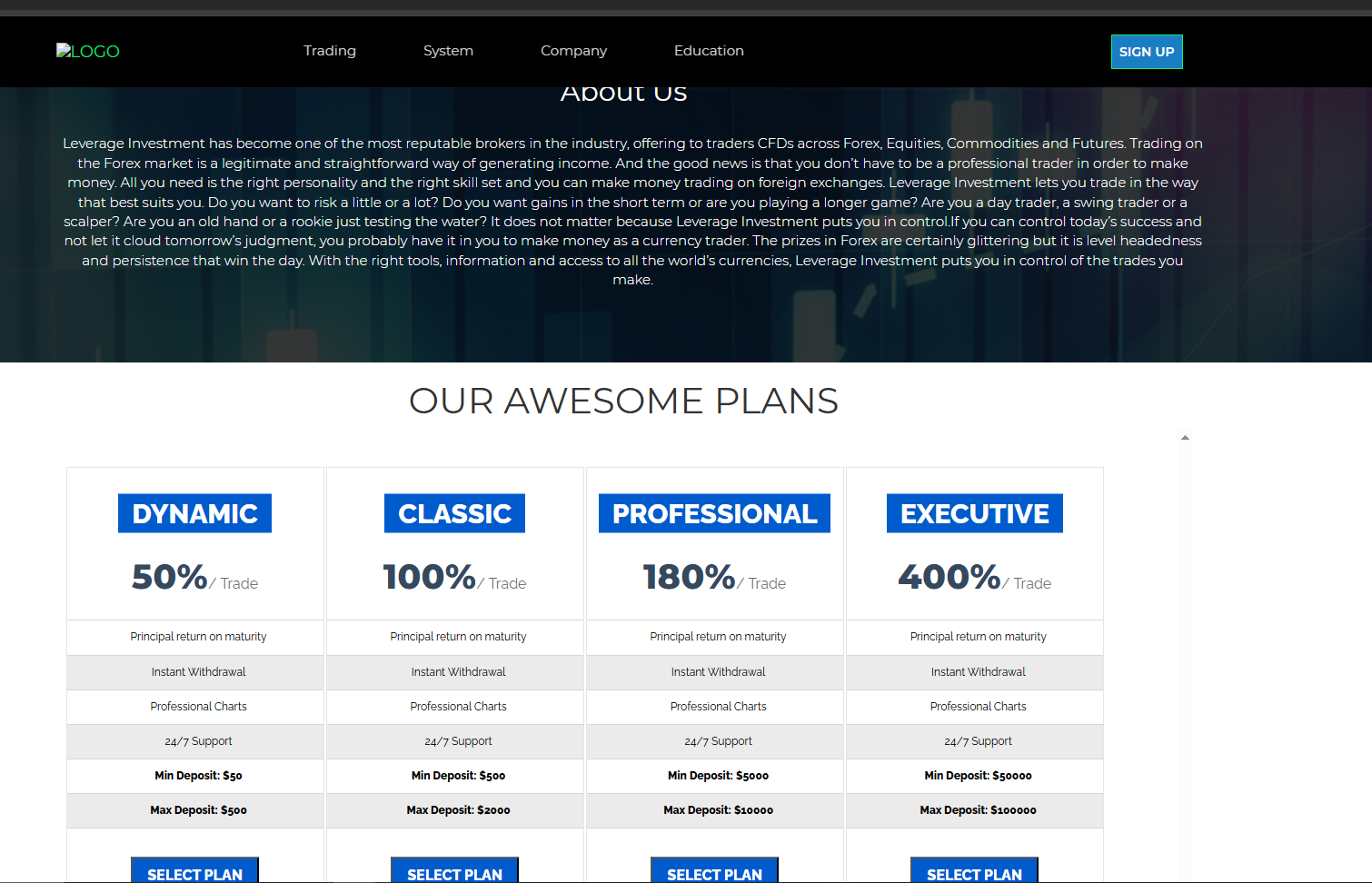

Excessive Return Promises & Upselling Tiers: The site lists multiple “plans” with unbelievable returns (e.g., 180%/trade, 400%/trade) and minimum deposits up to US $100,000 for the “Executive” plan. Legitimate trading carries risk; no regulated broker can guarantee returns or such multipliers. Such structure (tiered plans, big promises, up-selling to larger deposit levels) is characteristic of investment-scam models where early traders may get small returns to build credibility, then later deposits get “locked” or withdrawn only with further deposit.

-

Opaque Ownership & Contact Details: The owner is listed as a private individual in Nigeria using a Gmail address. Legit brokers normally have a corporate structure (Ltd/PLC), address, audited accounts, clear executive team, and domain‐authenticated email addresses (not free Gmail). This anonymity means accountability is weak.

-

Shared Hosting & Low Trust Score: According to a trust‐analysis site, the server hosts other websites with low trust, the email addresses are free type, the age is young, and the site has been flagged for sending spam. Shared hosting means risk of cross-site attack, impersonation, and the site might be spun up and down easily.

-

Operating in a Weak Regulatory Environment: Although the site may claim global operations, its registration appears Nigerian and the hosting offshore. Fraudsters often base themselves in jurisdictions with low oversight, targeting vulnerable investors (e.g., Nigeria, parts of Africa). Guides confirm that many scam brokers in Nigeria operate without proper regulatory oversight.

-

Difficulty of Recovery / No Investor Protections: With no credible regulator, no investor compensation scheme, and limited transparency, if you deposit funds and subsequently wish to withdraw or recover, your options may be very limited. Scammers commonly lure you with small returns, then ask you to deposit more for larger profits or better withdrawal options; once you deposit large amounts the “service” becomes non-responsive or funds vanish.

Given all the above, my assessment is that FXLeverageInvestment is very likely a scam or at best an unregulated and extremely high-risk provider. Any funds you deposit are at high risk of loss — not because the trading is poor — but because the structural safeguards (licence, audit, withdrawal transparency, regulatory oversight) are missing or inadequate.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Fxleverageinvestment

Pros

- The website is functional, the sign-up process is visible, and claims to offer demo accounts/support (which may encourage “trying it out”).

- Accessible entry: minimum deposit plans (as low as US $50) make it easy for someone to feel they can participate with little capital.

- Attractive‐looking marketing: for a novice investor the site is polished and may appear professional, offering many asset types and seemingly modern trading tools.

Cons

- Extremely high risk due to lack of transparent regulation/licensing — your funds may not be protected.

- Unrealistic promises of guaranteed or massive returns (e.g., “400%/Trade”), which are red‐flags for fraudulent schemes.

- Poor corporate transparency: ownership, registration, third-party audit, segregated client funds are all missing or questionable.

- Withdrawals likely to be difficult or blocked (based on general patterns of such platforms) — no credible proof of easy withdrawal is shown.

Website Overview

Country:

Turkey

Operating Since:

2025

Platforms:

Mobile/Desktop

Type:

Forex/trading

Spread:

N/A

Funding:

Forex/trading

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

The site claims “globally regulated” in its marketing text, yet there is no verifiable regulatory licence information provided (or at least publicly validated). In regulated jurisdictions, you would expect registration numbers, regulator names etc. The site is vague.

The website has a valid SSL certificate (so data in transit is encrypted).

It presents a professional interface, references standard trading instruments (Forex, CFDs, shares, commodities, crypto) and claims to offer “premium” features like multi-platform access, insured funds, and educational resources.

It uses plausible broker-language (spreads, leverage, multi-assets) which may create the impression of legitimacy to an uninformed visitor.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

In conclusion, although FXLeverageInvestment.com is packaged to look like a modern, feature-rich broker offering access to multi-asset trading with “insurance”, “tight spreads” and “professional service”, the underlying facts paint a very different picture. The lack of regulation, the very new domain, vague corporate details, extraordinary return promises, and common scam-broker red flags all point in the direction of fraud or at best a highly speculative and untrustworthy platform.

If you are considering trading via this site, I strongly advise you to stop and reconsider. Legitimate brokers will have clear regulation, transparent terms, auditable proof of client fund segregation, and realistic risk-reward profiles. Here, the odds are stacked heavily against the investor. It is better to avoid investing any capital with this site. If you already have, you should treat your investment as potentially lost, and avoid adding additional funds. Consult local financial regulators, or at minimum ensure you use a platform licensed in your country with proven withdrawal track records and verifiable regulation.

Comments