Review on Hexagoncapital

Summary

About Hexagoncapital

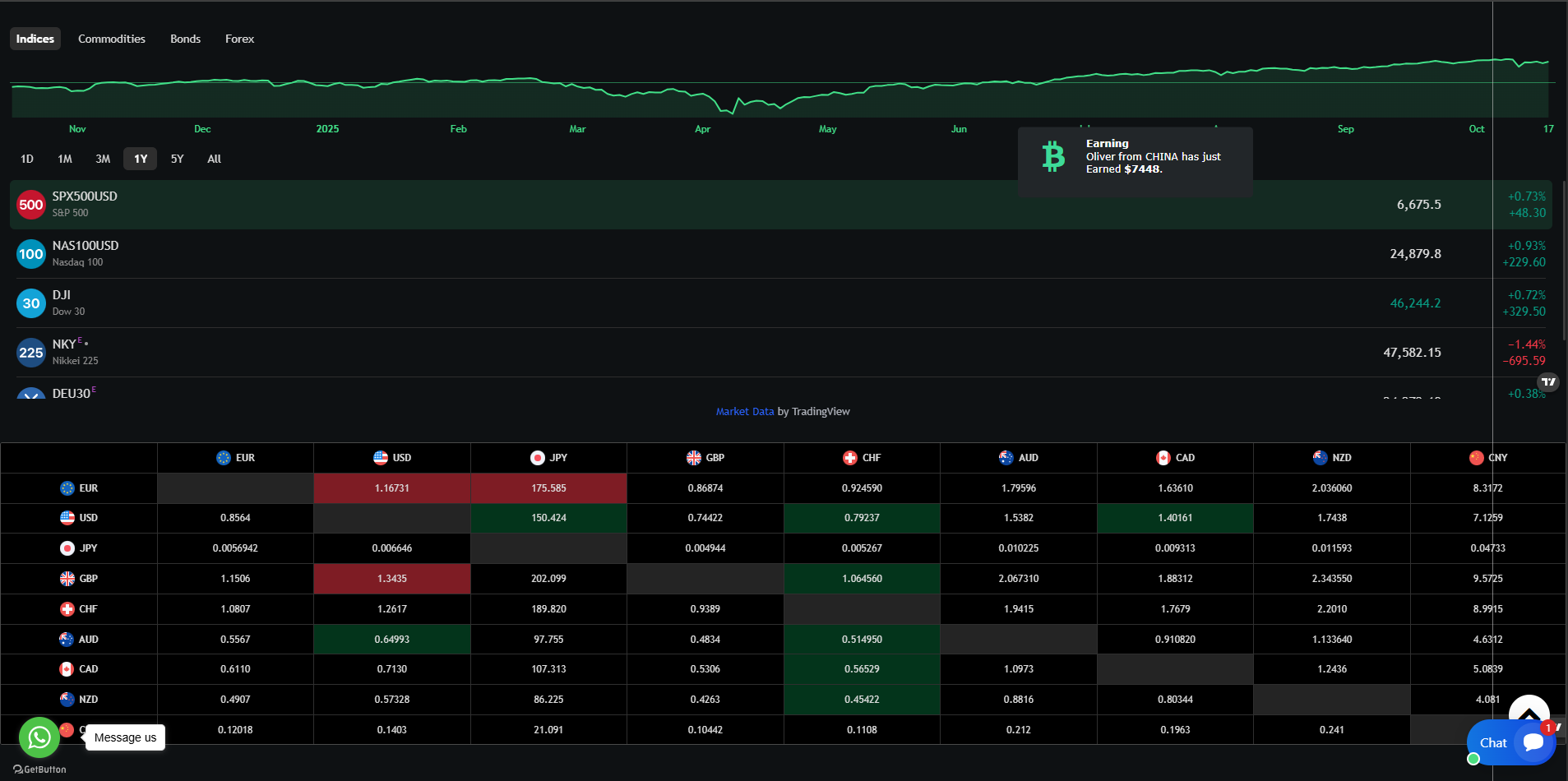

HexagonCapital.ltd presents itself as an online investment and forex platform, promising users robust returns on investments, trading opportunities, and wealth growth. Its website showcases polished graphics, trading dashboards, account tiers, and persuasive marketing language about “expert traders,” “guaranteed profits,” and “industry-leading returns.” However, a closer look raises serious doubts about its legitimacy. There is little to no verifiable regulatory evidence, no transparent management or audit history, and warnings from third-party watchdogs that entities using “Hexagon Capital / Hexagon Financial / Hexagon Capital Management” branding are unregulated and likely fraudulent. Many of the claims on the site follow the typical playbook of high-yield investment programs (HYIPs) and offshore “too good to be true” schemes.

Over the following sections, I present a detailed breakdown of the red flags, strengths (if any), and an in-depth explanation of why this site is almost certainly a scam rather than a legitimate investment firm.

More Details

A. Anatomy of a Scam / HYIP Parallel

Many illicit investment platforms follow the High-Yield Investment Program (HYIP) model, where returns are not truly generated by real market activity, but rather paid to earlier investors from the incoming funds of new depositors. That model is inherently unsustainable and collapses under its own weight when new deposits slow or users try to withdraw en masse.

Hexagon’s profiles match key HYIP characteristics

-

Lack of verifiable revenue generation: The site does not disclose real trading logs, audit trails, or proof of legitimate operations.

-

Guaranteed or improbably high returns: Promises of high fixed returns irrespective of market conditions is a major red flag.

-

Obscure corporate structure: Use of offshore addresses, anonymity, or shell entities.

-

Referral incentives / pyramid elements: Encouraging users to recruit others to contribute (common in HYIPs).

-

Withdrawal issues: Many victims report being unable to withdraw or subject to delays, “verification issues,” or sudden account suspension.

B. Regulatory Warnings and Industry Assessments

Independent broker assessment platforms have explicitly warned against firms labeled “Hexagon” due to their lack of regulation. These warnings are grounded in cross-checking financial regulator databases, user reports, and absence of valid licensing.

When a company claims to be a legitimate broker or investment firm, we expect:

-

Registration with a known regulator

-

Transparent public disclosure of corporate structure, audit documents

-

Proof that client funds are segregated and not used for company operating costs

-

Compliance with KYC / AML / financial reporting

Hexagon fails to credibly check any of these boxes.

C. No Evidence of Long-Term Trust and Performance

Reputable financial firms accumulate third-party coverage, user testimonials, and audited performance histories over years. In contrast, Hexagon has no verifiable long track record, no credible independent reviews, and appears to pivot through name variations.

Additionally, some organizations with “Hexagon Capital / Hexagon Financial / Hexagon Capital Management” monikers have surfaced in lists or analyses of scam or untrusted entities, further eroding credibility.

D. Risk Model: Collapse & Money Loss

Because these platforms depend on continuous inflows to pay existing users, once inflows slow (due to market conditions, regulatory pressure, user distrust), the structure fails. Users seeking to withdraw may find their funds locked.

Given absence of safeguards, escrow, insurance, or regulatory oversight, investors risk total loss.

E. Conclusion of the Post Section

Bringing all the evidence together:

-

No verifiable regulation, audits, or transparency.

-

Marketing and promises matching classic scam patterns (HYIP).

-

Independent warnings from broker rating platforms.

-

Absence of credible user testimonials or proof of withdrawal.

-

Likely dependence on new deposits to pay earlier users (Ponzi mechanics).

All these factors make it extremely likely that HexagonCapital.ltd is not a genuine, sustainable investment or forex platform but a fraudulent scheme designed to extract money from users.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Hexagoncapital

Pros

- User interface (trading dashboards, account tiers) gives an illusion of legitimacy and sophistication.

- Promises of high returns are appealing to people seeking quick growth of capital.

- If someone is skilled at marketing, they might get initial referrals or new users to deposit funds, creating an early “proof of concept” illusion (but not sustainable).

Cons

- Extreme risk of losing all invested capital.

- No regulatory protection or recourse.

- The platform is opaque: no proof of operations, audits, or real trading activity.

- Reduces ability to withdraw funds or delays withdrawals with excuses.

Website Overview

Country:

Turkey

Operating Since:

2025

Platforms:

Mobile/Desktop

Type:

Investment/forex

Spread:

N/A

Funding:

Investment/forex

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

Lack of credible regulation External analysis shows that “Hexagon Capital Management” / “Hexagon Financial” is not regulated by any major (Tier-1 or Tier-2) financial regulator. Traders Union Regulatory databases do not yield verifiable licenses tied to the company name. Lack of transparency about regulatory registration on the website itself (no license numbers, no regulator logos verifiable).

Overpromised returns / marketing language The promotional wording suggests “guaranteed profits,” “high returns,” “expert traders doing all the work” — classic hallmark of investment scams. There’s no detailed explanation of how profits are generated (what strategies, what risk, what assets).

Opaque corporate identity / management The site does not clearly show who owns it, who runs it, or verifiable backgrounds of management. Important corporate documents, audited financial statements, or public reviews are missing or not credible. In some cases, companies named “Hexagon Capital PTE. LTD.” have been registered in different jurisdictions with unrelated business descriptions, raising suspicion about name reuse or shell company usage.

Reputation and third-party assessments negative Brokers and financial watchdog analyses caution against dealing with entities branded “Hexagon,” labeling them unsafe and untrusted. Persistent online warnings, user complaints, or anti-scam forums flag Hexagon as a “scam or unsafe choice.”

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

After thorough review, the balance of evidence overwhelmingly suggests HexagonCapital.ltd is a scam / fraudulent investment platform, not a legitimate forex or wealth-management service. The site’s polished appearance and marketing promises are masks for a high-risk, unregulated, opaque operation. Anyone considering depositing funds into this platform is exposing themselves to a very high probability of losing money, with little or no recourse.

It is strongly advised to avoid any monetary dealings with the site. If you or someone you know has deposited funds, immediately seek to cease further transfers, document all communications, and explore legal or regulatory complaints (where your jurisdiction allows). Treat any claims of high guaranteed returns with extreme skepticism, especially in the absence of good regulatory backing.

If you like, I can also examine the site structure (domain registration, hosting, SSL, certificate, etc.) for further proof or trace links to other suspected scam networks. Would you want me to do that?

Comments