Review on Lanfieldcoperatemarkets

Summary

About Lanfieldcoperatemarkets

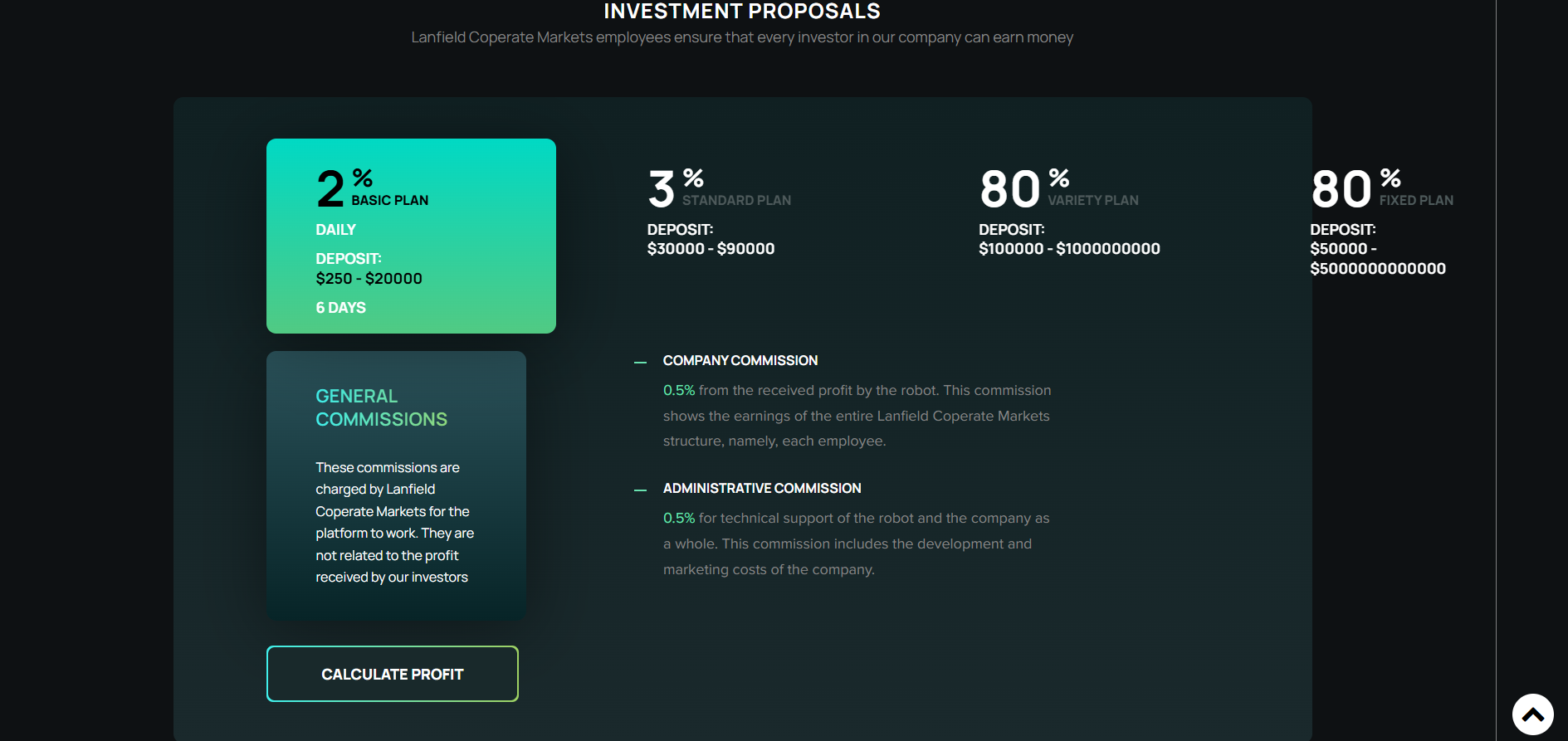

The website lanfieldcoperatemarkets.com (operating under the name Lanfield Corporate Markets) presents itself as an investment and trading platform offering lucrative opportunities to users — including high-returns, automated trading tools, and apparently easy access to cryptocurrency or forex markets. On paper, it markets itself as a friendly, sophisticated trading hub for both beginners and experienced investors.

However, a deeper look reveals that the claims do not align with credible investment practices, regulatory transparency, or verifiable track records. A recent independent site review describes it as “Advance Fee Scam” territory: meaning it likely asks for upfront fees or deposits, promises high returns, and then blocks withdrawals or disappears.

In essence: the site’s marketing is enticing, but the underlying operation exhibits many of the classic characteristics of a trading/investment scam. If you are considering using this platform, you should proceed with great caution — there is a substantial risk of losing your money.

More Details

1. Unrealistic Promises

The site’s marketing leverages promises like “automated trading with guaranteed high returns” and “minimal risk” — such claims are immediate red flags. In genuine financial markets, no one can guarantee profits and especially not in automation without risk. Credible brokers emphasise risk disclosure, not guarantees.

2. Advance Fee / Withdrawal Issues

The independent review found clear warning that this site fits the profile of an “Advance Fee Scam” — meaning users pay upfront (for “verification”, “taxes”, “service fee”, etc.) and then cannot withdraw funds. This pattern is consistent with many fraudulent investment platforms. Once the operator gets the deposit/fee, they may vanish or block access to funds.

3. Lack of Regulatory Transparency

There is no credible evidence that this company is regulated by a reputable financial authority, such as the FCA (UK), SEC (US), or a similarly authorised body. If you cannot find a licence, registration number, or regulatory body overseeing the company, your risk is significantly amplified. Legitimate brokers and platforms display their regulatory status prominently.

4. Poor Website Credibility & Verification

-

The domain name contains a misspelling (“coperatemarkets” instead of “corporatemarkets”) which suggests carelessness or an attempt to mimic a real‐corporate style brand.

-

There is little historical trace of the company being used by many real users, or press coverage, independent audits, user testimonials verified by third parties. These deficiencies reduce the trustworthiness of the site.

-

Scams often have short lives: they come up, collect money, then disappear or change names. The rapid flagging of the site by scam-watching sites further indicates this risk.

5. Marketing Over Substance

The emphasis is on flashy design, “big returns”, and automation rather than clear explanations of how the trading works, what underlying assets are being used, what are the track records. Real investment firms provide performance data, risk metrics, and transparent fee structures. This site appears to prioritise marketing over substance.

6. User Withdrawal Risk

There is high probability that you will have trouble withdrawing your money. Common indicators in similar scams: user is told to deposit more to “unlock” profits, or pay extra “tax” or “processing fee” before withdrawal. None of these are standard in legitimate investment firms. The warning in the independent review strongly indicates that withdrawing will not proceed smoothly.

7. Overall Risk vs Reward Mismatch

Essentially, the expected reward (very high returns) is pitched, but the risk (complete loss of deposit, no regulatory protection) is hidden or downplayed. In legitimate investing you know the risk up front; here the risk seems obscured and the “too good to be true” returns dominate the message.

Conclusion of this section: Given all of these factors — unrealistic claims, warning of advance fee scam, lack of regulation, poor domain credibility, withdrawal risks — the balance of evidence strongly indicates that Lanfield Corporate Markets is not a legitimate investment platform, but rather a scam-operation posing as one.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Lanfieldcoperatemarkets

Pros

- For a potential user: the site is easy to access and presents itself in a polished way, which may give the appearance of professionalism.

- It may offer a learning opportunity: by investigating it, you’ll gain awareness of risks in online trading platforms.

- The marketing may motivate a user to think about alternative investment/trading options (but this is more indirect).

Cons

- The biggest disadvantage: very high risk of losing funds, especially deposits you make believing their promises.

- Lack of credible regulation or transparency: you cannot verify that your money is safe, or that the trades are really happening.

- Very likely you will face difficulties when attempting withdrawal or may be asked for extra fees.

- The promises of “guaranteed returns” or “no risk” are unrealistic and indicate poor investment ethics / possible fraud.

Website Overview

Country:

Jamaica

Operating Since:

2024

Platforms:

Mobile/Desktop

Type:

Trading/investment

Spread:

N/A

Funding:

Trading/investment

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

The site uses bold promises of “easy profits,” “automated high-return trading,” and “risk-free” or “low-risk” investment — claims that are unrealistic in real financial markets.

There appears to be little or no verifiable regulatory disclosure: no publicly confirmed licence number, regulatory body, or credible audit trail is evident.

The website name itself is somewhat odd/spelled incorrectly (“coperatemarkets” rather than “corporate markets”) which raises credibility questions.

Independent reviews classify the platform as an “Advance Fee Scam” — meaning once you pay, you may not get your funds or be able to withdraw.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

While the website of Lanfield Corporate Markets is slick and its promises appealing, the deeper look reveals serious concerns that cannot be ignored. If you deposit money into this platform, you face a real chance that you will not be able to retrieve it — and you may be asked for further payments or fees just to access funds.

Legitimate investment platforms are transparent about risk, regulated, provide verifiable performance, and allow users to withdraw funds without unreasonable barriers. This site displays none of those assurances. Instead, it mirrors the typical pattern of fraudulent “get rich quick” investing schemes: promise big returns, solicit deposit/fee, then hinder withdrawals and fade away.

Therefore, unless new credible evidence emerges (such as a verifiable regulation, audited track record, publicly documented user withdrawals), I strongly advise that you treat this site as a scam and avoid investing any money with it.

Your capital is too important to risk on unverified promises. If you are looking to invest or trade, choose platforms with full regulatory disclosure, long track records, transparent fee and withdrawal policies, and user reviews from independent credible sources.

Comments