Review on Mytrustcu

Summary

About Mytrustcu

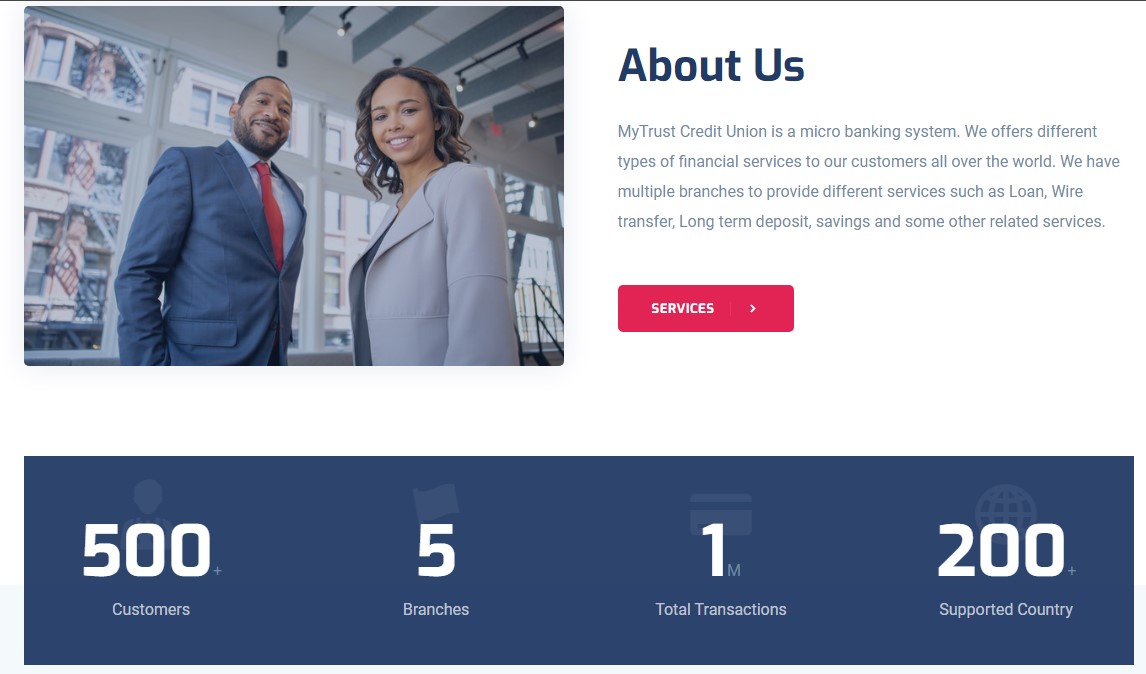

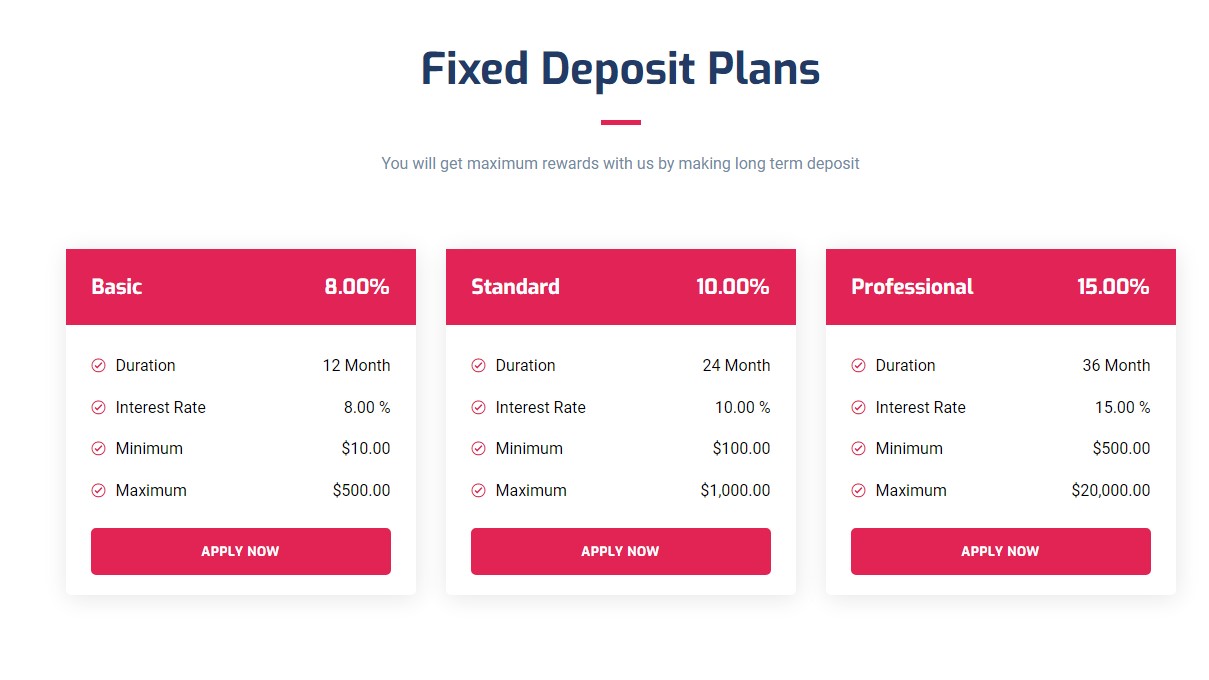

MyTrustCU is marketed as a digital banking platform offering a broad spectrum of financial services, including savings accounts, checking accounts, personal loans, and investment opportunities. The site highlights its commitment to providing modern banking solutions with features such as online account management, competitive interest rates, and 24/7 customer support. It positions itself as a user-friendly and secure option for managing one’s finances, featuring advanced encryption technology and promises of superior customer service.

On closer inspection, however, MyTrustCU reveals itself to be a fraudulent operation. Despite its polished presentation and appealing offers, there are significant concerns that undermine its legitimacy. The site lacks crucial transparency about its regulatory status and fails to provide verifiable details about its licensing or compliance with financial regulations. This is a major red flag, as legitimate banks are required to adhere to strict regulatory standards to protect their customers. Furthermore, the promises made by MyTrustCU about high returns and lucrative financial products are alarmingly unrealistic and often indicative of scams. The website also presents inconsistent and unverifiable contact information, adding to the suspicion about its authenticity.

More Details

MyTrustCU is unequivocally considered a scam due to several compelling factors that highlight its fraudulent nature. A primary indicator of its illegitimacy is the complete absence of regulatory oversight. Genuine online banking institutions are regulated by financial authorities and are required to adhere to stringent standards designed to safeguard customer interests. They provide clear information about their regulatory status, licensing, and compliance with financial regulations. MyTrustCU, however, conspicuously lacks this crucial information, suggesting that it operates without proper oversight.

Moreover, the site employs classic scam techniques designed to lure and deceive potential users. This includes making unrealistic promises about high returns and lucrative financial products that sound too good to be true. These promises are often used to entice individuals into making deposits or sharing sensitive personal information. The site also displays inconsistencies in its contact information, making it difficult to verify its authenticity or reach customer support if needed. Negative feedback and user reviews further corroborate the site's fraudulent nature, pointing to a pattern of deceptive practices and financial exploitation.

In conclusion, MyTrustCU is not a legitimate banking platform. Its lack of regulatory compliance, unrealistic promises, and inconsistent information are strong indicators of its fraudulent intentions. Users should steer clear of MyTrustCU to avoid potential financial harm and ensure their personal information remains secure.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Mytrustcu

Pros

- Attractive Offers: MyTrustCU may offer attractive financial products and high interest rates that could initially seem beneficial.

- User-Friendly Interface: The website design is modern and user-friendly, which might make it appear more legitimate.

Cons

- High Risk of Fraud: Engaging with MyTrustCU poses significant risks of financial loss and identity theft.

- No Regulatory Oversight: The absence of clear regulatory information indicates that the site is not monitored by any financial authority.

- Misleading Information: The site uses deceptive tactics to attract and exploit users, including false promises and hidden terms.

- Inconsistent Customer Support: Contact information is unreliable, and customer support may not be responsive or genuine.

Website Overview

Country:

USA

Operating Since:

2024

Platforms:

Desktop, Mobile

Type:

Online Banking

Spread:

N/A

Funding:

Online Banking

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

Unrealistic Promises

Inconsistent Contact Information

Lack of Regulation

Suspicious User Reviews

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

When evaluating MyTrustCU, it becomes evident that the site is not a credible or legitimate banking institution. Authentic banks operate under strict regulatory frameworks and are subject to regular oversight by financial authorities. They provide transparent information about their licensing, regulatory compliance, and operational practices. In contrast, MyTrustCU falls short in all these critical areas.

The website’s failure to disclose any verifiable information about its regulatory status or licensing is a major concern. Additionally, the site makes unrealistic promises of high returns and superior financial products that are designed to attract unsuspecting users. The absence of transparent contact details and the presence of negative user reviews further confirm the site's fraudulent nature. Users should be extremely cautious and avoid engaging with MyTrustCU to prevent potential financial loss and identity theft. The site’s deceptive practices and lack of accountability make it a risky and unreliable choice for anyone seeking legitimate banking services.

Comments