Review on Novarainternational

Summary

About Novarainternational

Offering personal and business banking, credit, cards, loans, and savings products, Novara International (novarainternational.org) positions itself as a digital banking company. According to its webpage, "We do banking differently. Everybody is entitled to a wonderful experience at every stage. It promotes a lot of numbers: 50,000+ satisfied clients, $2.5B+ in assets managed, and a routing/branch hours/round-the-clock support contact. Additionally, there is a section called "Apps" that promises "zero liability guarantee" and fraud protection.

Independent online security firms, however, give it a very poor trust score, suggesting that it might be a hoax.

The infrastructure, ownership, and registration of the site are all unclear. Despite its compelling assertions, it does not provide substantiated evidence of regulation, license, or of the existence of lawful banking activities. Until more evidence is found, its claim of financial services should be regarded with mistrust.

More Details

Extremely Low Trust Score

The fact that a trusted site evaluation tool gives the domain an “extremely low” trust rating is a strong warning sign. It suggests the domain fails many key legitimacy checks (ownership, registrar, server reputation, longevity, etc.).-

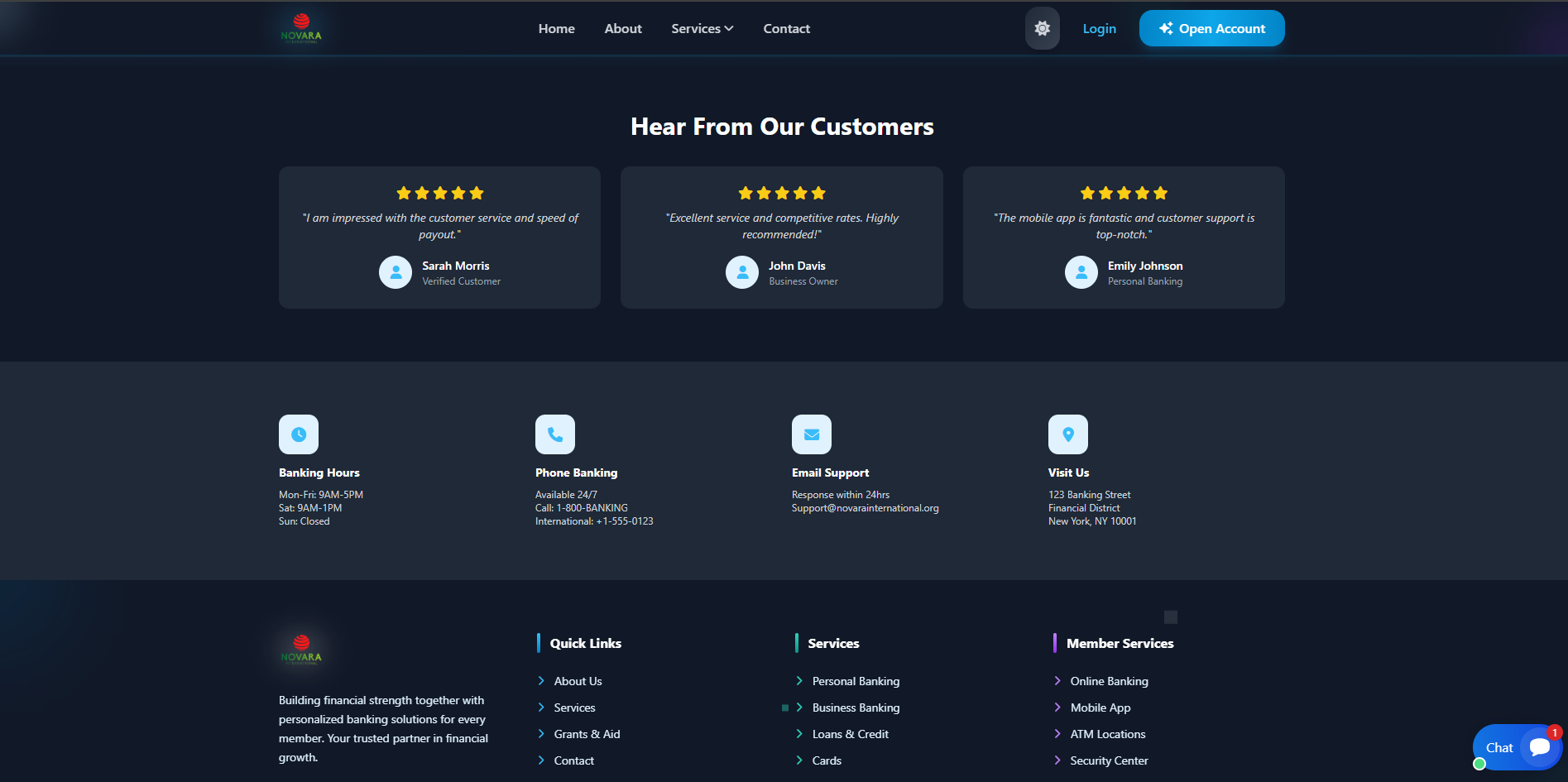

Generic / dubious contact information

The privacy page provides an email (Support@novarainternational.org), phone “1-800-BANKING,” and a generic address “123 …”. None of these are verifiable as being tied to a real bank. This typical vagueness is often used by scam sites to appear plausible while maintaining anonymity. -

Unsubstantiated claims of scale and assets

The site claims "$2.5B+ assets managed" and "50K+ happy customers," which would require public disclosure, audits, and regulatory oversight in real banking. No evidence of such oversight or audits is visible. This is a classic marketing tactic in fraudulent banking / investment sites. -

Promises of “fraud protection” without proof

The “Apps” section promises 24/7 monitoring and zero liability guarantees. But unless these protections are backed by recognized financial insurers or legal guarantees, they can be misleading. Many scam banks use such promises to reduce suspicion, but they are void if the institution is not regulated or real. -

Ownership / domain anonymity / suspicious hosting

For a real bank, domain registration is transparent and accountable, often with a verifiable corporate address. The anonymity or hidden registration suggests a desire to avoid legal accountability. Many scam / fraudulent financial sites use anonymized domain registration. -

Mismatch with real banking regulation

Real banks are regulated, required to publish annual reports, subject to audits and oversight. Novara International does not show any such regulatory compliance or third-party corroboration. The site’s promises and appearance are inconsistent with what regulated banks do.

Thus, combining all these points, the site fits strongly into the profile of an online banking scam: using polished façade, making grand claims, hiding identity, lacking proof.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Novarainternational

Pros

- Professional interface — The site has the look and feel of a real bank website: navigation, banking terminology, apps section.

- Appealing claims — High yield accounts, “zero liability,” large customer base, etc., which are meant to reassure and draw attention.

- Basic security features — The site is accessible, pages load, presumably uses HTTPS (as most modern sites do).

Cons

- No credible licensing or regulation — No proof it is registered under any banking authority.

- Hidden / generic ownership and contact info — Much of the listed contact is too vague or generic.

- Highly questionable trust & safety rating — The site is flagged as high risk by independent tools.

- High risk to users — Deposits may be lost, account withdrawals blocked, funds not insured or protected, personal data exposure.

Website Overview

Country:

Turkey

Operating Since:

2025

Platforms:

Mobile/Desktop

Type:

Online bank

Spread:

N/A

Funding:

Online bank

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

It claims large numbers: “50K+ Happy Customers,” “$2.5B+ Assets Managed,” etc. Such numerical claims are not substantiated by regulatory filings or external audits; common tactic in scams to create illusion of scale.

Uses a domain and site infrastructure that works (pages load). Ownership and registration details are hidden or not credible; domain used by many suspicious sites; likely no legitimate banking license.

It advertises fraud protection, “zero liability guarantee,” mobile apps. These protections are often used as marketing promises; without proof of insurance or audited backing, they can be meaningless.

The site looks polished and professional: has a homepage, “About,” “Services,” “Contact,” “Apps,” etc.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

Novarainternational.org should be treated as a likely fraudulent online banking site rather than a legitimate institution. Despite its polished look and banking language, the lack of transparency, low trust rating, generic contact info, and unverified claims outweigh any superficial positives.

If you are considering interacting with it — opening an account, depositing money, providing personal / banking data — you should not proceed unless you obtain solid, independent verification: regulation, licensing, audit reports, verifiable user testimonials. Until then, the prudent assumption is that it is a scam and your risk is high.

Comments