Review on Standardvestments

Summary

About Standardvestments

A Deep Dive Into Standardvestments.com

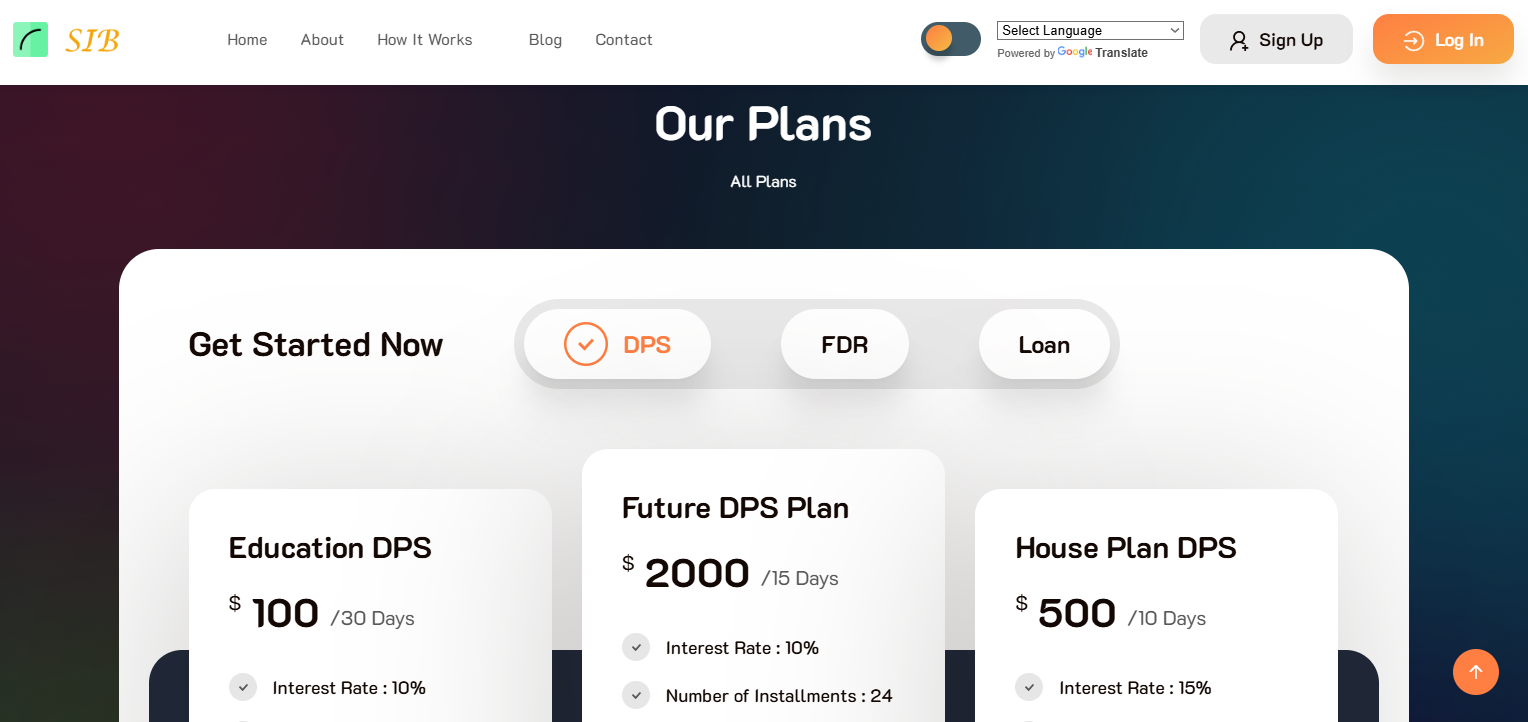

Standardvestments.com promotes itself as a robust online banking and investment platform offering financial services such as savings, loans, fixed deposits, and high-yield investment plans. At first glance, the site appears professional and well-organized, aiming to attract users looking for quick returns on investments.

However, further examination reveals numerous concerning elements. The website promises exceptionally high profits such as 15% returns every 10 days which are simply not sustainable in any legitimate financial market. These types of claims are often associated with Ponzi schemes, which rely on money from new investors to pay returns to earlier participants.

Additionally, there is a noticeable lack of information about the company’s leadership, physical headquarters, or licensing credentials. No details are available regarding its registration with recognized financial regulators. The absence of this vital information is a major red flag that suggests the platform may not be operating legally or transparently.

Testimonials shown on the website cannot be verified and appear generic. Without confirmation of their authenticity, they add no credibility to the platform. The site also uses tactics common in fraudulent schemes, such as encouraging users to invite others through referral programs with promised bonuses an effort to increase reach while concealing the true nature of operations.

More Details

In-Depth Examination of Why Standardvestments.com Raises Serious Concerns

Upon closer analysis, it becomes increasingly evident that standardvestments.com exhibits numerous traits that are often associated with deceptive financial operations. Although the site attempts to present itself as a trustworthy investment and online banking platform, several underlying factors suggest otherwise.

To begin with, one of the most striking issues is the site’s promotion of guaranteed high-yield returns within extremely short timeframes. It claims to offer profits such as 15% every 10 days, which is far above the average returns even in the most aggressive and high-risk investment markets. In the world of legitimate finance, such offers are almost never feasible, especially on a continuous basis. Institutions that operate under regulatory standards understand that investment carries inherent risk, and they typically make efforts to educate users about the possibility of both gains and losses. In contrast, standardvestments.com seems to promote only the upside, ignoring the realities of market behavior, which is an immediate red flag.

In addition to these financial claims, the platform fails to provide essential transparency that is expected of any reputable financial service provider. There is no clearly stated physical address, no information about the company's executives or operational team, and no legal documentation or credentials displayed on the website. This lack of transparency severely undermines any confidence a user might place in the platform. When individuals entrust their money to an institution, they should be able to verify who is handling their funds, how the funds are being managed, and under what legal framework the business operates. The complete absence of such disclosures is highly suspicious.

Furthermore, the website employs marketing language and user engagement strategies that are characteristic of high-risk or fraudulent schemes. One such tactic involves the use of referral incentives. Users are encouraged to invite others to join the platform, often with the promise of bonuses or commissions. This kind of structure often creates a dependency on new member sign-ups to sustain the platform, rather than generating returns through genuine investment activity. When a platform relies more heavily on bringing in new users than on solid investment strategies, it reflects a deeply flawed or even deceptive business model.

Another issue lies in the lack of user accountability and security assurance. Secure financial platforms invest heavily in data protection, encryption, compliance with anti-money laundering laws, and identity verification systems. In contrast, standardvestments.com provides no visible evidence of such measures. There are no signs of regulatory audits, security certifications, or any form of user protection mechanisms. This means that users have no recourse if their funds are mishandled or if the platform shuts down without warning.

Moreover, the customer testimonials provided on the platform raise serious concerns about authenticity. The feedback is vague, overly positive, and lacks any verifiable context. There are no user reviews tied to specific names, transactions, or real-life use cases that could be independently confirmed. This type of manufactured feedback is commonly used to create a false sense of credibility and trustworthiness. Without verified user experiences or transparent operational data, it becomes difficult if not impossible to determine whether anyone has truly benefited from the platform in a legitimate way.

The visual presentation of the site may initially appear convincing to the average visitor, but a deeper inspection reveals a lack of technical robustness and professional oversight. There is no detailed information about customer support channels beyond generic email forms. Real financial institutions typically offer multi-layered support systems, including dedicated lines, compliance departments, and even dispute resolution channels. This absence of real-time customer service infrastructure suggests that user concerns may go unanswered, especially if issues arise after money has been deposited.

In addition, the platform does not make available any educational materials, disclaimers, or tools that would help investors understand the risks associated with investing. Genuine financial institutions usually provide a broad range of resources to help users make informed decisions. By omitting these tools, standardvestments.com appears more focused on attracting deposits than on building long-term financial literacy or customer relationships.

Lastly, there is an overall sense of urgency embedded into the platform’s messaging. The emphasis on quick returns, rapid sign-up processes, and limited-time offers are all designed to provoke impulsive decision-making rather than informed judgment. This urgency tactic is often used to prevent users from taking time to research or think critically about the potential consequences of their actions.

In summary, when evaluating standardvestments.com, it is clear that the platform does not meet the standards expected of a legitimate financial service. The combination of exaggerated investment returns, lack of transparency, absence of regulatory compliance, and manipulative marketing strategies creates a highly concerning picture. While the website may appear to function smoothly on the surface, the deeper structural issues suggest a very real possibility that the platform is not operating in the interest of its users. Instead, it appears to be structured primarily to extract funds with minimal oversight or accountability. Individuals considering engagement with the platform should exercise extreme caution, and ideally, avoid it altogether.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Standardvestments

Pros

- User Interface: The website is designed with a clean and intuitive layout, making it simple for users to navigate its services

- Diverse Offerings: It advertises a broad range of financial services, which could attract a wide audience of potential investors.

Cons

- Unrealistic Investment Returns: Promised returns far exceed industry norms and signal unsustainable operations.

- Lack of Regulatory Oversight: There is no evidence that the platform is licensed by any official financial authority, which undermines its credibility.

- Anonymous Ownership: The website does not provide verifiable details about its management or legal structure.

- Fake Testimonials: The feedback posted on the platform cannot be linked to real individuals and lacks third-party validation.

- Urgency-Based Marketing: Users are urged to invest quickly and refer others, a tactic frequently used in fraudulent financial operations.

Website Overview

Country:

UK

Operating Since:

2024

Platforms:

Mobile/Desktop

Type:

Online Banking

Spread:

N/A

Funding:

Online Banking

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

Excessive Returns: The investment plans promise returns far beyond what is achievable in legitimate markets.

No Licensing Details: No documentation proving legal operation or financial regulation is available on the site.

Hidden Ownership: Users are not given any information about who runs the platform or where it is based.

Questionable Reviews: The platform provides customer feedback that lacks credibility and cannot be independently verified.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

Is Standardvestments.com Legitimate?

After a comprehensive review, it is clear that Standardvestments.com exhibits several warning signs commonly associated with fraudulent online investment schemes. From the outset, its claims of high profitability with little or no risk are alarmingly unrealistic. In financial markets, such offers are rarely sustainable and often turn out to be scams.

The platform fails to meet basic transparency standards. There is no regulatory registration, no information about leadership, and no independent reviews from legitimate financial entities. Without any form of oversight, user funds are entirely at the mercy of anonymous operators who can disappear at any time without consequence.

The absence of transparency, combined with marketing strategies that encourage rapid investment and recruitment, is deeply concerning. These characteristics, when taken together, provide a strong basis to conclude that the site is not a secure or trustworthy financial platform.

Investors are urged to avoid engaging with this platform and to report any suspicious activity to relevant financial authorities. Any investment opportunity that avoids regulatory scrutiny while promising rapid wealth should be treated with extreme caution.

Comments