Review on Starkvillecityb

Summary

About Starkvillecityb

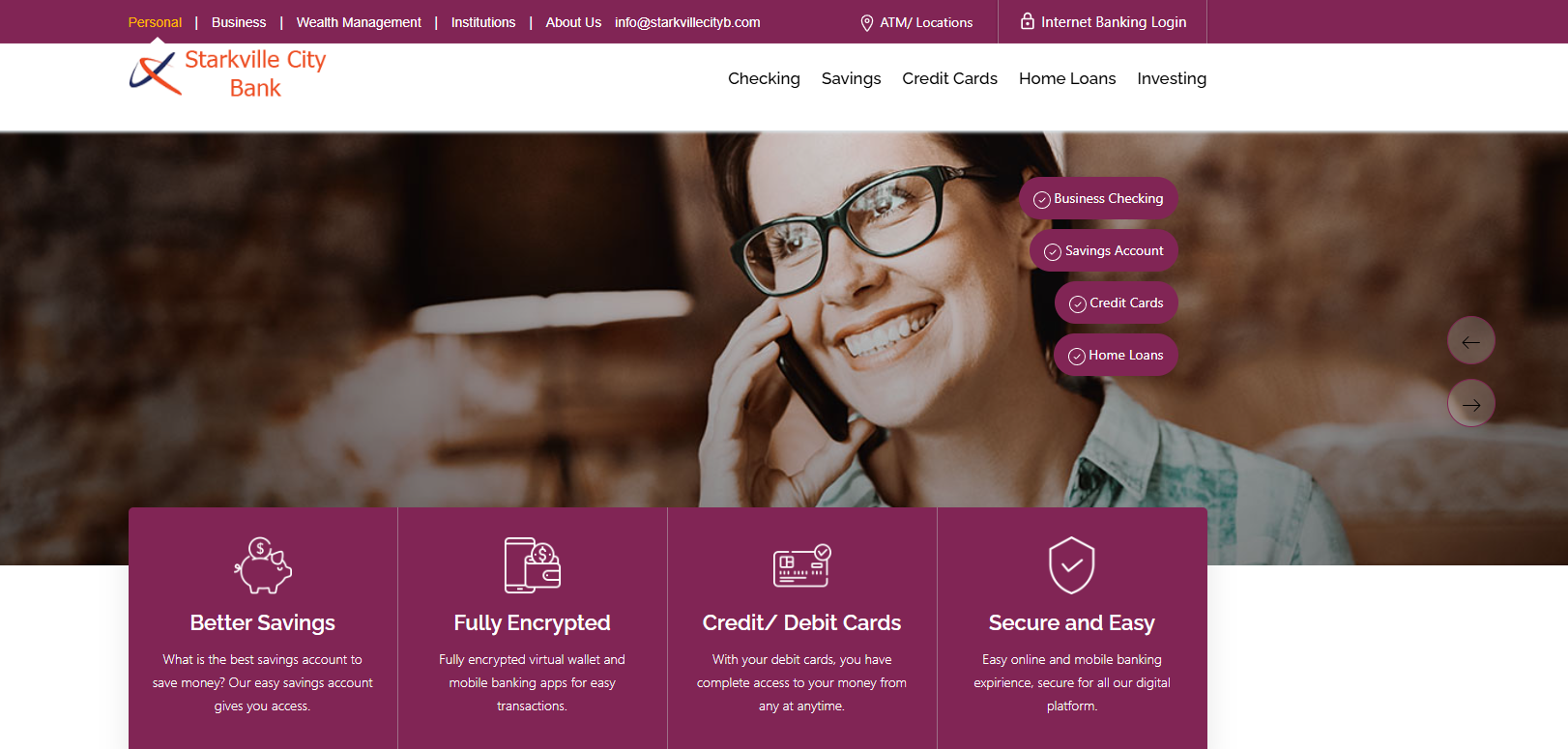

The website in question — https://www.starkvillecityb.com — presents itself as an online bank calling itself Starkville City Bank. It offers a full complement of banking services: checking, savings, credit cards, home loans, foreign exchange, global remittance, digital wallets, online and mobile banking. According to the site’s “About Us” page, the bank claims to have been founded in 2022 in the United States, currently holding approximately $25.1 billion in total assets and 2,800+ associates across six states. The site lists a contact phone number +1 203-555-6103 and an address of “70 Old Liberty Street Sanford, NC 27330” in its Contact Us section.

At first glance, the presentation resembles a typical bank website: standard navigation (Personal / Business / Wealth Management), sections on services (Checking, Savings, Foreign Exchange, Global Remittance), login pages, and even a “Security & Fraud” section with tips. However — upon closer inspection — there are multiple inconsistencies, red flags, and missing verifications that strongly suggest this entity is not a legitimate, regulated U.S. bank.

In the sections below I walk through the key observations, pros and cons of the site, a detailed analysis of its legitimacy, and finally my conclusion.

More Details

After a detailed review of the website’s content, claims, domain and contact data, I conclude that the site is very likely a scam, and I strongly advise against using it for any banking transactions. Here is the reasoning in detail:

-

Missing regulatory trace / no legitimate banking charter found

A genuine U.S. bank must have a charter (state or national), be listed with the FDIC or the Federal Reserve, publish its routing number, and have verifiable physical branches. The website gives a generic address and a phone number, but independent searches did not corroborate the existence of a bank by the name “Starkville City Bank” with the claimed asset size of $25 billion. The absence of such verification is a critical flaw. -

Unrealistic growth and inconsistent history

The website claims the bank was founded in 2022, yet also claims more than 100 years of service. It further claims $25.1 billion in assets and a workforce of 2,800+ across six states in a very short span. For a new bank, that level of scale is highly unlikely without external records or media coverage. The internal inconsistency undermines credibility. -

Domain/branding issues

The domain uses “starkvillecityb.com” rather than “starkvillecitybank.com” or similar. The clipped “b” may be an attempt to mimic “bank” while avoiding detection or reservation of the more obvious domain. Also, the use of “Starkville” (a city in Mississippi) combined with an address in Sanford, North Carolina, raises geographic inconsistency. The phone number uses the “555” fictitious prefix often seen in TV/film, which suggests it may not be real. -

Inconsistent support e-mail and login messages

On the login page, an error message directs users to send email to support@firmtrustbk.com — a domain wholly different from the main site. This kind of mismatch is often seen in phishing sites or scam pages where script is reused from other domains. If a real bank had professional infrastructure, these details would align. The mismatch suggests little professionalism and likely malicious intent. -

Emphasis on wires/global remittance

Legitimate banks offer global remittance services, but a new/unverified bank emphasising global remittance and foreign exchange may be targeting the movement of funds in a way that is less easily monitored. Scam operations often lure victims into sending money internationally or providing sensitive banking credentials. The website’s heavy push into remittance, digital wallets and foreign exchange without verifiable credentials is suspicious. -

Lack of independent public footprint

If a bank genuinely had $25 billion in assets, 2,800 employees, and presence in six states, there would be regulatory filings, press releases, news articles, or branch data publicly available. None were found. The absence of such a footprint is a red flag. -

No visible FDIC disclosure / routing number / branch locator

Legitimate banks show “Member FDIC” logos, routing numbers for payments, branch lists, investor information (if public), and regulatory disclosures. This site lacks those key features, making it difficult or impossible to independently verify deposits are insured or the institution even exists for regulatory purposes. -

Potential risk for users

If a user were to deposit funds, provide sensitive personal or banking information, or attempt to transfer money, they could be at risk of losing those funds, having credentials stolen, or becoming part of a money‐laundering scheme. Because the operator is unverified, there is no guarantee of fund safety or regulatory protection.

Given all the above, the evidence overwhelmingly points to this being a scam operation masquerading as a bank. The site uses the appearance of legitimacy but fails basic external verification, uses commonly seen scam indicators (odd domain, mismatched email/domain, unrealistic claims). It is prudent to treat this as a fraudulent site and to avoid engaging with it.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Starkvillecityb

Pros

- It provides a “Security & Fraud” section that gives basic guidance (which could help new users become more aware).

- It displays a phone number and an address, which factors could raise trust if verified.

- The navigation and terminology fit standard banking service categories, making it appear professional initially.

Cons

- The site lacks independent verification of its legitimacy (regulatory information, branch network, public filings).

- The domain name is odd/misspelled (“b” instead of “bank”) which raises suspicion.

- Claims made by the site are inconsistent and unrealistic for a startup bank (e.g., $25.1 billion in assets after only one year founded).

- Contact details include a “555” phone prefix (which is often placeholder/fictitious) and an email referencing a different domain (firmtrustbk.com) in the login error message.

Website Overview

Country:

USA

Operating Since:

2025

Platforms:

Mobile/Desktop

Type:

Online bank

Spread:

N/A

Funding:

Online bank

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

No verifiable regulatory information: A legitimate U.S. bank should be listed with the Federal Deposit Insurance Corporation (FDIC) or state‐banking regulator, have a routing number clearly verifiable, show branch locations, etc. The site gives a phone number and address, but I could not locate independent confirmation of this bank’s charter, FDIC membership, or a valid routing number in trusted regulator databases.

Domain name and branding oddities: The domain “starkvillecityb.com” is unusual — missing the “ank” in “bank” (“b” instead of “bank”). If this were a genuine community bank it would likely use a more standard domain. Odd domain extensions / misspellings are common in scam sites.

Minimal evidence of physical branches: While the Contact Us section gives an address (70 Old Liberty Street, Sanford, NC 27330) and a phone number, there is no independent evidence of branch listings, branch hours, local presence in six states, or community services historically recorded. Legitimate banks usually advertise their branch network, regulators reference them, etc.

Highly generic service descriptions: The website content appears templated, with repeated statements (“Open Now”, “Learn More”, “Better Savings”) that appear generic and not tailored to a specific bank’s history or region.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

In summary, while the website for Starkville City Bank may look convincing at first glance — with polished service pages, a login portal, contact information and banking-industry style language — the deeper you look, the more concerning the inconsistencies become. For an institution to claim billions of assets and multiple states presence, one would expect a strong regulatory footprint, verifiable public data, banking charter listings, branch locations, deposit insurance disclosures, and credible domain branding. This site fails in most of those critical areas.

My recommendation is: do not open an account, do not deposit money, do not provide personal or banking credentials, and do not rely on this site for financial services. Treat it as high risk and likely fraudulent. If you have already engaged with it or transferred funds, you should cease further action, secure your personal data and consult appropriate financial authorities or law enforcement.

Given the substantial red flags and lack of verifiable legitimacy, my conclusion is that this website is not a real bank, but more likely a scam operation designed to trick individuals into transferring funds or disclosing sensitive information.

Comments