Review on Sterlingcapitalfx

Summary

About Sterlingcapitalfx

SterlingCapitalFX.com (often stylized “Sterling Capital FX”) presents itself as a high-reward, low-risk forex / CFD trading platform with strong support, free mentorship, and transparency via trade statistics. On its homepage it claims:

-

“Trading with high reward and low risk. We make, on average, 3 times more than what we risk.”

-

“Provides statistics of all trades, good and bad.”

-

“24/7 support before & after membership”

-

“FREE mentorship program to learn trading.”

-

It also asserts “+1,200 reviews, +6,000 feedback reviews, +100 video interviews and video testimonials from members.”

On paper, these promises are alluring: they imply that the platform is transparent, supportive, educational, and consistently profitable. However, a closer forensic look reveals many red flags, inconsistencies, and warning signs that strongly suggest this site is operating a scam, not a legitimate forex broker.

Below is a deep, multi-angle review and analysis of SterlingCapitalFX.com, highlighting its strengths (if any), many red flags, and a reasoned conclusion on its legitimacy.

More Details

1. Absence of credible regulation

Legitimate forex brokers operate under licensing by financial authorities (FCA in the UK, ASIC in Australia, SEC/CFTC in the U.S., etc.). These regulators enforce capital requirements, audits, segregation of client funds, dispute mechanisms, and oversight. SterlingCapitalFX provides no verifiable regulatory credentials or license numbers, no registration in recognized registries, and no transparency on where funds are held. That absence is a critical red flag.

2. Unrealistic promises and guarantees

The site’s claim of “3× returns with low risk,” always publishing trades, and consistent high profits are classic hallmarks of investment fraud. In financial markets, there is always risk; no service can guarantee a fixed multiple return or consistent profit without risk. Scams often lure victims with promises of high returns, then delay or block withdrawals once deposits increase.

3. Poor domain and technical trust

Security audits show that the domain is new (≈ 3 months old), has a very low trust score (1/100), and is flagged by security/antimalware engines. The domain’s infrastructure is weak (short SSL term, blacklisted by some services). Fraudulent sites often use fresh domains to avoid historical scrutiny, then discard them when flagged.

4. User reports of suspicious behavior

Some early users reported that their deposit showed up as balance, even inflated, then withdrawal requests failed, or the “withdraw” link malfunctioned. This typical “bait” tactic (show profits, then prevent withdrawal) is precisely how many scams operate.

5. Heavy reliance on testimonials and unverifiable feedback

They boast thousands of reviews and video testimonials—but independent verification is lacking. Scams often use fabricated reviews (sometimes AI-generated or scripted) to create an illusion of legitimacy. The site also displays “+1,200 reviews, +6,000 feedbacks,” but independent platforms show only one negative review on Trustpilot.

6. Data abuse risk

The privacy policy reveals that they collect very sensitive personal and financial data (tax ID, net worth, trading experience, etc.). If the site is fraudulent, that data could be used for identity theft, phishing, or other malicious uses.

7. Lack of accountability or transparency

There is no credible information about the company’s real ownership, physical address, audited financials, or proof of operational legitimacy. Real brokers typically reveal enough details to satisfy regulator and client scrutiny. Scammers hide or fabricate such details.

Given the convergence of these factors, the conclusion is strong: SterlingCapitalFX is not a legitimate broker. Even if parts of it superficially mimic real broker features, the foundational elements of trust, regulation, transparency, and reliability are missing.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

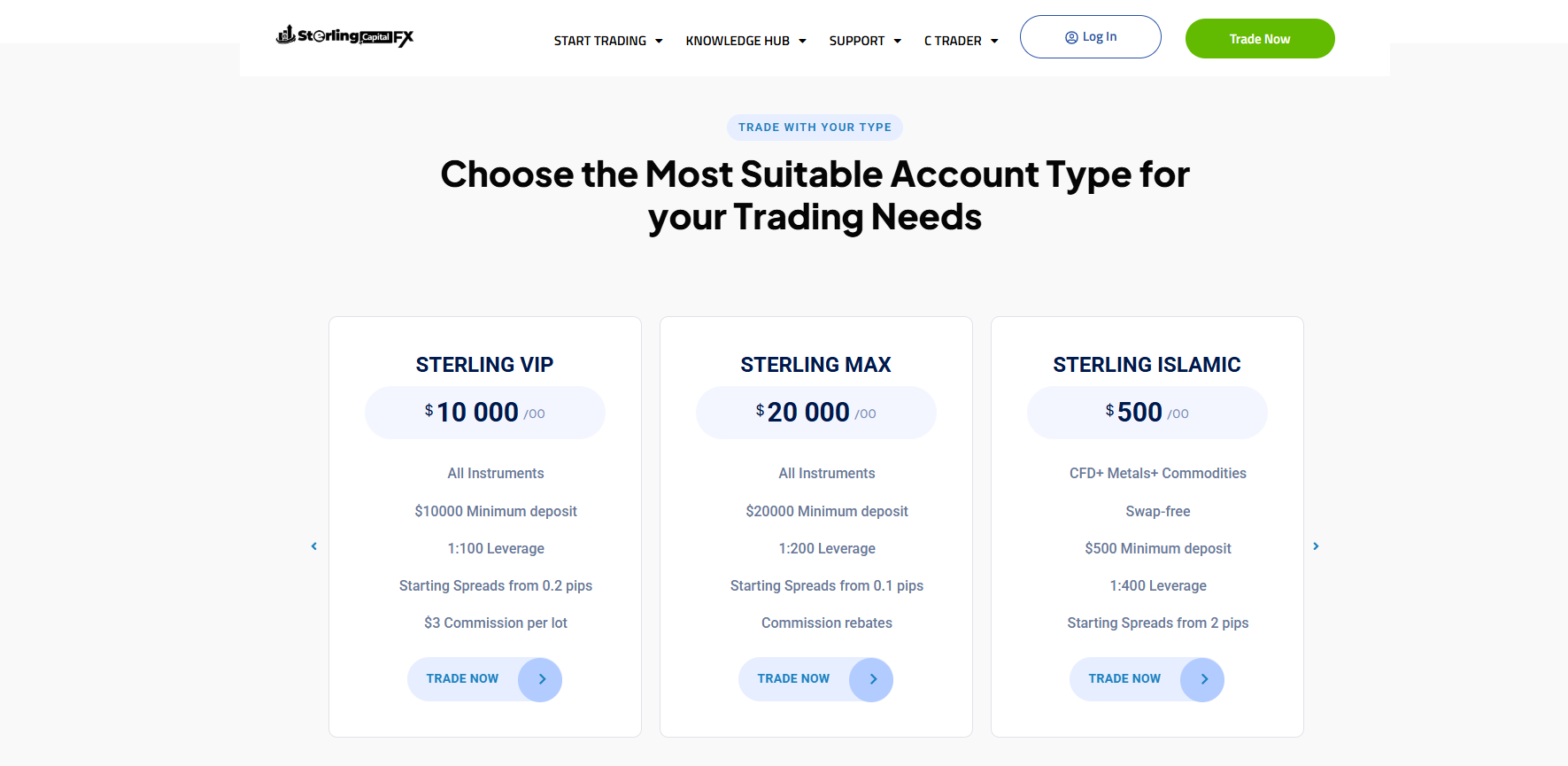

Photos of Sterlingcapitalfx

Pros

- Educational / mentorship narrative For people new to trading, the promise of “free mentorship” can be appealing (though whether it’s delivered is another matter).

- Trade statistics feature (claimed) They claim to publish both good and bad trade stats, which on the surface suggests transparency (though this may be fabricated).

- 24/7 support promise Promising round-the-clock service is a selling advantage (if it were real).

Cons

- No verified regulation or licensing Without oversight by a recognized regulator, users have very little recourse or protection.

- Unrealistic profit claims Guaranteed or consistent high returns in trading are virtually impossible. Such promises are classic scam tactics.

- Withdrawal problems / user complaints Reports from users indicate inability to withdraw or sudden account blocks.

- New, untrusted domain and poor reputation A domain with minimal history and very low trust ratings is highly suspicious.

Website Overview

Country:

USA

Operating Since:

2025

Platforms:

Mobile/Desktop

Type:

Forex/trading

Spread:

N/A

Funding:

Forex/trading

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

Domain Age is very short Security scanners report the domain is only a few months old (≈ 3 months). A new domain with financial claims is inherently risky.

Very low trust / reputation scores Gridinsoft gives a 1/100 trust score, classifying it as a “Suspicious Website.”

Lack of financial regulation / oversight There is no credible evidence that SterlingCapitalFX is regulated by a top-tier financial authority. Broker-chooser reviews of similar names mark them as untrusted for this reason.

Overly bold profit claims Claiming “3× more than what we risk” is an unrealistic guarantee in the volatile forex market. Such claims are hallmarks of get-rich-quick schemes.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

SterlingCapitalFX.com presents itself with polished marketing, bold promises, and an aura of legitimacy. But beneath the surface, its structure lacks the essential pillars of any real broker: regulation, transparency, credible track record, and accountability. The array of red flags—young domain, low trust, absence of licensing, user complaints, data overcollection, and too-good-to-be-true guarantees—coalesce into a high probability that this is a fraudulent operation designed to lure deposits, block withdrawals, and ultimately vanish (or extract as much as possible before disappearing).

If you or someone you know has engaged with this site (especially depositing funds), immediate caution is warranted. Do not deposit further, do not share more personal information, and attempt to recover any funds via your payment method, bank, or via reporting to your local financial fraud authority or cybercrime unit.

Unless the site can produce verifiable regulation, independent audited performance, and a history of satisfied customers, it should be classified as a scam in all but name.

Comments