Review on Syncxtrades

Summary

About Syncxtrades

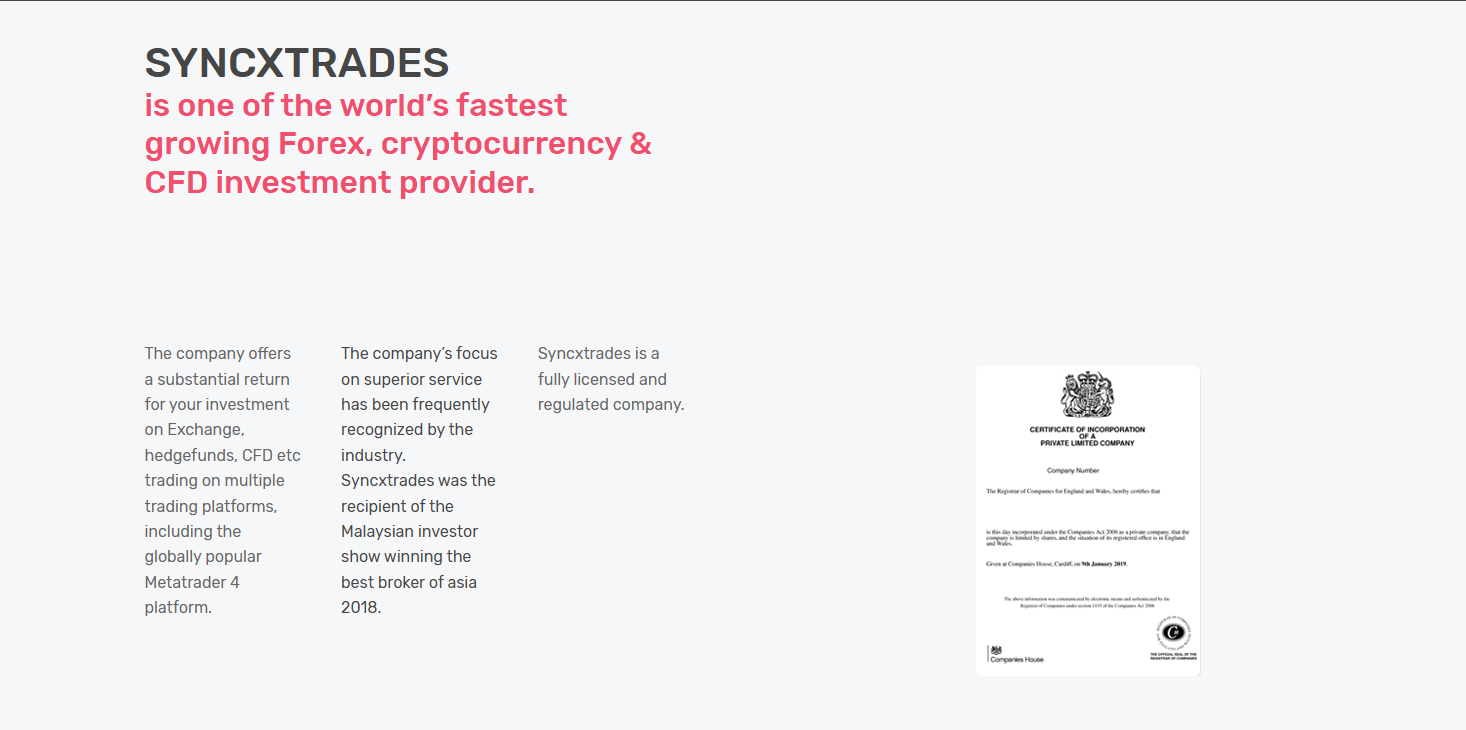

This review examines SyncXTrades (website: syncxtrades.com), which presents itself as a global investment-and-trading service provider specialising in Forex, cryptocurrencies and CFDs. On its homepage the site claims to be “one of the world’s fastest growing Forex, cryptocurrency & CFD investment providers.” It maintains that it offers “substantial return for your investment” via multiple trading platforms including the popular MetaTrader 4. In addition, the site states that SyncXTrades won the “Best Broker of Asia 2018” award at the Malaysian investor show. The company advertises trading on derivatives, options and other high-risk instruments. On the “Demo Trading” page it notes that the financial products it offers include “digitals, contracts for difference (CFDs), and other complex derivatives and financial products” and that “trading … may not be suitable for all investors because of the risk of losing all of your invested capital.”

So in short: SyncXTrades pitches itself as a fully-fledged broker/investment platform offering high returns, multiple asset classes, and global reach.

More Details

After careful analysis, I conclude that SyncXTrades is very likely a scam or at least an extremely high-risk platform with no credible evidence of full legitimacy. Here’s why:

-

Regulatory gap: The cornerstone of legitimacy for any investment/trading platform is regulation by a credible authority. SyncXTrades lacks that: the FCA warning explicitly states it’s not authorised. Without regulation, you cannot rely on deposit protection, oversight or independent dispute resolution.

-

Trust indicators: Independent trust-score systems flag the site with a very low trust rating. Scamadviser’s algorithm flagged it as “strong indicator of being a scam”. r Broker review sites also mark it as “not trusted broker”. When independent assessments align like this, it heightens the warning.

-

Customer complaints: The presence of multiple reviews claiming large losses, withdrawal problems or inability to recover funds strongly suggests actual problems in the market. For example, one reviewer claimed they were “scammed of $85,000”. Whether all claims are verified, the pattern is consistent with scam-broker behaviour.

-

Aggressive marketing + vague backing: Promising “substantial returns”, using marketing language like “fastest growing” and “Best Broker of Asia 2018”, without clear verifiable credentials or transparent regulatory proof, is typical of schemes that emphasise allure over substance.

-

High-risk products pushed to retail: The platform invites retail investors into CFDs and derivative “digitals” which are risky and often used in frauds. While not inherently fraudulent, when combined with the above factors, it becomes highly suspect ([see risk disclaimer page]).

-

Targeting globally without clarity: The site claims global reach but lacks clarity on jurisdictions, regulatory status per region, or protections per jurisdiction. The FCA note that the firm “may be targeting people in the UK” is a red flag.

Given all these factors—especially the regulatory void and multiple warnings—the platform does not meet the typical standards for a legitimate, trustworthy broker. For someone considering depositing funds, the risks are extremely high and the chance of recovery is low if things go wrong.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Syncxtrades

Pros

- The website is professionally presented and claims use of well-known trading platform (MetaTrader 4) which may appeal to genuine traders.

- It offers a broad range of asset classes (Forex, cryptocurrency, CFDs) which might suit diversified traders.

- The presence of some risk disclosure (“may not be suitable for all investors”) is better than absolute silence on risk.

Cons

- Lack of regulatory authorisation from credible bodies (such as FCA) means investor protection is weak or non-existent.

- Very low trust ratings from independent sources indicating high risk of scam.

- Reports of customer losses and withdrawal issues suggest real-world user problems.

Website Overview

Country:

USA

Operating Since:

2024

Platforms:

Mobile/Desktop

Type:

Trading/investment

Spread:

N/A

Funding:

Trading/investment

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

Unregulated status: The Financial Conduct Authority (FCA) in the UK has issued a warning that SyncXTrades is not authorised or registered by them. If you deal with the firm you won’t have access to UK-investor protections such as the Financial Ombudsman Service or FSCS (Financial Services Compensation Scheme).

Low trust rating: The website syncxtrades.com has been flagged by the review site Scamadviser as having a “very low trust score”. Similarly, other broker-review sources say the broker is “not a trusted broker” because it lacks regulation.

Aggressive promises & high-risk instruments: The platform highlights “substantial returns” and encourages trading in CFDs/digitals – instruments which carry high risk and are often used in fraudulent schemes.

Award claims & marketing flair: The claim of “Best Broker of Asia 2018” is difficult to verify independently from reliable award-organisers. This kind of marketing may be used to build trust via appearance rather than substance.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

In conclusion: I strongly advise against using SyncXTrades. While the website appears polished and the offering superficially appealing, the underlying foundations are weak and the risk of loss appears very real. The lack of regulation, low trust scores, complaints, and the nature of its marketing all combine to paint a picture of a likely scam or at best a platform that is highly unsafe for retail investors.

If you are seeking to invest or trade online, it would be far safer to choose a platform that is fully regulated in your jurisdiction (for example by the Nigerian regulators or another reputable body), offers transparent terms, verifiable credentials, and has a solid track record of user trust. With SyncXTrades, those safeguards are lacking, and thus the potential downside—loss of funds—is unacceptably high.

Comments