Review on Unityinb

Summary

About Unityinb

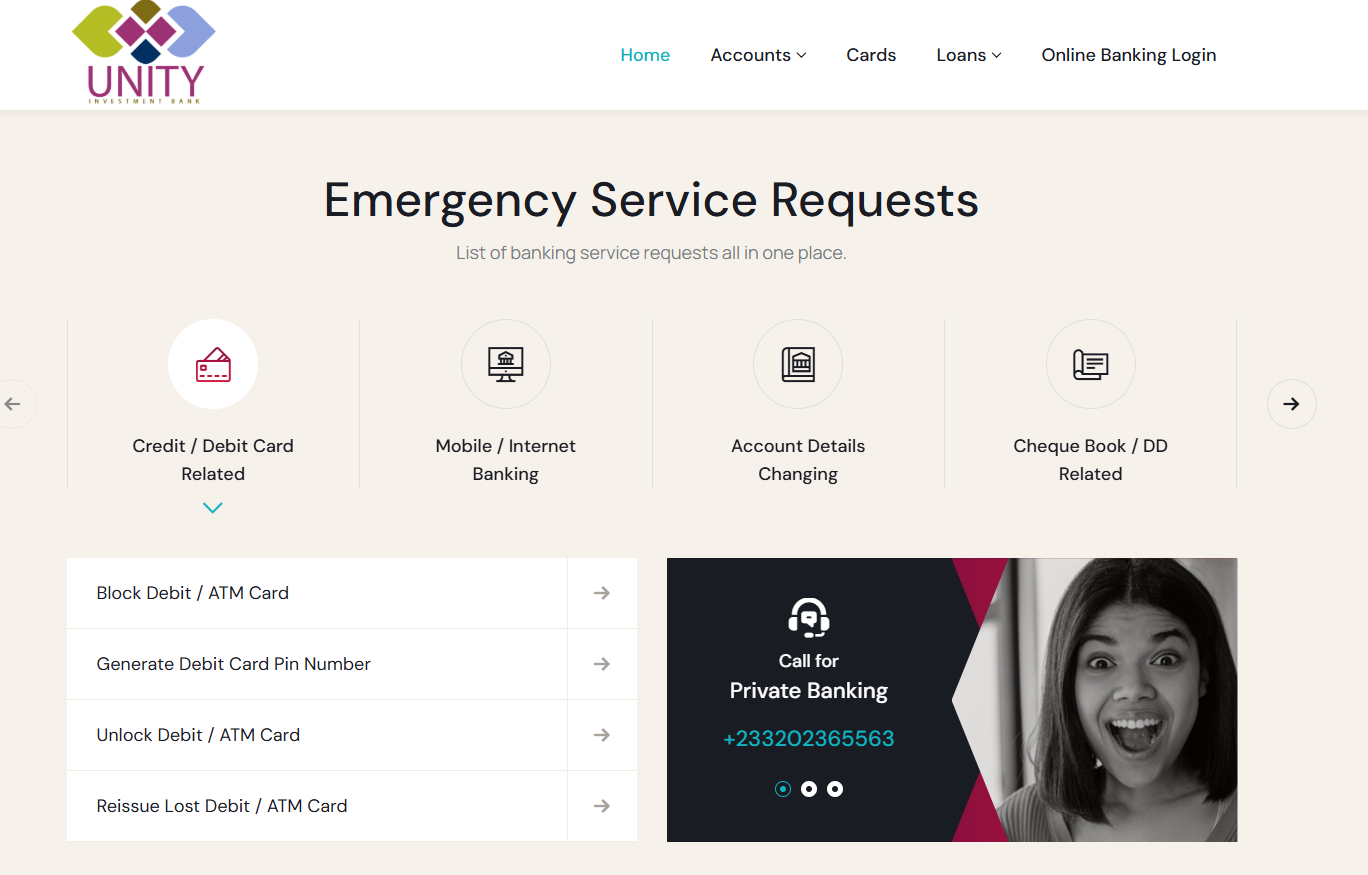

The website unityinb.com presents itself as an online bank—branding appears as “Unity Investment | BANK” and offers banking services for individuals and companies, including savings, CDs, online & mobile banking, consumer loans. On its “Accounts” page, it promises extremely high interest rates: up to 8% on “Savings Account” and 5% on “Current Account”. signs appear—lack of verifiable accreditation, exaggerated returns, unclear regulatory status, minimal proof of a real physical presence, and no independent reviews or confirmations of legitimacy.

In short: while the site claims to be a full‐service bank, the evidence strongly suggests it is not a typical regulated bank in any well‐known jurisdiction, and likely operates with high risk of being a scam.

More Details

Based on the evidence (or lack thereof), the website unityinb.com should be considered highly suspicious, and likely a scam rather than a legitimate bank. Here is the detailed reasoning:

-

Regulatory transparency missing: A legitimate bank normally discloses its regulatory body (e.g., central bank licence number), country of registration, deposit insurance scheme, and physical branch information. The site fails to clearly provide these. Without regulatory oversight, there is no guarantee of safety for depositors.

-

Unrealistic returns: Very high interest rates — e.g., 8% for savings — are far above typical rates in regulated markets. High yield offers are one of the most common bait tactics used by fraudulent “banks” or Ponzi operations. The sustainability of such high returns is questionable.

-

Name similarity to legitimate banks: The use of the word “Unity” and “Bank” may induce confusion with established institutions (e.g., Unity Bank in the U.S.). This may be intentional to borrow credibility. That said, the site’s domain “unityinb.com” is distinct (and not obviously referencing a known institution). This is a typical sign of impersonation or misleading branding.

-

Lack of independent verification: There are no well‐documented reviews, no news articles, no banking directories referencing this entity. If it were operating legitimately in multiple jurisdictions and soliciting international deposits, one would expect some regulatory listing or media review. The absence of that suggests the operations are under the radar.

-

Risk to depositors: If there is no deposit insurance or recognised regulatory oversight, depositors’ funds are at risk of being lost, frozen, or unreturnable. For users in Nigeria (or Africa broadly), cross‐jurisdiction recovery is extremely difficult and expensive.

-

Marketing tactics align with scams: High yield, “open account now”, minimal information on risk, and global targeting are all classic scam markers. The site uses product names (fixed deposit, current account) to mimic legitimate banking language, which may deceive unsuspecting users.

-

Due diligence inability: Because of the lack of visible corporate information (e.g., where the bank is registered, audited statements, regulator licence), any user cannot easily verify the entity’s legitimacy. Real banks provide audited accounts, regulatory disclosures, branch locators, etc.

Given all these red flags, the most prudent stance is to assume it is a scam. One should not deposit funds or commit money unless one can independently verify the bank through credible regulatory channels, physical presence, deposit protection, and clear track record.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Unityinb

Pros

- Attractive high interest rate offers (up to 8%) which may entice depositors seeking high returns.

- Online banking orientation: convenience of “open account now”, “online & mobile” banking emphasised.

- Offers multiple account types (savings, current, fixed deposit) which mimic real banks’ product lines.

Cons

- The unusually high interest offered is a strong red flag for sustainability and legitimacy.

- No clear verification of regulatory status or deposit protection, meaning if funds are lost, there may be no recourse.

- The site may be a “clone” or mis-brand of legitimate bank names, increasing confusion and risk of identity misplacement.

- Absence of independent reviews, ratings or customer testimonials verifying real customers using the service.

Website Overview

Country:

Iceland

Operating Since:

2024

Platforms:

Mobile/Desktop

Type:

Online bank

Spread:

N/A

Funding:

Online bank

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

Unrealistic interest rates – 8% on savings and 5% on “current account” are extraordinarily high compared to regulated banks in most jurisdictions, raising suspicion.

Lack of regulatory identification – The website does not clearly display a banking licence number, regulatory body, FDIC or equivalent deposit protection scheme, or country of regulation.

Domain name / brand ambiguity – The site uses “unityinb.com” (which is similar to legitimate institutions like “Unity Bank” or “Unity National Bank” but not matching them). This similarity could be used to confuse users into believing it is associated with a known bank.

Limited independent verification – No credible reviews or major bank directories list this entity as a recognised bank with deposit guarantee.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

While the website unityinb.com markets itself as an online bank offering attractive rates and services, the overall evidence strongly points towards it being a scam (or at best an extremely high‐risk speculative operation) rather than a safe, regulated bank. The combination of missing regulatory transparency, unrealistic returns, absence of independent verification, and typical scam marketing tactics means that any funds placed there are likely at significant risk of loss.

If you are based in Nigeria (or elsewhere) and considering opening an account there, I strongly recommend you steer clear. Treat this entity as untrusted until you have verified: (1) physical registration/licence of the bank in a recognized jurisdiction; (2) deposit protection scheme covering your funds; (3) audited financials and track record; (4) credible independent user reviews or regulatory history. Without that, you are essentially placing funds into an unverified entity.

In conclusion: the sensible route is to avoid unityinb.com for banking or deposits and instead deal with established banks where regulatory oversight and deposit protection exist.

Comments