Review on Voltchainsinvestment

Summary

About Voltchainsinvestment

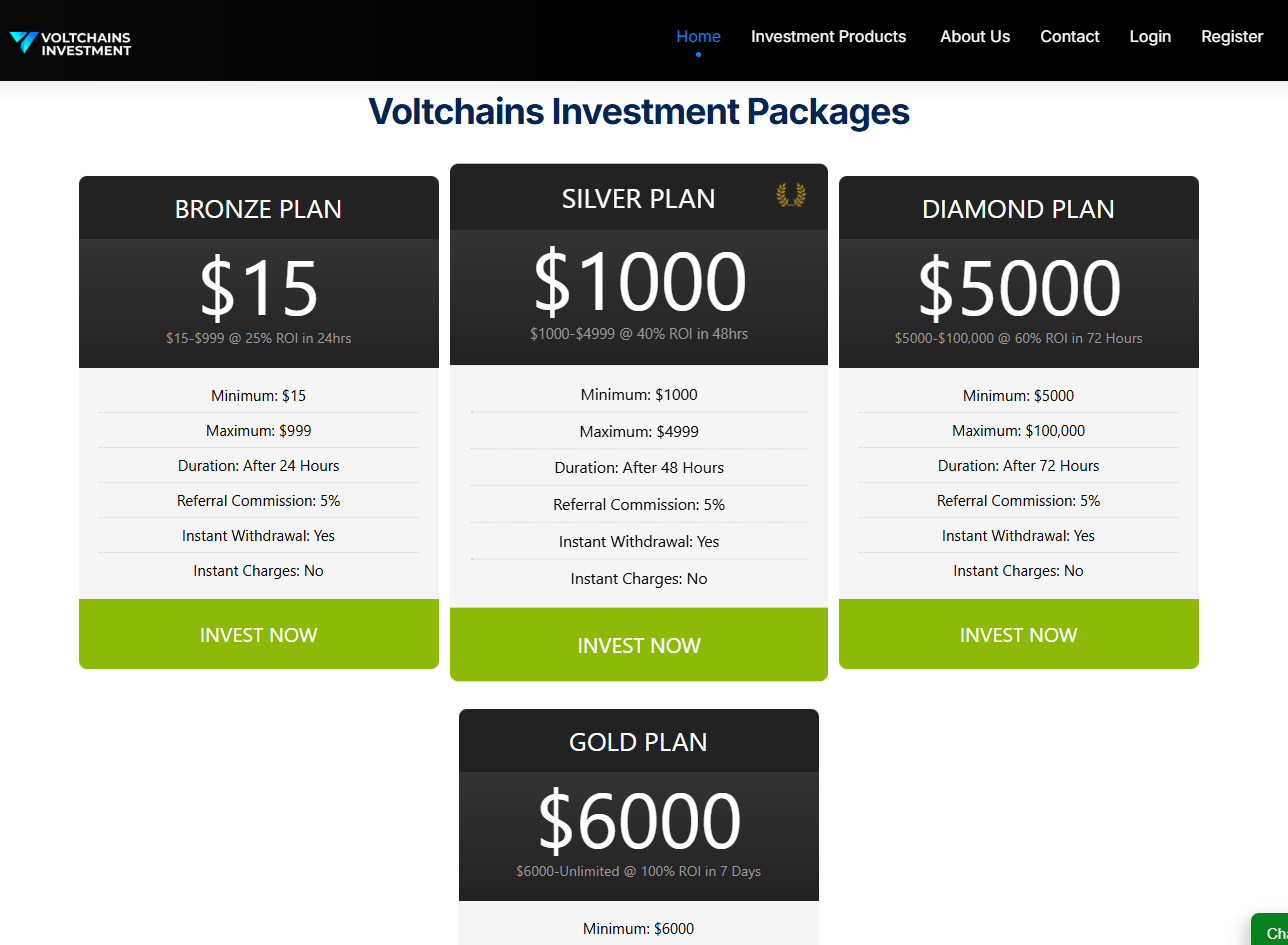

The website of VoltChains Investment (voltchainsinvestment.com) presents itself as an investment platform offering high-yield opportunities in real estate, stocks/equities and cryptocurrency. According to the site, users can invest small amounts (from as little as US$15) through different “plans” promising ROI of 25% in 24 hours, 40% in 48 hours, 60% in 72 hours, and even 100% in 7 days.

The site claims to be “Austria based and European regulated crypto & securities broker platform” with “funds secured in offline wallets” and “fully compliant with European data, IT and money-laundering security standards.”

It also states history: “Launched 2014… one of the fastest-growing real estate fintech companies in the U.S.” and “managed more than $1 billion in investments with 99.1% of principal returned to investors.”

However, independent reviews of the domain indicate very low trust scores, very recent registration (October 2023) and a number of red flags consistent with high-risk or scam-type offerings.

In short: the website presents the appearance of a legitimate investment platform, but the claims are highly aggressive (extremely high returns in short time) and the independent data raises serious concerns about its legitimacy.

More Details

On balance, the evidence strongly suggests that VoltChains Investment is very high risk and likely falls into the category of an investment opportunity with scam-like characteristics rather than a fully legitimate regulated investment platform.

Why it leans toward being a scam or risky scheme

-

Unrealistic returns

Returns of 25% in 24 hours, 40% in 48 hours etc are outside any conventional regulated investment product. Even highly speculative crypto funds seldom promise anything remotely comparable. Such promises are typical of HYIPs (high-yield investment programs) that often rely on new investor money to pay earlier investors rather than genuine profits. -

Short domain life & hidden ownership

The site is extremely new (Oct 2023 registration) which means there’s little track record. Hidden WHOIS means you cannot readily verify who owns or runs the business. Legit financial firms typically have transparent corporate identity, regulatory filings, registration numbers etc. -

Trust scores very low

Independent site-checkers give extremely low trust ratings (13.8/100 on one site) and label it “Untrustworthy. Risky. Danger.” Another review gives poor score (≈25%) for trust. When several independent systems flag serious risk, you must treat with caution. -

Bold claims without verifiable proof

The site claims huge track record, billions in origination, millions of users, auditor sign-off, regulation etc—but supplies no publicly verifiable documentation (no corporate registration number, no audit report, no regulatory licence). The mismatch between claimed history (since 2014) and actual domain age further undermines credibility. -

Referral commissions & “instant withdrawal” hype

These features are characteristic of schemes that emphasise recruitment (referral 5%) and promise instant payoff to lure in funds. Such models often collapse when inflows slow or withdrawals exceed new deposits. -

No clear regulation or investor protection

A legitimate financial investment platform will be registered with financial regulatory bodies in the jurisdictions where it operates (e.g., SEC, FCA, Austrian FMA for an “Austria based” platform). There is no publicly visible licence number or regulatory oversight published. Without protection, funds may not be recoverable if the business fails or becomes fraudulent.

Could it be legitimate?

While nothing viewed so far proves absolutely that it is a fraud (and one cannot conclusively declare without seeing internal books, regulated licence, audited financial statements), the balance of probabilities given all red flags suggests it is not a safe choice. One might argue it could be a very early stage, highly speculative platform—but for most investors that does not equate to “legitimate and safe”.

Bottom line

If you are considering investing with VoltChains Investment, you should approach it as extremely high risk—potentially equivalent to “all-or-nothing” speculation. You should not treat this as a regulated, safe investment product. If the site collapses, there appears to be very limited/no recourse to protect your funds. Unless you have done entire due diligence (verifying regulatory licence, getting audited performance proof, using only money you can afford to lose) the prudent approach would be to avoid or limit exposure heavily.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Voltchainsinvestment

Pros

- Professionally designed website with clear marketing, SSL certificate present (so SSL encryption is in place) which is better than many scam sites that lack even basic security.

- The idea of fractional investment across real estate, equity and crypto is conceptually appealing (diversification).

- Contact information (email, contact form) is provided, and the platform appears functional (login/register pages exist) which may give users initial comfort.

Cons

- The promised returns are unrealistic and unsustainable over the long term—very high ROI in very short timeframe is classic hallmark of high-risk or fraudulent models.

- Very short domain history + hidden proprietorship make the credibility weak.

- Independent trust assessments strongly flag the site as risky/untrustworthy.

Website Overview

Country:

USA

Operating Since:

2023

Platforms:

Mobile/Desktop

Type:

Investment/crypto

Spread:

N/A

Funding:

Investment/crypto

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

Low trust scores from independent checkers: For example, one review gives a “13.8/100” trust rating and labels the site “Untrustworthy. Risky. Danger.” Another review gives a “poor” trust score of about 25%.

Claim of regulation conflicting with other data: The site claims to be “Austria based and European regulated crypto & securities broker platform” with “3.5+ million happy users” and “excellent Trustpilot rating”. But there is no verifiable evidence publicly available confirming such registration/regulation or that many clients exist.

Force majeure of investment models: The business model (very high returns in very short timestamp) mirrors typical “high-yield investment program” (HYIP) schemes, which historically carry extremely high risk of collapse.

Shared hosting with other low-trust websites: One review notes that the server hosts “several low reviewed other websites” which raises suspicion.

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

In conclusion: While VoltChains Investment appears polished on the surface and offers a tempting “entry-level” investment option, it carries a multitude of red flags that strongly indicate it is either a very high-risk speculative venture or leans toward being a scam. The claim of extremely high short-term returns, lack of verifiable regulatory oversight, very recent domain registration, hidden ownership and poor independent trust scores all point toward caution.

For someone in Nigeria (or anywhere) considering this platform, the safest assumption is that you could lose your entire invested amount. If you choose to proceed, treat it more like gambling than a legitimate investment: invest only what you can afford to lose, verify any claimed documents yourself, and be ready to withdraw quickly if needed. Personally, I would not recommend using this site for serious investment of meaningful capital until/unless it produces verifiable audited results and proper regulation.

Comments