Review on Vtmarkets

Summary

About Vtmarkets

VT Markets is a global online trading broker offering services in forex and contracts for difference (CFDs) across multiple asset classes such as indices, commodities, shares, and cryptocurrencies. Founded in 2015 and headquartered in Sydney, Australia, the company claims to operate under the regulatory oversight of several financial bodies, including the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA) of South Africa, and the Financial Services Commission (FSC) of Mauritius.

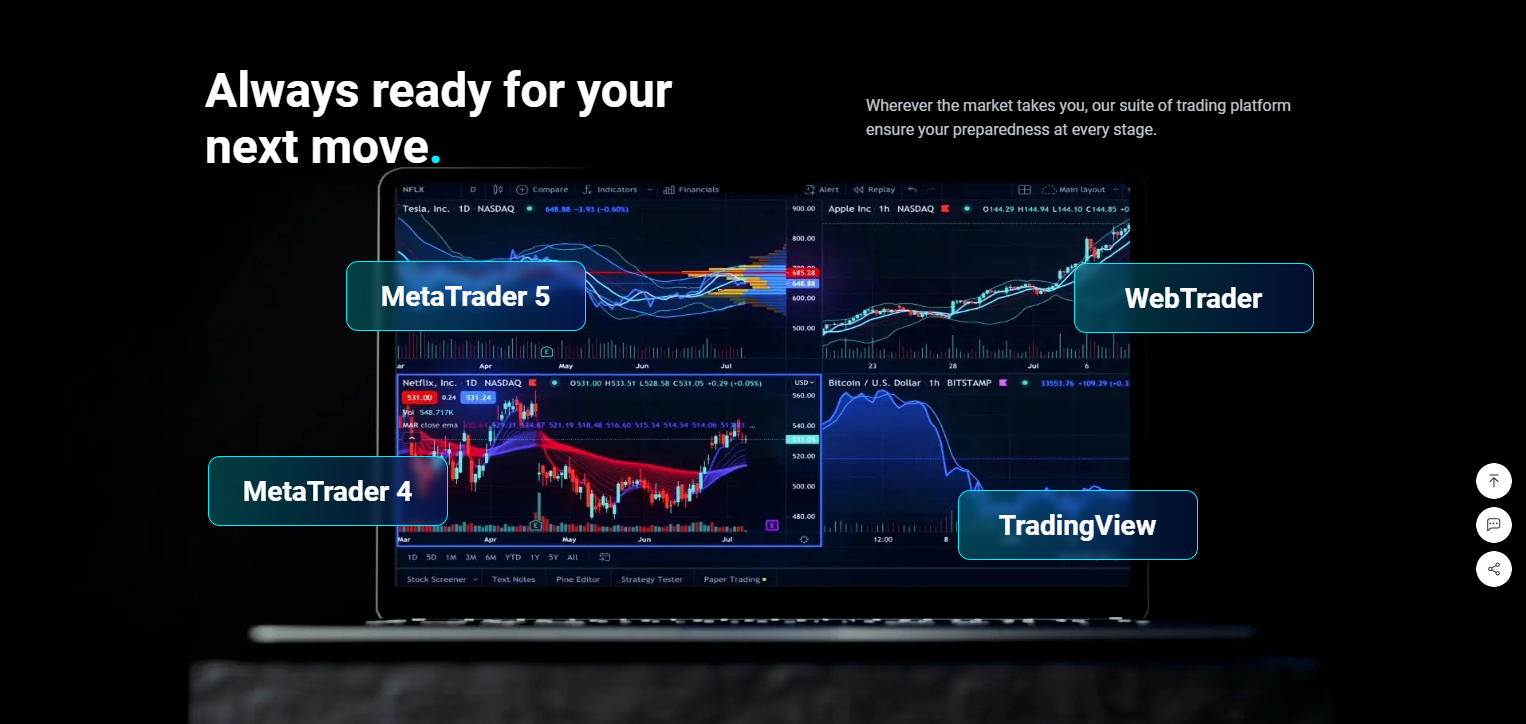

The platform provides access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a proprietary mobile application. VT Markets positions itself as a broker suitable for both beginner and professional traders, offering account options like Standard STP and Raw ECN. The broker also promotes features such as tight spreads, fast execution speeds, negative balance protection, and segregated client funds to enhance trust.

Despite these claims, the broker has received mixed reviews from users. While some clients report satisfactory trading conditions and platform reliability, others raise concerns over delayed withdrawals, account closures without notice, and unresolved customer service issues. These conflicting experiences create uncertainty about the true nature of VT Markets' operations and call for a thorough investigation before engagement.

More Details

A Detailed Analysis of Why VT Markets Raises Serious Concerns

VT Markets presents itself as a modern forex and CFD brokerage firm offering a wide range of trading instruments, advanced platforms, and various account types aimed at attracting both novice and professional traders. On the surface, the broker appears legitimate. Its website is professionally designed, filled with technical specifications, trading tools, and promotional content that signal reliability and innovation. The firm claims to offer cutting-edge trading infrastructure, access to MetaTrader platforms, and industry-standard features such as negative balance protection and segregated client funds. However, upon deeper inspection, there are several critical elements that raise concern regarding the credibility and operational integrity of the platform.

One of the most pressing issues involves inconsistencies in how VT Markets communicates its regulatory status. While the platform claims to be under the supervision of established financial authorities, this type of information, while reassuring at face value, cannot be accepted blindly. Simply stating that a broker is regulated does not automatically translate to reliable practice. What matters is not only regulation but how that broker applies transparent, ethical, and fair practices in the everyday handling of client funds and transactions. Too often, brokers use the name of a regulatory body to build artificial trust while engaging in questionable activities behind the scenes.

Another key concern lies in the broker’s relationship with its clients, particularly regarding withdrawals and account access. A significant number of individuals have shared experiences involving sudden account freezes, unjustified trade cancellations, or extended delays in withdrawing funds. While trading inherently involves risk and occasional technical issues, a consistent pattern of complaints over money accessibility cannot be brushed aside as isolated incidents. Instead, it signals systemic problems within the operational structure of the platform either through inadequate fund management, poor customer prioritization, or worse, intentional obstruction of user access to their own capital.

Furthermore, the broker’s customer support practices seem to reinforce the negative impression. Reports indicate that users who encounter issues often face poor communication, unresponsive staff, or pre-written replies that offer little in terms of real assistance. A trustworthy broker must be able to handle conflict resolution quickly, transparently, and respectfully. When users feel abandoned or silenced during critical moments especially when their funds are involved it severely undermines the credibility of the entire operation.

Transparency is another area where VT Markets appears to fall short. Despite boasting modern tools and a global reach, the company offers limited public information about its ownership, leadership team, internal policies, or operational history. In industries that deal with client funds and financial speculation, transparency is essential. Clients need to know who is behind the company, how disputes are handled, and what protections are in place in the event of misconduct. A lack of openness often points to an attempt to avoid accountability, or at the very least, a disregard for ethical standards of disclosure.

Another point of concern is the nature of VT Markets’ marketing strategies. Many users have reported experiencing aggressive outreach, including repeated phone calls, overly persuasive emails, and sudden promotional messages urging immediate deposits or bonus claims. This type of behavior is often characteristic of platforms more interested in acquiring short-term deposits than building long-term, trust-based relationships with clients. Ethical brokers focus on educating users, promoting responsible trading, and ensuring clients understand the risks involved. Pressuring individuals into funding accounts quickly especially those with limited experience is a tactic that should raise immediate suspicion.

Although VT Markets does have some functional features and may provide a standard trading experience to a portion of its user base, the number and nature of complaints point to a deeper issue. A legitimate broker should not generate this level of doubt across so many different aspects of its operations. From claims of hidden fees and platform manipulation to a general lack of support and questionable verification procedures, the evidence suggests that users are not consistently receiving the high standards of service and security they are promised.

In conclusion, while VT Markets may seem like a well-equipped broker on the surface, there are numerous warning signs beneath its polished branding. Users should be cautious, skeptical, and deliberate before deciding to trade on the platform. A broker that cannot ensure transparent operations, reliable fund access, and consistent client support cannot be considered safe. Trading is already a risky endeavor entrusting one’s capital to a company that raises repeated concerns only compounds that risk. Until VT Markets addresses these underlying issues and rebuilds trust through consistent and verifiable improvements, it should be approached with extreme caution.

Warning: Low score, please avoid this website!

According to our review, this website has a higher risk of being a scam website.

It may attempt to steal your funds under the pretense of helping you make money.

Notice: High Score — Not likely to be a scam website.

According to our review, this website has a low risk of being a scam.

There is minimal indication of fraudulent activity.

Notice: Moderate score — Caution advised.

According to our review, this website shows a moderate risk level based on current data.

There is no strong evidence of a scam, but users should proceed carefully.

Photos of Vtmarkets

Pros

- Platform Variety: Offers MT4 and MT5 along with a mobile trading app for flexible access.

- Account Types: Multiple account choices cater to various trader experience levels.

- Claims of Regulation: Presence of regulatory licenses may suggest a commitment to compliance.

- Leverage and Spreads: Competitive trading conditions for certain forex pairs and indices.

Cons

- Withdrawal Issues: Multiple complaints online regarding delays or inability to withdraw funds.

- Questionable Customer Service: Users often report lack of support or communication during critical times.

- Inconsistent Transparency: Difficulty in verifying some of the company’s claims, such as fund protection and licensing.

- Poor Educational Support: Learning resources lack depth, making it challenging for new traders to gain proper insight.

- Dubious User Reviews: Many positive reviews appear generic or potentially incentivized.

Website Overview

Country:

France

Operating Since:

2017

Platforms:

Mobile/Desktop

Type:

BROKER

Spread:

N/A

Funding:

BROKER

Leverage:

N/A

Commission:

N/A

Instruments:

N/A

Keypoints

Regulatory Coverage: VT Markets claims regulation under ASIC, FSCA, and FSC, yet independent verification should always be conducted.

Customer Feedback: Mixed user reviews, with recurring complaints related to withdrawal delays and poor customer service.

Product Offering: Offers a decent range of forex pairs, indices, commodities, and cryptocurrencies, though not as diverse as top-tier brokers.

Educational Tools: The platform provides learning materials, but many find the content superficial and insufficient for serious learning

Overall Score

Final Thoughts

After viewing and analyzing the site thoroughly by our experts and undergoing the proper process, we have reached a final conclusion.

VT Markets walks a fine line between appearing credible and exhibiting behaviors commonly associated with questionable online brokers. The presence of regulatory claims and familiar trading platforms may instill a sense of security, but users must approach with due diligence. The broker’s poor customer service reputation, allegations of withheld funds, and vague policy enforcement are significant red flags.

It is recommended that potential clients consider brokers with a long-standing reputation, clear regulatory oversight, and strong client feedback before engaging with VT Markets. Financial losses in such environments are not just a possibility they are a frequent outcome for unsuspecting traders who overlook warning signs. Always cross-reference broker credentials with official regulatory websites, and avoid platforms with an unclear history or aggressive sales techniques.

Comments